Engineered Components and Systems Stocks Q1 Recap: Benchmarking Gates Industrial Corporation (NYSE:GTES)

Earnings results often indicate what direction a company will take in the months ahead. With Q1 now behind us, let’s have a look at Gates Industrial Corporation (NYSE:GTES) and its peers.

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 11 engineered components and systems stocks we track reported a slower Q1; on average, revenues were in line with analyst consensus estimates. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and engineered components and systems stocks have had a rough stretch, with share prices down 5.4% on average since the previous earnings results.

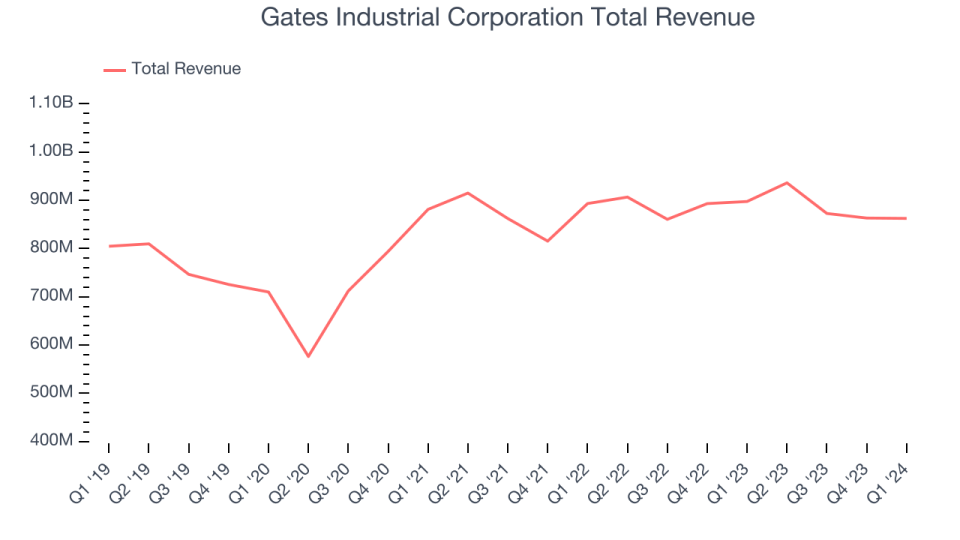

Gates Industrial Corporation (NYSE:GTES)

Helping create one of the most memorable moments for the iconic “Jurassic Park” film, Gates (NYSE:GTES) offers power transmission and fluid transfer equipment for various industries.

Gates Industrial Corporation reported revenues of $862.6 million, down 3.9% year on year, in line with analysts' expectations. It was a weaker quarter for the company with underwhelming earnings guidance for the full year and a miss of analysts' earnings estimates.

Ivo Jurek, Gates Industrial's Chief Executive Officer, commented, "We produced strong year-over-year margin expansion while experiencing softer industrial demand. Our enterprise initiatives are building momentum. I thank our global Gates associates for their commitment and dedication to serving our customers and communities."

The stock is down 13.7% since reporting and currently trades at $15.22.

Read our full report on Gates Industrial Corporation here, it's free.

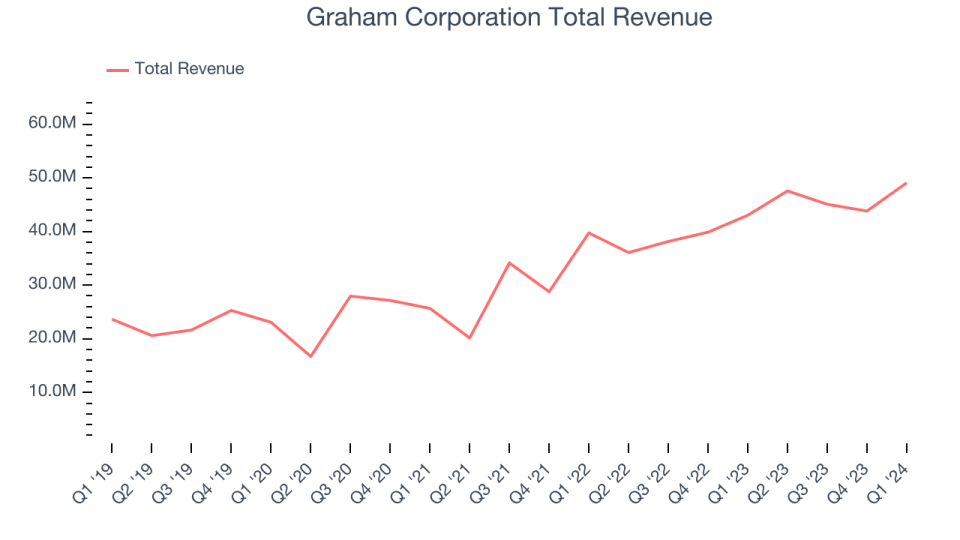

Best Q1: Graham Corporation (NYSE:GHM)

Founded when its founder patented a unique design for a vacuum system used in the sugar refining process, Graham (NYSE:GHM) provides vacuum and heat transfer equipment for the energy, petrochemical, refining, and chemical sectors.

Graham Corporation reported revenues of $49.07 million, up 14% year on year, outperforming analysts' expectations by 10.3%. It was an incredible quarter for the company with an impressive beat of analysts' earnings estimates.

Graham Corporation achieved the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 4.4% since reporting. It currently trades at $27.17.

Is now the time to buy Graham Corporation? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Worthington (NYSE:WOR)

Founded by a steel salesman, Worthington Enterprises (NYSE:WOR) specializes in steel processing, pressure cylinders, and engineered cabs for commercial markets.

Worthington reported revenues of $318.8 million, down 13.6% year on year, falling short of analysts' expectations by 9.6%. It was a weak quarter for the company with a miss of analysts' earnings and revenue estimates.

Worthington posted the weakest performance against analyst estimates in the group. As expected, the stock is down 12.3% since the results and currently trades at $43.98.

Read our full analysis of Worthington's results here.

Regal Rexnord (NYSE:RRX)

Bearing a century of engineering and optimization experience, Regal Rexnord (NYSE:RRX) provides power transmission and industrial automation solutions.

Regal Rexnord reported revenues of $1.55 billion, up 26.4% year on year, falling short of analysts' expectations by 1.4%. Looking more broadly, it was a weaker quarter for the company with a miss of analysts' organic revenue estimates.

Regal Rexnord delivered the fastest revenue growth among its peers. The stock is down 20.9% since reporting and currently trades at $133.53.

Read our full, actionable report on Regal Rexnord here, it's free.

Enpro (NYSE:NPO)

Holding a Guinness World Record for creating the world's largest gasket, Enpro (NYSE:NPO) designs, manufactures, and sells products used for machinery in various industries.

Enpro reported revenues of $257.5 million, down 8.9% year on year, falling short of analysts' expectations by 4.2%. Looking more broadly, it was a weak quarter for the company with a miss of analysts' earnings estimates.

The stock is down 6.7% since reporting and currently trades at $143.26.

Read our full, actionable report on Enpro here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance