Enphase Energy (ENPH) Q4 Earnings Beat Estimates, Sales Rise

Enphase Energy, Inc. ENPH reported fourth-quarter 2021 adjusted earnings of 73 cents per share, which surpassed the Zacks Consensus Estimate of 57 cents by 28.1%. The bottom line improved 43.1% from 51 cents per share reported in the prior-year quarter.

Including one-time adjustments, the company posted GAAP earnings of 37 cents per share, down 26% from 50 cents in the year-ago quarter.

The company reported adjusted earnings per share of $2.41 for full-year 2021, which increased 75.9% from $1.37 reported in 2020 and beat the Zacks Consensus Estimate of $2.27 by 6.2%.

Revenues

Enphase Energy’s fourth-quarter revenues of $412.7 million beat the Zacks Consensus Estimate of $403 million by 2.4%. The top line soared 55.8% from the year-ago quarter’s $264.8 million, driven by strong demand for its microinverter systems.

In full-year 2021, ENPH generated sales worth $1.38 billion and increased a solid 78.5% from the year-ago figure. Full-year sales surpassed the Zacks Consensus Estimate of $1.37 billion by 0.7%.

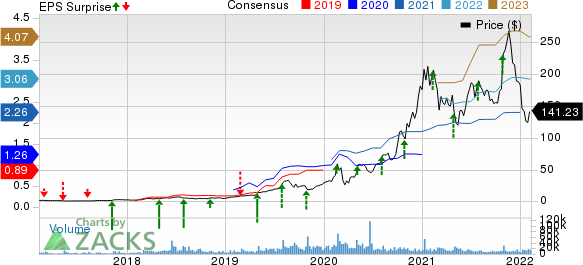

Enphase Energy, Inc. Price, Consensus and EPS Surprise

Enphase Energy, Inc. price-consensus-eps-surprise-chart | Enphase Energy, Inc. Quote

Operational Highlights

Enphase Energy’s total shipments during the reported quarter amounted to approximately 1,082 megawatts (MW) or 3,033,891 microinverters and 100.2 MW hours of Enphase IQ Batteries.

The company’s adjusted gross margin remained flat at 40.2% compared with the year-ago quarter’s margin.

Adjusted operating expenses escalated by 99.4% year over year to $68.2 million. This was primarily due to additional investment in product launches, R&D and IT infrastructure.

Adjusted operating income during the quarter soared 35.1% to $97.7 million compared with $72.4 million in the year-ago quarter.

Financial Performance

Enphase Energy had $119.3 million of cash and cash equivalents at the end of 2021, down from $679.4 million at the end of 2020.

Cash flow from operating activities amounted to $352 million as of Dec 31, 2021, compared with $216.3 million at the end of the prior year.

Q1 Guidance

For the first quarter of 2022, ENPH expects revenues in the range of $420-$440 million. The Zacks Consensus Estimate for the same is pegged at $411.1 million, lower than the company’s guided range.

Adjusted operating expenses are expected between $67.5 million and $70.5 million, excluding approximately $63 million estimated for stock-based compensation expenses, and acquisition-related costs and amortization.

Adjusted gross margin is likely to be 38-41%, excluding stock-based compensation expenses.

Zacks Rank

Enphase Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Solar Releases

SolarEdge Technologies SEDG is slated to release fourth-quarter 2021 results on Feb 15. SolarEdge boasts a long-term earnings growth rate of 21.1%.

The Zacks Consensus Estimate for SEDG’s fourth-quarter earnings, pegged at $1.29 per share, implies a year-over-year improvement of 31.6%. SolarEdge has a four-quarter earnings surprise of 7.26%.

SunPower Corporation SPWR is scheduled to release fourth-quarter 2021 results on Feb 16. The company boasts a long-term earnings growth rate of 15.6%.

The Zacks Consensus Estimate for SunPower’s fourth-quarter earnings, pegged at 4 cents per share, implies a year-over-year decline of 71.4%. SPWR has a four-quarter earnings surprise of 113.33%.

Sunrun RUN is slated to release fourth-quarter 2021 results on Feb 17. The Zacks Consensus Estimate for Sunrun’s fourth-quarter earnings, pegged at 10 cents per share, implies year-over-year growth of 266.7%.

The Zacks Consensus Estimate for RUN’s fourth-quarter sales, pegged at 398.9 million, suggests year-over-year growth of 24.5%. Sunrun has a four-quarter negative earnings surprise of 233.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SunPower Corporation (SPWR) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

Sunrun Inc. (RUN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance