Einhorn Loads Up on HP While Buffett Sells

Guru David Einhorn (Trades, Portfolio) recently disclosed that his hedge fund, Greenlight Capital, purchased a stake in HP Inc. (NYSE:HPQ) during the first quarter. Shares traded for an average price of $30.76. The investor noted the company stands to benefit from an artificial intelligence-driven upgrade cycle, which is not currently priced into the stock.

Meanwhile, legendary investor Warren Buffett (Trades, Portfolio) appears to have a different view of the stock as he liquidated Berkshire Hathaway's (NYSE:BRK.A) (NYSE:BRK.B) position during the first quarter. While it is difficult to say for sure why he decided to sell, tax planning may have played a role.

Shares of HP are cheap by most conventional metrics, trading at just 9.50 times full-year 2024 consensus earnings per share and at forward enterprise value-to-Ebitda ratio of roughly 7. Comparably, the S&P 500 trades at close to 21 times consensus forward earnings.

Despite operating in a highly competitive low-growth industry, the company has a number of catalysts that I believe have the potential to send shares sharply higher from current levels. These catalysts include an AI-driven product upgrade cycle, potential merger and acquisition opportunities and aggressive share repurchases.

For these reasons, I believe Einhorn is correct and HP represents an attractive value investment at current levels.

Buffett's HP exit

While Buffett has not said much publicly about his decision to sell HP, one potential reason is tax planning. Berkshire has recently been trimming its position in Apple Inc. (APPL) and thus has locked in large capital gains. The conglomerate purchased most of its HP shares at a price of close to $37 per share in early 2022. Over the past three quarters, Berkshire has been a seller of the stock at prices close to $30 per share. Thus, Berkshire has realized significant capital losses due to these transactions. Capital losses from these sales can be used to offset gains from Apple sales and thus offer a tax harvesting benefit to Berkshire.

Another potential reason why Buffett may have decided to unload HP shares is he believes the company is outside his circle of competence. Historically, the guru has avoided technology companies on the basis he does not have an edge in understanding the business. While Apple represents a key exception to this philosophy, Buffett has said he views Apple as a consumer goods company with strong pricing power. Comparably, HP is more of a commoditized business with limited pricing power.

For these reasons, I do not view Buffett's decision to sell as a major negative for the stock.

AI-driven upgrade cycle

HP's personal system segment accounts for roughly two-thirds of the company's total revenue. One potential near-term upside catalyst for this business is a multiyear upgrade cycle driven by AI-capable personal computers.

On March 7, HP rolled out a suite of AI-capable PCs that are designed to leverage the power of AI to enhance productivity. Within the next three years, management believes the penetration of AI PCs will be 40% to 60% of total sales with the bulk of the impact coming in 2025 and 2026. Industry experts have estimated the total PC market will grow by 7% in 2024 and 10% in 2025 due to an AI-driven product upgrade cycle as well as the end of Microsoft support for Windows 10 in late 2025.

Currently, consensus estimates call for HP to report revenue growth of -0.3% and 4% for fiscal years 2024 and 2025. Earnings per share is expected to grow by 4.50% and 6.20% respectively over the same periods.

Given these relatively low-growth estimates, I tend to agree with Einhorn's thesis that the benefits related to a potential AI driven upgrade cycle are not currently reflected in consensus estimates.

Furthermore, JPMorgan recently released a research note with an overweight rating and $34 price target for the stock. As part of its note, the analysts said an improving PC upgrade cycle and potentially volume and pricing upside related to AI-enabled products. Additionally, HP recently received a ratings upgrade from Barclays, which suggests Wall Street appears to see an improving near-term earnings picture for the company.

Potential M&A opportunities

At the Morgan Stanley Technology, Media and Telecom industry conference held in March, HP CEO Enrique Lores noted he sees potential M&A opportunities related to consolidation of the printing business.

So we continue to think that consolidation in this industry is going to happen," he said. "The market is flat or not growing. There are multiple players. And at some point, we expect that in print, it will happen something similar to what happened in PCs over a long period of time. So it's going to happen. It's going to take is going to take longer because companies are still making money because of the print business model, but we think at some point will have -- and at some point, we may participate in that, as we did with Samsung.

HP's printing business accounts for roughly one-third of the company's total revenue and approximately 60% of operating profits due to its higher operating margins compared to the PC business. Currently, the company is estimated to be the global leader in the printing market with roughly 21% market share. The market remains highly fragmented with key players Canon (TSE:7751), Epson and Brother (TSE:6448) accounting for estimated respective market shares of 17%, 11% and 10%. Thus, significant consolidation potential exists and HP is well positioned to absorb smaller operators.

In March 2020, HP rejected a takeover offer from Xerox Holdings Corp. (NASDAQ:XRX) on the basis it undervalued the company and that Xerox shareholders would have fared better than HP shareholders. The structure of the Xerox transaction was challenging in that HP is a much larger company with much larger market cap. Currently, HP has a market cap of roughly $30 billion, while Xerox has a market cap of around $1.70 billion. While HP rejected Xerox's proposed takeover, I believe a more reasonable transaction would be for HP to acquire Xerox.

While it is difficult to know which printing companies may ultimately be open to being acquired by HP, I believe consolidation of the printing business represents a key medium-term catalyst given its market-leading position and potential for synergies related to acquiring smaller players.

Aggressive share repurchase program

HP has been an active repurchaser of its own stock of late, buying 17.10 million shares for total consideration of $500 million during the first quarter of 2024. The implied repurchase price was roughly $29.23 per share. HP has a remaining repurchase authorization of $1.50 billion, which represents roughly 5% of shares outstanding at current market prices. The company's significant repurchase activity suggests management views the stock as attractive at current levels.

Given the company's commitment to return 100% of free cash flow to shareholders over time, I believe there is further room for the company to increase its repurchase program. Currently, HP estimates it will generate $3.1 billion to $3.6 billion for 2024. Based on the company's current quarterly dividend of 27.60 cents per share, roughly $1.08 billion will be paid in the form of dividends. Thus, roughly $2.30 billion remains for potential repurchases assuming a 100% return of free cash flow. This compares to the current remaining authorization of just $1.50 billion. For this reason, I believe the company is poised to increase its repurchase authorization in the coming quarters, which would be a positive development for the stock.

Reasonable valuation

HP's forward price-earnings ratio of just 9.50 is well below the S&P 500's forward price-earnings ratio of roughly 21. While HP trades cheap compared to the broader market, it does so for a reason. The company competes in a highly competitive industry that has limited growth prospects and is highly cyclical. As a result of these factors, HP has historically tended to trade at a significant discount to the broader market.

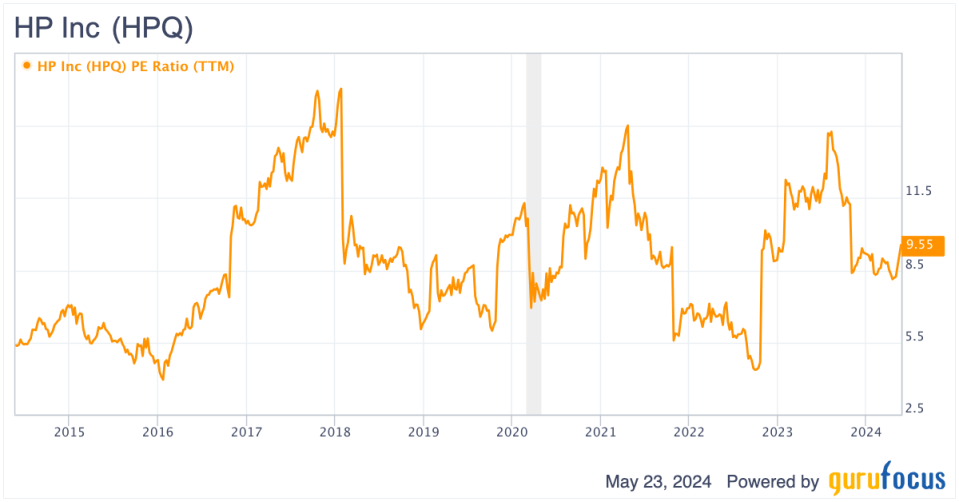

Over the past 10 years, HP has traded at an average price-earnings ratio of roughly 8.70. Thus, the stock is currently reasonably valued versus historical norms. Moreover, I find the stock's current valuation to be reasonable given the potential earnings upside related to the AI upgrade cycle.

HPQ Data by GuruFocus

Economic slowdown represents a key risk

One key risk to the HP bull case is a severe economic downturn. The PC and printer upgrade cycle tends to be highly economically sensitive as individuals and companies tend to view product upgrades as nice to have rather than essential. While an economic slowdown would likely result in lower-than-expected earnings, this risk is one of the reasons why the stock trades at a substantial discount to the broader market.

Recent economic data suggests the economy remains strong and thus, I do not expect a significant near-term economic slowdown.

Takeaways

Einhorn has been buying shares of HP while Buffett has been selling. I view HP as a cheap stock with a number of key catalysts. The stock is currently trading at a reasonable valuation relative its own historical norm and may have significant upside due to an AI-driven PC upgrade cycle.

Additional catalysts include the potential for M&A-related consolidation activity in the printer industry and a potential increase in the share repurchase program later this year.

I view HP shares an attractive risk-reward investment opportunity at current levels. Moreover, given the low expectations around the company's AI potential, the stock represents an attractive way for value investors to gain exposure to the AI space without paying a sky-high valuation.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance