Embraer (ERJ) to Deliver 5 E175 Jets to Nigeria's Air Peace

Embraer S.A. ERJ recently secured an order from Air Peace, a Nigeria-based airline company, for delivering five of its E175 jets valued at $288.3 million. This should boost Embraer’s revenues, starting from 2024, when the deliveries of these jets will commence.

With Air Peace, the largest airline in West Africa, upgrading its fleet from the existing 50-seater ERJ145 to 88-seater E175, Embraer may witness more aircraft orders from the airline, like the latest one. This should significantly boost ERJ’s order book and thereby revenues.

Growth Prospects of Embraer

Steady growth observed in air passenger traffic over the past few months, wearing down the impacts of the pandemic, has once again bolstered the prospects of the commercial aerospace industry. Also, the ease of traveling restrictions in China has lately added to the recovery of the industry.

Per a report released by the International Air Transport Association in July 2023, the recovery of global passenger traffic measured by Revenue Passenger Kilometers (“RPK”) has been strong, reaching 95.6% of the 2019 level.

Amid this backdrop, commercial aircraft makers like Embraer continue to witness strong demand for jets worldwide, particularly ERJ’s E-jets. Impressively, in the second quarter, the company delivered 47 E-jets, an increase of 47% compared to the second quarter last year.

Considering the favorable trends in the commercial aerospace industry to prevail in the coming days, the outlook for this industry remains bright. Total global RPKs are expected to increase by 20% in 2023.

Such solid opportunities prevalent in the air travel business should boost the growth of Embraer’s commercial aviation business, thus boosting its overall revenue generation prospects.

Peers to Gain

Apart from Embraer, aircraft manufacturers in the industry that may gain from the flourishing demand for aircraft are as follows:

Airbus EADSY: It delivered 189 commercial aircraft in the second quarter, thus registering growth of 21.9% year over year.EADSY expects to deliver 720 commercial aircraft in 2023.

The long-term earnings growth of Airbus stands at 12.4%. The Zacks Consensus Estimate for 2023 sales calls for a growth rate of 17.8%.

Boeing BA: It remains the largest aircraft manufacturer in the United States in terms of revenues, orders and deliveries. The strong demand for its commercial planes can be gauged by revenues in the Commercial segment, which increased 41% year over year. The backlog for its Commercial segment remained healthy, with more than 4,800 airplanes valued at $363 billion.

Boeing boasts a long-term earnings growth rate of 4%. Shares of BA have risen 47.7% in the past year.

Price Movement

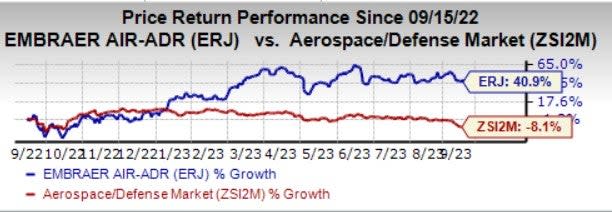

In the past year, shares of Embraer have rallied 40.9% against the industry’s decline of 8.1%.

Image Source: Zacks Investment Research

Zacks Rank & a Key Pick

Embraer currently carries a Zacks Rank #3 (Hold). One better-ranked stock in the same industry is Textron TXT, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Textron’s 2023 sales suggests a growth rate of 7.7% from the prior-year reported figure. The Zacks Consensus Estimate for TXT’s 2024 earnings calls for a growth rate of 32.2% from the prior-year estimated figure.

TXT has a long-term earnings growth rate of 11.7%. Shares of Textron have risen 18.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Boeing Company (BA) : Free Stock Analysis Report

Embraer-Empresa Brasileira de Aeronautica (ERJ) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance