EUR/USD Fundamental Analysis – week of August 7, 2017

For much of the week, the EURUSD pair was in a state of consolidation and ranging as all the major news was lined up only towards the end of the week and any news before that was just the starter before the main course that was to be served late in the week. That is why, we saw some ranging during the middle of the week with no specific direction.

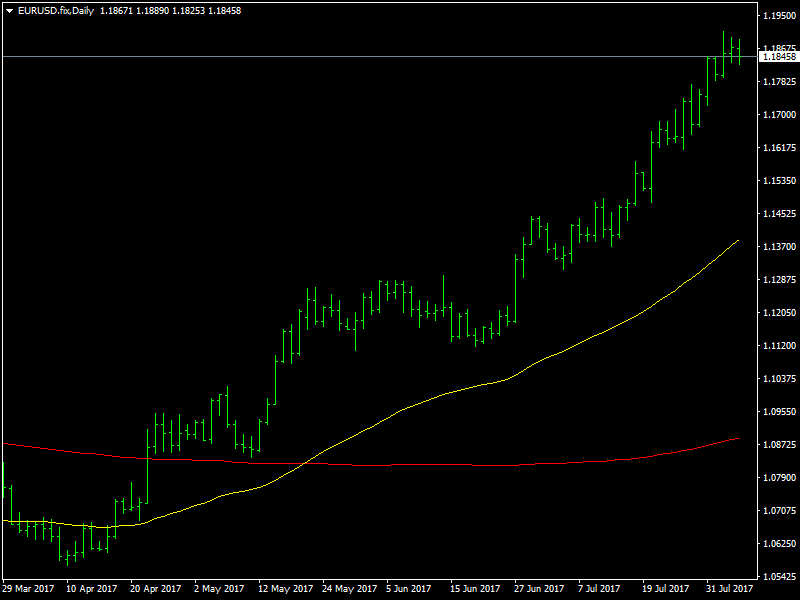

EURUSD Still Looking Bullish

To begin the week, we saw some recovery in the dollar strength which helped to push the EURUSD down towards the strong support at 1.1710 region and we continued to maintain that any deep correction was possible only if this region was broken through. The break did not come though and hence we saw the pair move up during the course of the week. We also saw the ADP employment report released during the middle of the week which came in slightly weaker than expected and this stopped the dollar recovery in its tracks.

Though the dollar recovery was stopped, the dollar continued to hold steady in the middle of the week as it awaited the NFP and the wages data on Friday. A lot hinged on these reports as far as the short term direction was concerned and also to prove that the weak data over the last few weeks was only a blip. The NFP did come in stronger at 209K and with the average wages also coming in as per expected, the dollar managed to recover to close the week and this is likely to be the trend for the short term.

Looking ahead to the coming week, as long as the support region at 1.1710 holds, we are still bullish on the pair. Though a part of the market believes that the euro is overbought and that the dollar is oversold, we know that a currency can be overbought or oversold for as long as it wants to be and still continue in that direction. The ECB is yet to begin its cycle of tapering while the US economy is faltering and may not be able to sustain many more hikes. Also, the Fed seems to be happy with a weak dollar and considering all this, it is only logical for this uptrend to continue.

This article was originally posted on FX Empire

More From FXEMPIRE:

E-mini Dow Jones Industrial Average (YM) Futures Analysis – August 4, 2017 Forecast

Dow Jones 30 and NASDAQ 100 Price Forecast August 4, 2017, Technical Analysis

Stocks Finished Mixed after Russia Investigation News Rattles Investors

E-mini Dow Jones Industrial Average (YM) Futures Analysis – August 3, 2017 Forecast

Equities and Forex Producing Caution Ahead of Important Reports

Yahoo Finance

Yahoo Finance