If EPS Growth Is Important To You, Johnson Service Group (LON:JSG) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Johnson Service Group (LON:JSG), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Johnson Service Group

Johnson Service Group's Improving Profits

Johnson Service Group has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. Johnson Service Group's EPS shot up from UK£0.05 to UK£0.082; a result that's bound to keep shareholders happy. That's a impressive gain of 64%.

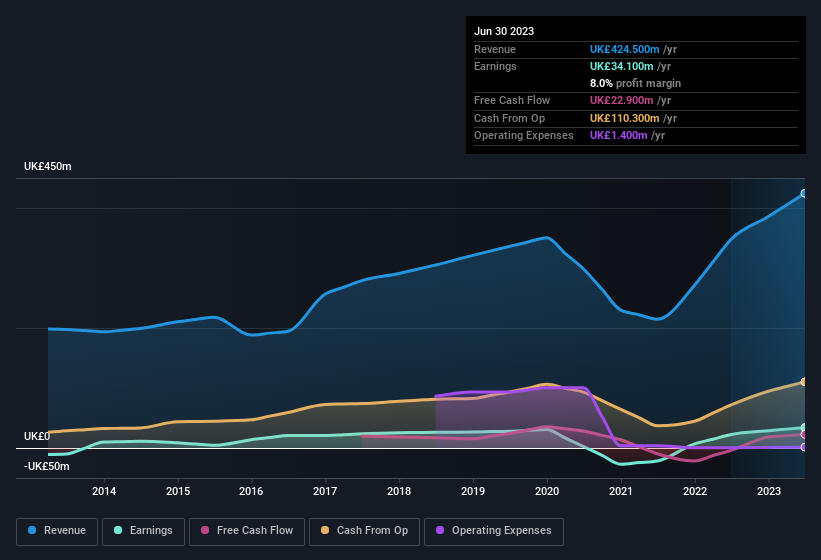

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Johnson Service Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 22% to UK£425m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Johnson Service Group's future profits.

Are Johnson Service Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Johnson Service Group shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Peter Egan, the CEO, Executive Director and Director of Health of the company, paid UK£29k for shares at around UK£1.17 each. Purchases like this can help the investors understand the views of the management team; in which case they see some potential in Johnson Service Group.

It's commendable to see that insiders have been buying shares in Johnson Service Group, but there is more evidence of shareholder friendly management. Namely, Johnson Service Group has a very reasonable level of CEO pay. Our analysis has discovered that the median total compensation for the CEOs of companies like Johnson Service Group with market caps between UK£316m and UK£1.3b is about UK£1.1m.

Johnson Service Group offered total compensation worth UK£624k to its CEO in the year to December 2022. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Johnson Service Group Deserve A Spot On Your Watchlist?

You can't deny that Johnson Service Group has grown its earnings per share at a very impressive rate. That's attractive. But wait, it gets better. We have seen insider buying and the executive pay seems on the modest side of things. The overriding message from this quick rundown is yes, this stock is worth investigating further. Now, you could try to make up your mind on Johnson Service Group by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The good news is that Johnson Service Group is not the only growth stock with insider buying. Here's a list of growth-focused companies in GB with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance