Euronext Paris Dividend Stocks With Yields Up To 8.9%

Amidst a backdrop of rising inflation and policy adjustments in Europe, the French market has shown resilience with the CAC 40 Index navigating through economic uncertainties. In such an environment, dividend stocks remain a focal point for investors seeking yields and stability in their portfolios.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 5.97% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.40% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.32% | ★★★★★★ |

Fleury Michon (ENXTPA:ALFLE) | 5.37% | ★★★★★☆ |

Métropole Télévision (ENXTPA:MMT) | 8.97% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 3.77% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.17% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.79% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 3.87% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.14% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Euronext Paris Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

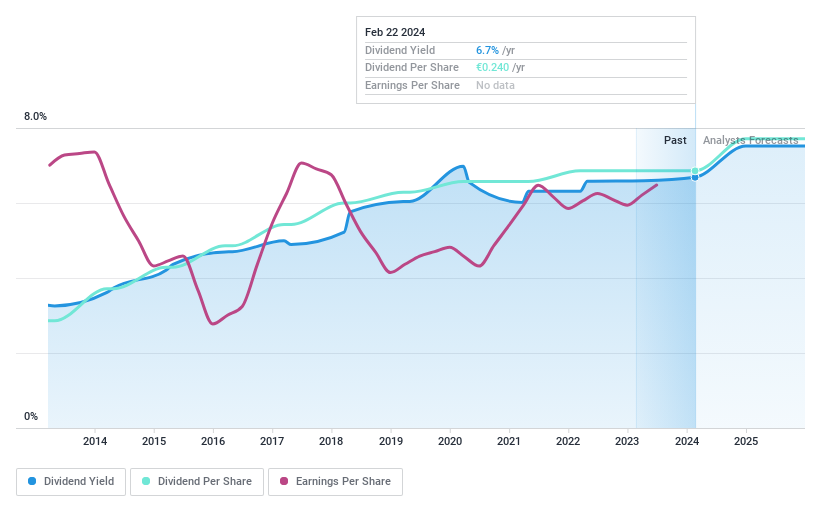

CBo Territoria

Simply Wall St Dividend Rating: ★★★★★★

Overview: CBo Territoria SA is a French company specializing in urban planning and development, as well as property development and investment, with a market capitalization of €136.08 million.

Operations: CBo Territoria SA generates revenue primarily through two segments: land sales, which contributed €25.51 million, and property promotion activities, accounting for €58.08 million.

Dividend Yield: 6.3%

CBo Territoria exhibits a balanced profile for dividend investors, offering a high and reliable yield of 6.32%, supported by a decade of stable and growing payouts. Despite a slight dip in net income from €16 million to €14.1 million in 2023, its dividends remain well-covered with earnings and cash flows, showcasing payout ratios of 61% and 25.4% respectively. The firm's price-to-earnings ratio stands at an attractive 9.7x, below the French market average of 17x, although it carries a high level of debt which could be a concern for sustainability.

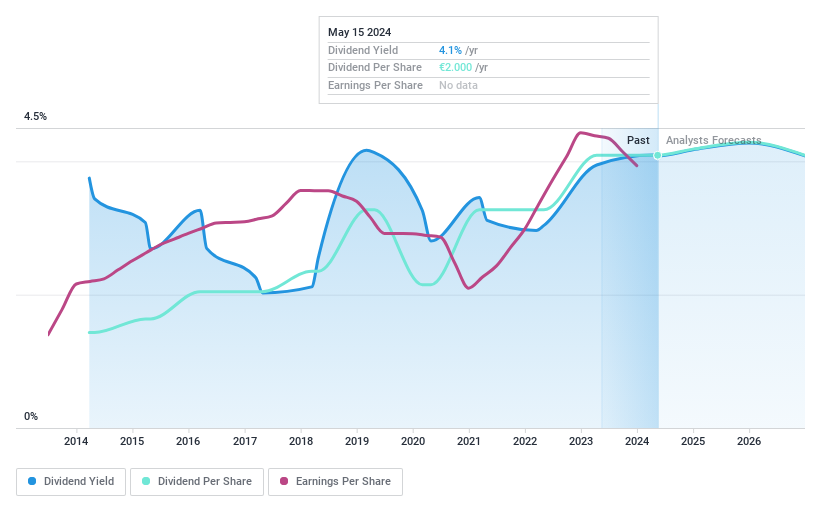

Infotel

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Infotel SA, with a market cap of €318.89 million, specializes in designing, developing, marketing, and maintaining software solutions focused on security, performance, and management across the globe.

Operations: Infotel SA generates revenue primarily through its Services segment, which brought in €296.02 million, and its Software segment, which contributed €11.53 million.

Dividend Yield: 4.3%

Infotel SA's dividend yield at 4.35% trails behind the top French dividend payers, reflecting a modest performance in a competitive market. Despite this, its dividends are well-supported by earnings and cash flows with payout ratios of 76.2% and 63.7%, respectively, suggesting financial prudence in distribution policies. However, the company's decade-long track record shows volatility in dividend payments, indicating potential uncertainty for long-term stability. Recent financials reveal a slight revenue increase to €307.5 million but a dip in net income to €18.1 million as of December 2023.

Unlock comprehensive insights into our analysis of Infotel stock in this dividend report.

Our valuation report unveils the possibility Infotel's shares may be trading at a discount.

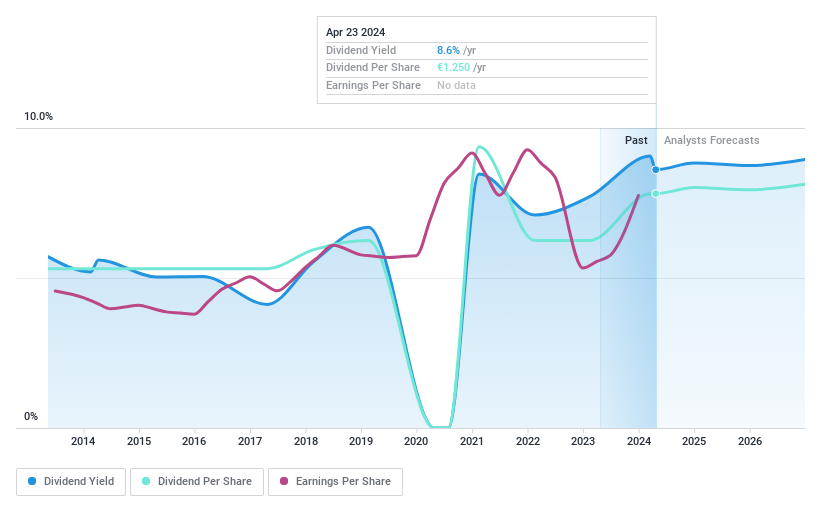

Métropole Télévision

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Métropole Télévision S.A., operating under the ticker ENXTPA:MMT, is a media company offering a diverse array of programs, products, and services across multiple platforms, with a market capitalization of approximately €1.75 billion.

Operations: Métropole Télévision S.A. generates revenue through its television segment (€1.05 billion), radio (€166.20 million), production and audiovisual rights (€153.70 million), and other diversification activities (€38.50 million).

Dividend Yield: 9%

Métropole Télévision S.A. has demonstrated a notable dividend yield of 9.7%, positioning it among the top French dividend payers. Despite this, the company's dividends have shown volatility over the past decade, with a recent increase to €1.25 per share for 2023. Dividend coverage remains sound with earnings and cash flow payout ratios at 67.2% and 70.8% respectively, although earnings are projected to decline by an average of 6.7% annually over the next three years, which could pressure future payouts.

Summing It All Up

Unlock our comprehensive list of 33 Top Euronext Paris Dividend Stocks by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:CBOT ENXTPA:INF and ENXTPA:MMT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance