Stocks Eke Out Gains in Fed Run-Up as Euro Falls: Markets Wrap

(Bloomberg) -- Stocks eked out gains in a cautious session that saw investors positioning for the Federal Reserve decision and key inflation data. Apple Inc. sank even after unveiling new artificial-intelligence features.

Most Read from Bloomberg

Russia Is Sending Young Africans to Die in Its War Against Ukraine

NYC Landlord to Sell Office Building at Roughly 67% Discount

Investment Bank Moelis Probes Incident After Video of Employee Appearing to Punch Woman

Apple Unveils ‘AI for the Rest of Us’ in Bid to Retake Spotlight

As traders braced for volatility ahead of US macroeconomic catalysts, uncertainties across the Atlantic also kept a lid on equities. European shares slid after French President Emmanuel Macron called a legislative vote in the wake of a crushing defeat in European Parliament elections. Yields on France’s 10-year bonds hit their highest this year, while the nation’s top banks tumbled. The euro led losses in developed-world currencies.

Wall Street’s most-prominent trading desks from JPMorgan Chase & Co. to Citigroup Inc. are urging investors prepare for a stock market jolt after Wednesday’s consumer price index and the US rate decision.

The Fed is widely expected to hold borrowing costs steady, but there’s less certainty on officials’ rate projections. A 41% plurality of economists expect them to signal two cuts in the “dot plot,” while an equal number expect the forecasts to show just one or no cuts at all.

“The interest-rate guessing game goes on,” said Chris Larkin at E*Trade from Morgan Stanley. “Even the friendliest inflation numbers probably won’t push the Fed to act any sooner than September.”

The S&P 500 rose 0.3% to close at a fresh record. Nvidia Corp. began trading after a 10-for-one stock split. GameStop Corp. plunged 12%.

The Treasury market also saw small moves as a weak $58 billion three-year auction knocked sentiment ahead of Tuesday’s $39 billion 10-year sale.

“The release of a new ‘dot plot’ outlining Fed projections for the path of rates will be the top focus,” said Jason Pride and Michael Reynolds at Glenmede. “For fixed income investors, the Fed’s more patient higher-for-longer approach is likely to keep bond yields elevated as inflationary pressures remain.”

Whether it’s another move up or a dive down, traders are bracing for wider swings on Wednesday, with a report on consumer prices in the morning and the Fed’s rate decision in the afternoon.

The options market is betting the S&P 500 will move 1.25% in either direction that day, based on the cost of at-the-money puts and calls, said Stuart Kaiser, Citigroup Inc.’s head of US equity trading strategy. Should that pricing remain in place by Tuesday’s close, that figure would be the largest implied swing ahead of a Fed decision since March 2023, he added.

“The equity market has had a terrific year, but there is a current pause in the rally as the Fed comes into question,” said David Donabedian at CIBC Private Wealth US. “There is a real chance if the economy does not slow down there will be no rate cut this year.”

Investors remain too optimistic about the timing of a Fed rate cut, according to RBC Capital Markets strategists led by Lori Calvasina, who see the risk of a slump in US stocks if easing fails to materialize this year.

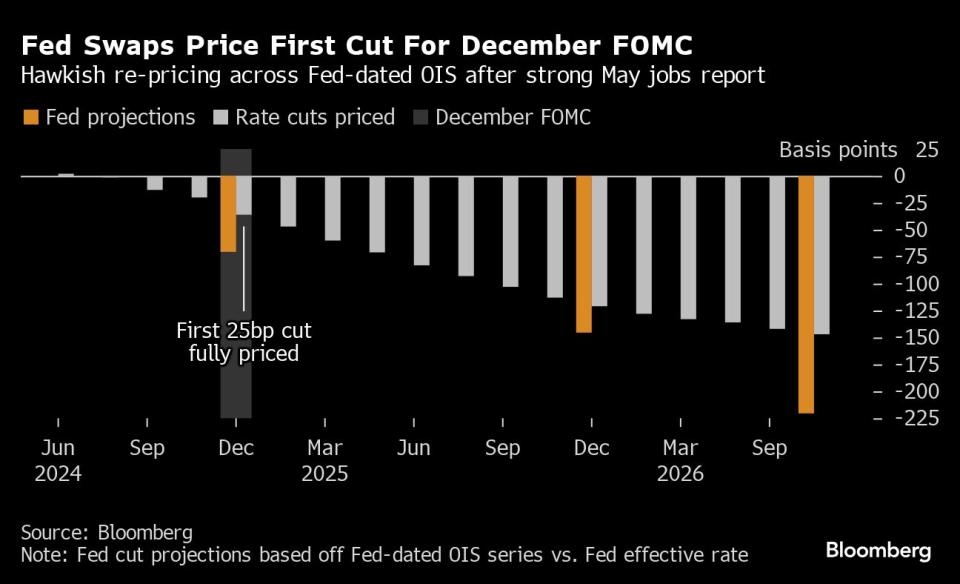

Traders are now only pricing in one full rate reduction by December, according to swaps data, but even that projection is too optimistic, Calvasina said. And with signs of pressure on low-income consumers fanning concerns about economic growth, “there is some modest downside risk to the US equity market if the Fed does nothing this year and inflation is stickier than expected.”

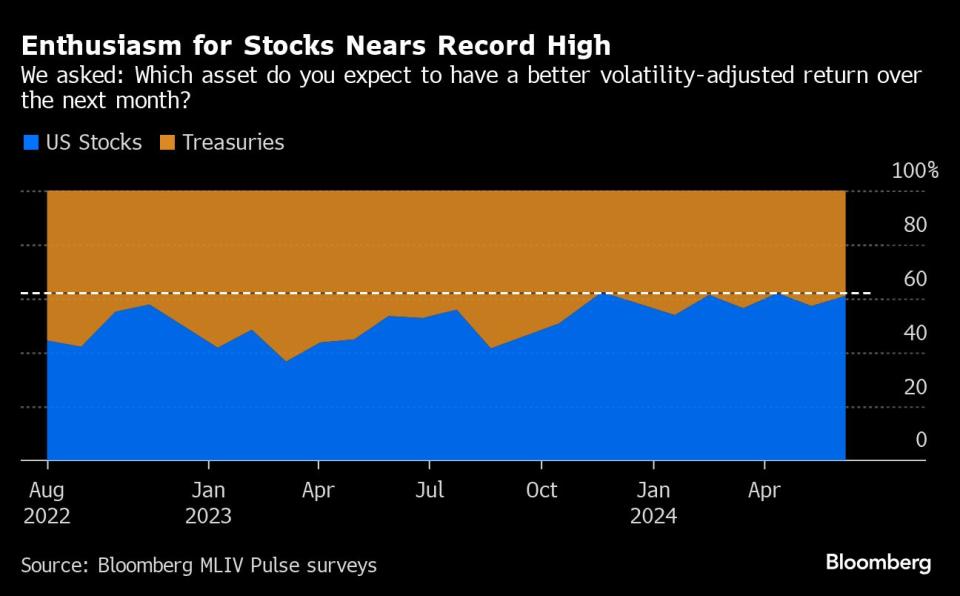

More than 60% of respondents in the latest MLIV Pulse survey expect US stocks to outperform Treasuries on a volatility-adjusted basis next month.

That reading has been higher only three times in the history of the survey going back to August 2022.

Corporate Highlights:

Activist Elliott Investment Management called for sweeping changes to Southwest Airlines Co.’s leadership to reverse what it sees as years of underperformance by one of the biggest US carriers.

Advanced Micro Devices Inc. was cut at Morgan Stanley, which said investor expectations for the chipmaker’s AI business “seem too high.”

KKR & Co., CrowdStrike Holdings Inc. and GoDaddy Inc. will join the S&P 500 as part of its latest quarterly weighting change.

Noble Corp., the world’s biggest offshore oil-rig contractor by market value, agreed to buy its smaller rival Diamond Offshore Drilling Inc. in a deal valued at $1.6 billion.

Key events this week:

China PPI, CPI, Wednesday

Germany CPI, Wednesday

US CPI, Fed rate decision, Wednesday

G-7 leaders summit, June 13-15

Eurozone industrial production, Thursday

US PPI, initial jobless claims, Thursday

Tesla annual meeting, Thursday

New York Fed President John Williams moderates a discussion with Treasury Secretary Janet Yellen, Thursday

Bank of Japan’s monetary policy decision, Friday

Chicago Fed President Austan Goolsbee speaks, Friday

US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

The S&P 500 rose 0.3% as of 4 p.m. New York time

The Nasdaq 100 rose 0.4%

The Dow Jones Industrial Average rose 0.2%

The MSCI World Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.4% to $1.0762

The British pound was little changed at $1.2730

The Japanese yen fell 0.2% to 157.01 per dollar

Cryptocurrencies

Bitcoin fell 0.4% to $69,434.01

Ether fell 1% to $3,663.81

Bonds

The yield on 10-year Treasuries advanced three basis points to 4.47%

Germany’s 10-year yield advanced five basis points to 2.67%

Britain’s 10-year yield advanced six basis points to 4.32%

Commodities

West Texas Intermediate crude rose 3.1% to $77.89 a barrel

Spot gold rose 0.7% to $2,309.10 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Stephen Kirkland, Catherine Bosley, Andre Janse van Vuuren, Selcuk Gokoluk, Jessica Menton, Kasia Klimasinska, Felice Maranz and Sagarika Jaisinghani.

Most Read from Bloomberg Businessweek

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

Sam Altman Was Bending the World to His Will Long Before OpenAI

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance