Euro Struggling Amid Weaker Sentiment and Likely Rate Cuts

In a relatively quiet week of economic data and news, the euro has been among the bigger losers of major currencies along with the yen. Ifo Business Climate and GfK Consumer Confidence from Germany showed in the last few days that sentiment in the eurozone’s largest economy is worse among both businesses and consumers. This article summarises recent data affecting the euro and looks briefly at the charts of EURUSD and EURJPY.

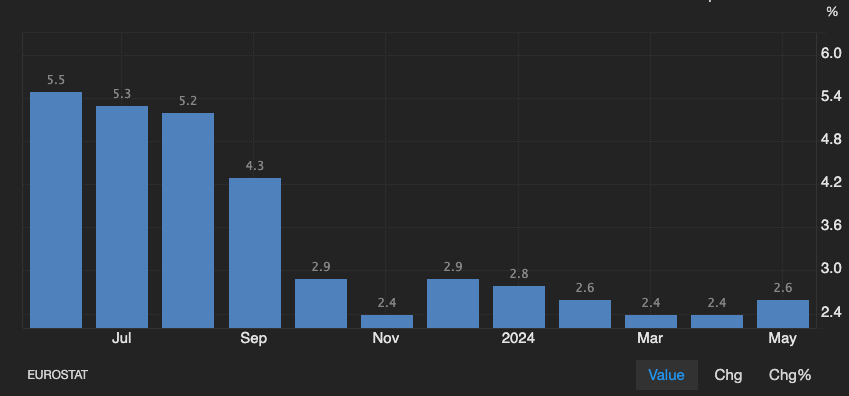

The European Central Bank (‘the ECB’) was among the first major central banks to cut rates this year, moving the main refinancing rate down to 4.25% on 6 June. That comes as inflation seems to be more-or-less under control but still above the usual target of 2%:

Now that inflation seems to have settled below 3%, the ECB has options to cut. However, that doesn’t necessarily mean a consistent cycle of loosening policy, at least not yet. Part of the challenge for the ECB is the diversity of the countries in the eurozone; different industries, services and trade profiles mean different rates of inflation. For example, the latest release showed a range between only 0.8% annual non-core inflation in Italy up to 3.8% in Spain.

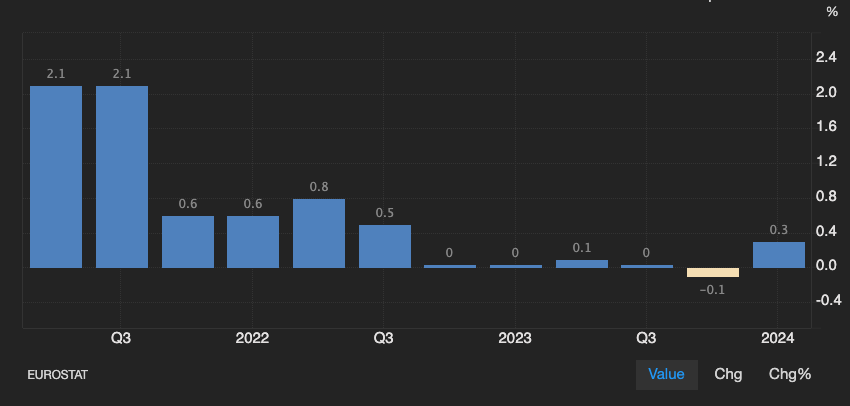

Somewhat like the Federal Reserve (‘the Fed’) in the USA, there’s no sign of a pending economic crisis generating urgency for rates to be cut:

Obviously, economic performance in the eurozone hasn’t exactly been great in the last couple of years, but the final figure of 0.3% quarterly growth in GDP last quarter shows that the bloc isn’t in a technical recession. If it does come later this year, a technical recession would probably be minimal and only really felt in specific countries such as the Baltic states.

Most expectations for the ECB’s policy in the second half of 2024 suggest two more cuts. However, it’s not clear yet when these might be. If this consensus is accurate, it’d be unlikely to see both cuts in succession; rather, one in September and another in December might seem more probable. Based on projections from the ECB’s last meeting on 6 June, inflation isn’t likely to reach the target of 2% until sometime in the first half of 2026, so it would seem sensible for the ECB to wait and evaluate upcoming data before committing to more cuts.

Sentiment both across the eurozone and in Germany specifically worsened slightly overall in May. The exception was eurozone-wide consumer sentiment, which was slightly less pessimistic last month according to data on 27 June, although overall sentiment was still lower.

Politics remains a key factor for the euro. France’s legislative elections on 30 June and 7 July could have a strong effect on the euro in all of its pairs. Even though currently the right-wing National Rally (‘RN’) is expected to win a plurality of votes, around 36%, polling can change quickly in the immediate runup to an election and the actual results are often surprising. If the RN’s actual performance is worse than expected, the euro might make gains.

Euro-dollar, Daily

Euro-dollar held close to monthly lows in the middle of June as traders continued to expect more cuts from the ECB than the Fed this year and it remained clear that overall economic performance in the eurozone is worse than the USA. However, it’s unlikely that either the EU or the USA will face a recession this year or a significant divergence in policy will open up between the Fed and the ECB before possibly Q1 2025, so fundamentals don’t strongly favour either currency at the moment.

Since $1.067 has been tested unsuccessfully three times so far this month, the price probably won’t break clearly below there without a significant fundamental driver; most of the time, second and subsequent tests of a technical area are less likely to break through. The main reference on this chart remains the 38.2% weekly Fibonacci retracement around $1.072.

Both on the daily chart (if zoomed out somewhat) and the weekly, the current trend looks more like sideways than downward, so the value area between the 20, 50 and 100 SMAs might cap any gains in the next few sessions. Traders are concentrating on the French elections, but German and eurozone-wide preliminary inflation on 1 and 2 July respectively are important releases.

Euro-yen, Daily

The euro has made gains against the yen in June, with the Japanese currency losing out across the board over the last several months as the Bank of Japan (‘the BoJ’) has been more cautious than expected in starting to tighten policy. Fresh verbal interventions by the government of Japan continue but so far haven’t had a significant impact on markets.

The current area just below ¥172 is the EURJPY’s highest price since the introduction of the euro in 2002, so it’s difficult to project the next possible resistance apart from psychological areas. It’s also questionable whether gains will continue at this pace due to a clear overbought signal from the slow stochastic and the lack of any significant retracement since May.

Many traders are expecting a material intervention – i.e. not just more headlines saying ‘we’ll do something when we need to’ – by the BoJ within the next few weeks. If this occurs, which is not guaranteed, there might be a similar situation to late April and early May when volatility massively increased around the BoJ’s meeting. The 50 SMA from Bands seems to be a strong dynamic support given that it’s been tested unsuccessfully four times since 12 April.

This article was submitted by Michael Stark, an analyst at Exness.

The opinions in this article are personal to the writer. They do not reflect those of Exness or FX Empire.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance