Emerging Markets are Back: How to Tap into the Growth

What are Emerging Markets?

According to the Corporate Finance Institute, “Emerging markets” is a term that refers to an economy that experiences considerable economic growth and possesses some, but not all, characteristics of a developed economy. Emerging markets are countries that are transitioning from the “developing” phase to the “developed” phase.

Investors are Rotating into Emerging Markets

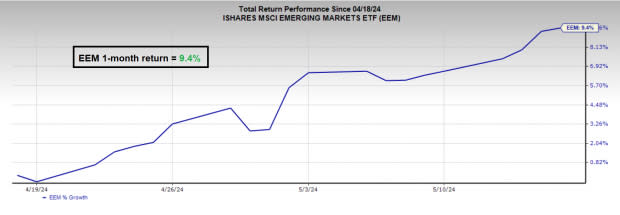

Emerging markets have been serial underperformers for nearly a decade. However, one important lesson I have learned is that when investors lose interest in a market area, that is precisely the moment in which the market turns. The iShares MSCI Emerging Markets ETF (EEM), the most heavily-traded emerging market ETF in the U.S., is up a robust 9.2% over the past month, far outpacing the S&P 500 Index’s 0.21% gain.

Image Source: Zacks Investment Research

Jumia: A Unique Growth Story

Zacks Rank #3 (Hold) stock Jumia (JMIA) is a leading e-commerce platform in Africa. JMIA can be thought of as the “Amazon (AMZN)” of Africa because it offers a plethora of products for sale, including electronics, beauty products, and more. The company also offers services beyond e-commerce such as a DoorDASH (DASH) – like food delivery service and a Booking (BKNG) – like travel booking service. Jmia is also expanding into payment processing, logistics, and data analytics.

Tapping into Africa’s Explosive Growth

According to the World Bank, Africa’s GDP will grow to 3.4% in 2024 and continue to grow into 2025. Outside of Asia, Africa will continue to be the fastest-growing area globally. Furthermore, Africa is behind Western Nations and most of the developed world regarding e-commerce adoption and many of the services JMIA offers. Because JMIA is the dominant e-commerce player in this largely untapped region, the company will benefit as Africa’s economies modernize and more people move online.

Explosive Chart Pattern

JMIA exploded 18% on massive volume after earnings were released earlier this month. Now, shares are emerging from a tight bull flag pattern that could quickly send them to the recent high of $8.

Image Source: TradingView

Bottom Line

Investors are rotating into emerging markets after a long hiatus. Jumia offers investors a unique way to tap into Africa’s growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

iShares MSCI Emerging Markets ETF (EEM): ETF Research Reports

Booking Holdings Inc. (BKNG) : Free Stock Analysis Report

Jumia Technologies (JMIA) : Free Stock Analysis Report

DoorDash, Inc. (DASH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance