Embedded Security Market by Security Type, Application, Offerings and Region - Global Forecast to 2027

Global Embedded Security Market

Dublin, April 20, 2022 (GLOBE NEWSWIRE) -- The "Embedded Security Market by Security type (authentication and access management, payment and content protection), Application, Offerings (hardware, software and services) and Region (North America, Europe, APAC, RoW) - Global Forecast to 2027" report has been added to ResearchAndMarkets.com's offering.

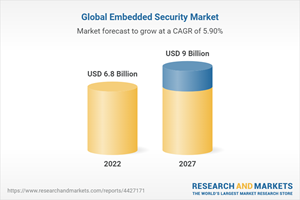

The embedded security market size is valued at USD 6.8 Billion in 2022 and is anticipated to be USD 9.0 Billion by 2027; growing at a CAGR of 5.9% from 2022 to 2027.

Growing demand for embedded security in electric and hybrid vehicles to drive the growth of embedded security

The embedded security industry is likely to be driven by rising demand for embedded security systems commonly used in automobiles. Due to the high demand for safety and comfort, while driving, all modern vehicles are equipped with embedded systems. Embedded security is used in a variety of automotive applications such as body electronics, navigation systems, steering systems, brakes, traffic control, powertrain, chassis control, as well as mobile access apps and eCommerce. The embedded security industry is growing as demand for electric and hybrid vehicles has increased and public awareness of the environment's deterioration has increased.

APAC is the fastest-growing region in the embedded security market

The fastest-growing region for embedded security is the Asia Pacific. APAC is focusing on increasing its security spending in response to the ever-increasing threat landscape. South Korea, China, Australia, and Hong Kong are among the growing economies in APAC. Factors such as remote working, the increasing complexity of business, and the growing trend of BYOD necessitate robust security solutions, which are forces companies to use a variety of security solutions.

APAC has seen great economic expansion, political revolution, and social change in the recent decade. Countries such as South Korea, Japan, and Singapore have modified or established new security measures in response to the increasing cyber threats.

Samsung (South Korea) and Renesas (Japan) are some of the key players operating in the embedded security market in the Asia Pacific.

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

4 Premium Insights

4.1 Attractive Market Opportunities in Global Embedded Security Market

4.2 Embedded Security Market, by Offering

4.3 Embedded Security Market, by Application and Security Type

4.4 Region Analysis of Embedded Security Market

4.5 Embedded Security Market, by Region

4.6 Embedded Security Market, by Application

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growing IoT Applications Would Increase Need for Embedded Security

5.2.1.2 Inclusion of Payments Functionality in Wearables

5.2.1.3 Government Agencies Promoting Digitization

5.2.1.4 Increase in Data Breaches and Cyberattacks

5.2.1.5 Increased Demand for Embedded Security in Electric and Hybrid Vehicles

5.2.1.6 Intensifying Need to Secure Digital Crypto-Based Transactions

5.2.2 Restraints

5.2.2.1 Non-Adherence to Government Regulations Due to Lack of Auditing

5.2.2.2 Susceptibility of Embedded Systems to Cyber-Threats and Security Breaches

5.2.2.3 Costs Associated with Hardware Security Modules

5.2.2.4 Strong Inclination of Customers Toward Adoption of Hardware Security Modules on Rental Basis

5.2.3 Opportunities

5.2.3.1 Integration of Embedded Security in Electric Vehicles

5.2.3.2 Need for Integrated Security Solutions for IoT Paired with Advent of Smart Cities

5.2.3.3 Growing Adoption of Embedded Systems in Healthcare Systems

5.2.3.4 Introduction of 5G and Development of 5G-Enabled Embedded Devices

5.2.4 Challenges

5.2.4.1 Lack of Awareness Regarding Safety and Low-Security Budget

5.2.4.2 High Energy Consumption Associated with Compact Embedded Systems

5.2.4.3 Complexities Involved in Designing Embedded Systems

5.2.4.4 Shortage in Supply of Semiconductors

5.3 Porter's Five Forces Analysis

5.4 Trade Analysis

5.4.1 Export Scenario of Automatic Data Processing Machines

5.4.1.1 Import Scenario of Automatic Data Processing Machines

5.5 Ecosystem

5.6 Value Chain Analysis

5.7 Embedded Security Market: Case Studies

5.8 Patent Analysis

5.9 Revenue Shift and New Revenue Pockets for Players in Embedded Security Market

5.10 Regulatory Standards

5.10.1 Standards in Embedded Security

5.10.2 Global Regulations Focused on Fraud Prevention and Standardization

5.10.3 Regulations in US Focused on Consumer Protection

5.10.4 Regulations in Europe Focused on Standardization

5.10.5 Regulations in APAC Focused on Domestic Payment Networks

6 Technology Trends

6.1 Growing Emphasis on Automobile Security

6.2 Increased Contactless Payment

6.3 Rise of Wearables

6.4 Increased Number of IoT Devices

6.5 Emergence of 5G

6.6 Average Selling Price (ASP) Trends

6.7 Key Conferences & Events in 2022-2023

7 Embedded Security Market, by Security Type

7.1 Introduction

7.2 Authentication and Access Management

7.2.1 Authentication and Access Management Devices Block Unauthorized Users from Accessing Devices

7.3 Payment

7.3.1 Payment Security Provides Security to Sensitive Consumer Data and Enables Secured Transactions Between Merchants and Customers

7.4 Content Protection

7.4.1 Content Protection Protects Sensitive Organizational Data from Malicious Attacks, Fraudulent Activities, Cyber-Attacks, Network Threats, and Privacy Breaches

8 Embedded Security Market, by Offering

8.1 Introduction

8.2 Hardware

8.2.1 Secure Element and Embedded Sim

8.2.1.1 Increasing Number of M2M Connections is Driving Market Growth

8.2.2 Embedded Sim

8.2.2.1 Esim, is a Reprogrammable Chip That Comes in Various Shapes and Sizes

8.2.3 Trusted Platform Module

8.2.3.1 Increasing Number of Cyber Security Threats is Driving Trusted Platform Module Market

8.2.4 Hardware Security Module

8.2.4.1 Increasing Demand for Information and Data Security is Driving Growth of Hardware Security Module Market

8.2.5 Hardware Token

8.2.5.1 Increase in Number of Internet-Based Transactions and Need for High Level of Security is Driving Hardware Token Market

8.3 Software

8.3.1 Firewall

8.3.1.1 Firewalls Stop Unauthorized Users from Gaining Access to Computers or Networks

8.3.2 AntivirUS

8.3.2.1 Antivirus Software Tackles Security Concerns When Attackers Get Past a Firewall

8.3.3 Antispyware

8.3.3.1 Antispyware Software Detects Specific Actions Taken by Spyware by Monitoring Communications

8.3.4 Network Security

8.3.4.1 Network-Level Security Implementation is More Cost-Efficient Than Other Methods

8.4 Services

8.4.1 System Integrated Services

8.4.1.1 Systems Integration Services Can Help Businesses Gain Connectivity

8.4.2 Support and Maintenance Services

8.4.2.1 Specialized Support and Maintenance Services Help in Immediate Bug Fixing for Critical Issues as Well as Permanent Resolution for High-Level Optimization.

8.4.3 Security Consulting

8.4.3.1 Security Consulting Assist Companies in Improving Effectiveness of Business and It Processes

9 Embedded Security Market, by Application

9.1 Introduction

9.2 Wearables

9.2.1 Increasing Payments Through Wearables is Driving Demand for Embedded Security

9.3 Smartphones

9.3.1 Increasing Use of IoT Applications is Driving Need for Security Solutions for Smartphones

9.4 Automotive

9.4.1 Growing Demand for Connected Cars is Fueling Demand for Embedded Security Solutions

9.5 Smart Identity Cards

9.5.1 Emergence of Multi-Application Smart Cards is Driving Smart Identity Cards Market

9.6 Industrial

9.6.1 Increasing Focus on Integrating IoT into Industrial Control Systems is Driving Market Growth

9.7 Payment Processing and Cards

9.7.1 Increasing Ecommerce Sales, Along with Growing Internet Penetration, is Driving Payment Processing and Cards Market

9.8 Others

10 Geographic Analysis

11 Competitive Landscape

11.1 Introduction

11.2 Revenue Analysis: Top 4 Companies

11.3 Strategies of Key Players

11.4 Market Share Analysis, 2021

11.5 Company Evaluation Quadrant, 2021

11.5.1 Star

11.5.2 Pervasive

11.5.3 Emerging Leader

11.5.4 Participant

11.6 Competitive Benchmarking

11.6.1 Application and Regional Footprint Analysis of Top Players

11.7 Small and Medium-Sized Enterprises (Sme) Evaluation Quadrant, 2021

11.7.1 Progressive Company

11.7.2 Responsive Company

11.7.3 Dynamic Company

11.7.4 Starting Block

11.8 Competitive Situations & Trends

12 Company Profiles

12.1 Key Players

12.1.1 Infineon Technologies

12.1.2 Stmicroelectronics

12.1.3 Nxp Semiconductor

12.1.4 Texas Instruments

12.1.5 Qualcomm

12.1.6 Renesas

12.1.7 Thales Group

12.1.8 Microchip

12.1.9 Samsung

12.1.10 Idemia

12.2 Other Players

12.2.1 RambUS

12.2.2 Cisco

12.2.3 Escrypt

12.2.4 Kurz and Ovd Kinegram

12.2.5 Bae Systems plc

12.2.6 Lantronix, Inc.

12.2.7 Ibm

12.2.8 Swift

12.2.9 Mcafee LLC

12.2.10 Broadcom Inc

12.2.11 Hitex Gmbh

12.2.12 Analog Devices Inc

12.2.13 Advantech Co. Ltd.

12.2.14 Eta Compute

12.2.15 Runsafe Security

13 Appendix

For more information about this report visit https://www.researchandmarkets.com/r/uv7w65

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance