EUR/USD Mid-Session Technical Analysis for November 17, 2017

The EUR/USD is trading higher on Friday. Most of the rally is being fueled by a weaker dollar rather than a stronger Euro. The greenback is under pressure because of a report from The Wall Street Journal which stated the Trump campaign’s records had been subpoenaed as part of the investigation into Russian interference in the U.S. Presidential election.

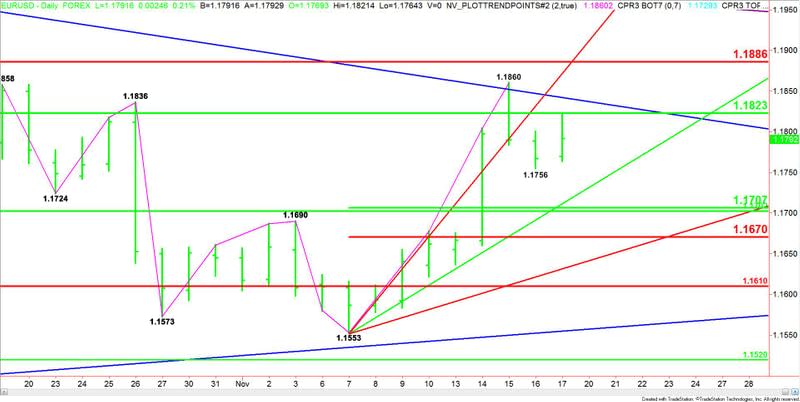

Daily Technical Analysis

The main trend is up according to the daily swing chart. A trade through 1.1860 will signal a resumption of the uptrend.

A trade through 1.1756 will change the minor trend to down.

On the upside, the resistance zone is 1.1823 to 1.1886.

The main range is 1.1553 to 1.1860. Its retracement zone at 1.1707 to 1.1670 is the primary downside target. Inside this zone is the major 50% level at 1.1702.

The best support cluster is 1.1707 to 1.1702.

Daily Technical Forecast

The early price action indicates that investors are respecting the 50% level at 1.1823. Overtaking this level could drive the market into the long-term downtrending angle at 1.1842. This angle stopped the rally earlier in the week.

Overcoming 1.1842 is likely to drive the EUR/USD into the high for the week at 1.1860, followed by the Fibonacci level at 1.1886.

If the upside momentum starts to taper off, we could see an intraday break into yesterday’s low at 1.1756. If this price fails then look for a move into the uptrending angle at 1.1713, followed by a pair of 50% levels at 1.1707 to 1.1702.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance