Enphase (ENPH) Ventures Into the Solar Market of South Africa

Enphase Energy, Inc. ENPH recently ventured into the solar market of South Africa by unveiling its IQ8 Microinverters for the nation’s residential customers as well as for usage in small commercial applications. With this launch, Enphase Energy’s revenues from the international market can be expected to enhance in the coming quarters.

A Peek Into Enphase’s Expansion Plans

With a lackluster performance in the United States in the past couple of quarters, Enphase has been steadily expanding its footprint in other regions to capitalize on the growing global solar demand. The company’s recent expansion in South Africa is in line with its plan to leverage the increasing demand worldwide.

ENPH’s efforts to expand in global solar markets have resulted in nearly 3,500 installers of Enphase Energy Systems in worldwide markets like Brazil, Mexico, India, Spain and other emerging markets.

The company’s global expansion strategy is yielding positive results, as testified by its second-quarter performance, wherein Enphase witnessed record growth in international revenues. In light of such an expansion strategy by the company, it is reasonable to assume that Enphase’s revenue generation prospects remain bright in markets outside the United States.

Peer Moves

Per the report from the Mordor Intelligence firm, the global solar energy market is poised to witness a CAGR of 12.7% over the 2023-2028 period. This strongly aligns with Enphase’s global expansion strategy.

Other solar majors that are steadily expanding their footprint in global solar markets are as follows:

SolarEdge SEDG: Its international presence continues to bolster its revenue generation prospects. The company has a strong presence in Germany, the United Kingdom, Switzerland, South Africa and Thailand. SolarEdge expects the momentum to continue to grow in Europe, particularly in Germany, where installation activity is anticipated to rise from 7.5 GW in 2022 to 10 GW in 2024.

SolarEdge boasts a long-term earnings growth rate of 23.6%. The Zacks Consensus Estimate for SolarEdge’s 2023 earnings suggests a growth rate of 59.2% from the prior-year reported figure.

Canadian Solar CSIQ: It caters to a geographically diverse customer base across key markets in the United States, China, Japan, the U.K. and Canada and emerging markets in Brazil, India, Mexico, Italy, Germany, South Africa and the Middle East. Of late, the company has expanded its global late-stage project pipeline into nations like Argentina, Australia and South Korea as these markets are expected to see the next phase of industrial growth.

The Zacks Consensus Estimate for Canadian Solar’s 2023 sales suggests an improvement of 15.6% from the prior-year reported figure. The Zacks Consensus Estimate for Canadian Solar’s 2023 earnings calls for growth of 80.5% from the prior-year reported figure.

First Solar FSLR: The company is steadily expanding its footprint in India and Europe. First Solar has finished the construction of its 3.3 GW first manufacturing facility in India and is expected to have begun production by the end of August 2023, per its earlier made projection.

The Zacks Consensus Estimate for First Solar’s 2023 sales suggests a growth rate of 35.2% from the prior-year reported figure. Shares of FSLR have returned 18% returns to its investors in the past year.

Price Movement

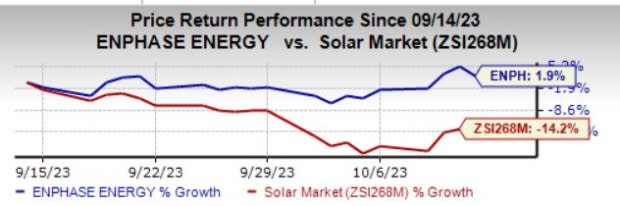

In the past month, shares of Enphase Energy have increased 1.9% against the industry’s decline of 14.2%.

Image Source: Zacks Investment Research

Zacks Rank

Enphase Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Canadian Solar Inc. (CSIQ) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance