Election uncertainty knocks activity in service sector

Election uncertainty knocked business activity in the services sector last month, a closely watched survey suggests, although the sector performed better than first expected.

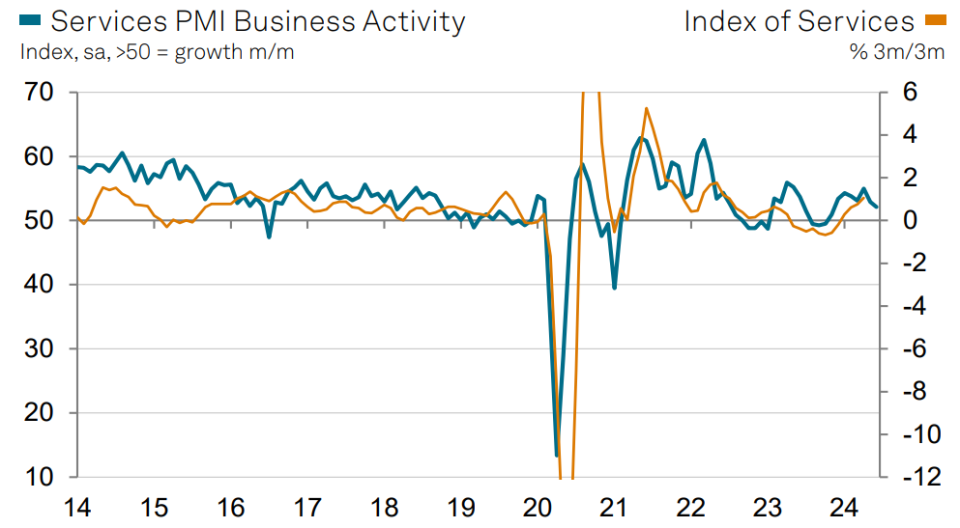

S&P’s purchasing managers’ index (PMI) for the services sector fell to 52.1 in June, a seven month low and down from 52.9 in May. PMIs measure business activity in the private sector with anything above 50 indicating expansion.

Despite the fall, June’s final PMI was higher than the 51.2 recorded in the initial ‘flash’ estimate and confirms that the services sector has remained in expansionary territory for eight consecutive months.

The survey suggested that firms were taking a ‘wait-and-see’ approach before placing new orders and commissioning new projects due to the election.

The slowdown in new orders was particularly acute in the domestic market, with the survey pointing to a “slight pick-up” in demand from non-domestic customers.

Firms remained optimistic, with 48 per cent of respondents predicting growth over the next year. An improving economy, lower interest rates and stronger demand will all lift activity levels, companies said.

Rob Wood, chief UK economist at Pantheon Macroeconomics, said the PMI would likely “bounce back” after the election.

The upward revision brought the composite PMI, which includes both the manufacturing sector and the services sector, to 52.3, up from an initial estimate of 51.7.

Over the second quarter as a whole, the PMI averaged 53.3 which was only marginally slower than the first quarter, when it averaged 53.7. This showed that the economy only suffered a “modest loss of momentum”.

There was mixed news on inflation, with input price inflation across the services sector falling to its slowest rate since February 2021 despite a stubbornly high wage bill.

However, this was not enough to prevent prices charged from increasing at a slightly stronger rate than seen in June, with inflation picking up from May’s 37-month low.

“Prices still continue to show a high degree of stickiness across the UK service sector, although input cost inflation once again trended lower in June,” Joe Hayes, principal economist at S&P Global Market Intelligence said.

“The direction of travel here is encouraging for the Bank of England, but our survey’s gauge of prices charged actually rose on the month as some companies noted their pricing power was strong enough to raise their fees,” Hayes added.

Yahoo Finance

Yahoo Finance