Eni (E) Introduces Plenitude, To Lead Energy Transition

Eni SpA E announced that its retail and renewable power business will be named Eni-Plenitude (Plenitude) at a capital markets event in Milan. Eni intends for the business unit's initial public offering (IPO) next year, subject to market conditions.

As presented by Eni, the financial framework revealed that as of Jan 1, 2022, the net debt of Plenitude will be around zero. Eni added that through from 2022 to 2025, Plenitude will have an average yearly investment program of €1.8 billion. The investment will mostly be allocated toward renewable activities, accounting for more than 80% of total capital spending. E also said that Plenitude will finance its yearly investment program with its cash flow and borrowing.

As presented by Eni, the framework included that Plenitude will have a €1.3 billion in EBITDA target by 2025. By the same time frame, Plenitude will achieve roughly €1 billion in cash flow from operations, expects Eni.

The planned IPO reflects Eni’s strong belief that Plenitude – planning to supply all of its decarbonized energy products to its customers by 2040 – will get more capital and will be able to grow at a faster pace on its own. In Plenitude, Eni will continue to have a majority interest following the IPO.

This intended structural move reflects Eni’s strong focus on capitalizing on mounting demand for renewables and green energy products. The intention also reveals Eni’s focus on creating more values through energy transition. E further said that the creation of the industrial and financial entity will help it to lower its Scope 3 emissions.

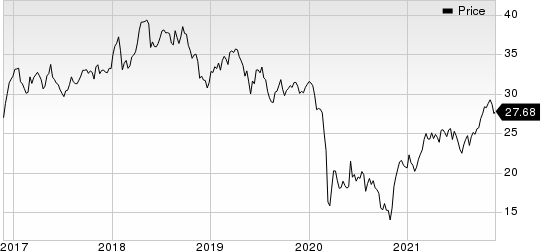

Eni SpA Price

Eni SpA price | Eni SpA Quote

Eni currently sports a Zacks Rank #1 (Strong Buy). Other prospective players in the energy space include Whiting Petroleum Corporation WLL,Continental Resources, Inc. CLR and Callon Petroleum Company CPE. While Continental Resources carries a Zacks Rank #2 (Buy), Whiting Petroleum and Callon Petroleum sport a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Whiting Petroleum is a leading upstream energy company and is the top producer of crude oil in North Dakota. With oil price improving at a healthy pace, Whiting Petroleum is expecting to continue to generate handsome cashflows while maintaining a healthy balance sheet.

Headquartered in Denver, CO, Whiting Petroleum has witnessed upward earnings estimate revisions for 2021 in the past 30 days. Looking at the price chart, WLL has gained 162.6% year to date, outpacing 97.5% improvement of the composite stocks belonging to the industry.

Continental Resources is also a leading upstream energy company with proven reserves in North Dakota and Oklahoma. The oil inventories of Continental Resources are among the best in the industry.

Headquartered in Oklahoma City, Continental Resources has witnessed upward earnings estimate revisions for 2021 in the past 30 days. Considering the price chart, CLR has gained 180.5% so far this year, outpacing the 97.5% improvement of the composite stocks belonging to the industry.

Callon Petroleum is also a leading exploration and production company with a strong presence in prolific unconventional resources that comprise Permian Basin and Eagle Ford Shale play.

CPE has witnessed upward earnings estimate revisions for 2021 in the past 30 days. Looking at the price chart, Callon Petroleum has gained 305.8% year to date, outpacing the 97.5% improvement of the composite stocks belonging to the industry.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Eni SpA (E) : Free Stock Analysis Report

Continental Resources, Inc. (CLR) : Free Stock Analysis Report

Whiting Petroleum Corporation (WLL) : Free Stock Analysis Report

Callon Petroleum Company (CPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance