If EPS Growth Is Important To You, Laurentian Bank of Canada (TSE:LB) Presents An Opportunity

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Laurentian Bank of Canada (TSE:LB). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Laurentian Bank of Canada with the means to add long-term value to shareholders.

Check out our latest analysis for Laurentian Bank of Canada

How Quickly Is Laurentian Bank of Canada Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Laurentian Bank of Canada grew its EPS by 11% per year. That's a pretty good rate, if the company can sustain it.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Our analysis has highlighted that Laurentian Bank of Canada's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. Laurentian Bank of Canada reported flat revenue and EBIT margins over the last year. That's not a major concern but nor does it point to the long term growth we like to see.

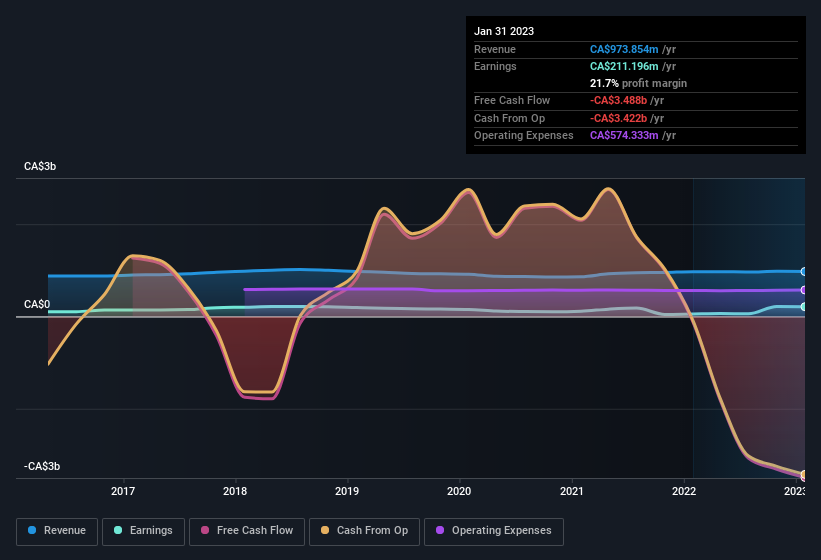

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Laurentian Bank of Canada's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Laurentian Bank of Canada Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Shareholders in Laurentian Bank of Canada will be more than happy to see insiders committing themselves to the company, spending CA$632k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. Zooming in, we can see that the biggest insider purchase was by Independent Chairman of the Board Michael Mueller for CA$498k worth of shares, at about CA$33.43 per share.

Should You Add Laurentian Bank of Canada To Your Watchlist?

One important encouraging feature of Laurentian Bank of Canada is that it is growing profits. While some companies are struggling to grow EPS, Laurentian Bank of Canada seems free from that morose affliction. The eye-catcher here is the reecnt insider share acquisitions which are undoubtedly enough to entice some investors to keep watch for the future. Before you take the next step you should know about the 2 warning signs for Laurentian Bank of Canada (1 shouldn't be ignored!) that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, Laurentian Bank of Canada isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance