If EPS Growth Is Important To You, Bytes Technology Group (LON:BYIT) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Bytes Technology Group (LON:BYIT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Bytes Technology Group with the means to add long-term value to shareholders.

See our latest analysis for Bytes Technology Group

How Fast Is Bytes Technology Group Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's easy to see why many investors focus in on EPS growth. Bytes Technology Group's EPS shot up from UK£0.095 to UK£0.15; a result that's bound to keep shareholders happy. That's a fantastic gain of 59%.

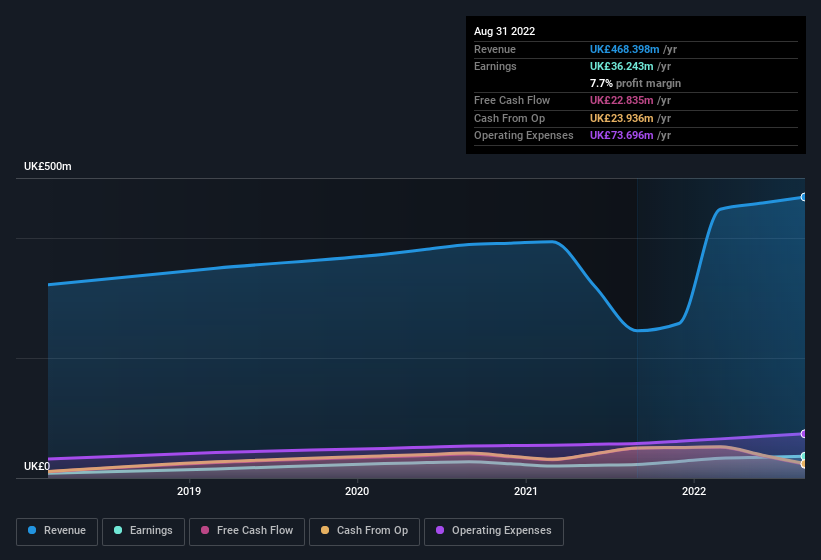

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the revenue front, Bytes Technology Group has done well over the past year, growing revenue by 91% to UK£468m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Bytes Technology Group?

Are Bytes Technology Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Shareholders in Bytes Technology Group will be more than happy to see insiders committing themselves to the company, spending UK£390k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. We also note that it was the CEO & Director, Neil Murphy, who made the biggest single acquisition, paying UK£200k for shares at about UK£3.94 each.

Along with the insider buying, another encouraging sign for Bytes Technology Group is that insiders, as a group, have a considerable shareholding. To be specific, they have UK£17m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 1.7% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Bytes Technology Group's CEO, Neil Murphy, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like Bytes Technology Group with market caps between UK£797m and UK£2.6b is about UK£1.6m.

The Bytes Technology Group CEO received total compensation of just UK£739k in the year to February 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Bytes Technology Group Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Bytes Technology Group's strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. These things considered, this is one stock worth watching. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Bytes Technology Group.

Keen growth investors love to see insider buying. Thankfully, Bytes Technology Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance