Euronext Paris Highlights: 3 Growth Companies With Insider Ownership Up To 16%

Amidst a backdrop of rising optimism in European markets, with France's CAC 40 Index experiencing a notable increase of 3.29%, investors are closely monitoring growth companies that demonstrate high insider ownership. Such characteristics can signal confidence from those most familiar with the company, potentially making these stocks appealing in the current economic climate.

Top 10 Growth Companies With High Insider Ownership In France

Name | Insider Ownership | Earnings Growth |

VusionGroup (ENXTPA:VU) | 13.3% | 25.8% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 37.7% |

WALLIX GROUP (ENXTPA:ALLIX) | 19.9% | 101.4% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

OSE Immunotherapeutics (ENXTPA:OSE) | 25.1% | 92.9% |

Adocia (ENXTPA:ADOC) | 12.8% | 104.5% |

Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

Arcure (ENXTPA:ALCUR) | 21.4% | 41.7% |

Munic (ENXTPA:ALMUN) | 29.2% | 150% |

MedinCell (ENXTPA:MEDCL) | 16.6% | 68.8% |

We'll examine a selection from our screener results.

OVH Groupe

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. operates globally, offering public and private cloud services, shared hosting, and dedicated server solutions, with a market capitalization of approximately €1.23 billion.

Operations: The company generates revenue from three main segments: public cloud (€140.71 million), private cloud (€514.59 million), and web cloud (€179.45 million).

Insider Ownership: 10.5%

OVH Groupe S.A., a French growth company with high insider ownership, is navigating through a transformative phase. Despite its highly volatile share price in recent months, OVH has shown promising financial improvements with a reduction in net loss from €26.59 million to €17.24 million year-over-year and an increase in sales to €486.09 million. The company is forecasted to become profitable within three years, outpacing average market growth, although its expected revenue growth of 11.3% per year lags behind the desired 20% threshold but still exceeds the French market average of 5.8%. However, concerns remain regarding its low projected return on equity of 3.8%. The recent appointment of Benjamin Revcolevschi as head of operations underscores a strategic push towards innovation and international expansion, enhancing OVH's development trajectory amidst competitive pressures.

Click to explore a detailed breakdown of our findings in OVH Groupe's earnings growth report.

Our valuation report here indicates OVH Groupe may be overvalued.

Solutions 30

Simply Wall St Growth Rating: ★★★★★☆

Overview: Solutions 30 SE offers support solutions for new digital technologies across multiple European countries including France, Italy, Germany, the Netherlands, Belgium, Luxembourg, Poland, and Spain, with a market capitalization of approximately €0.24 billion.

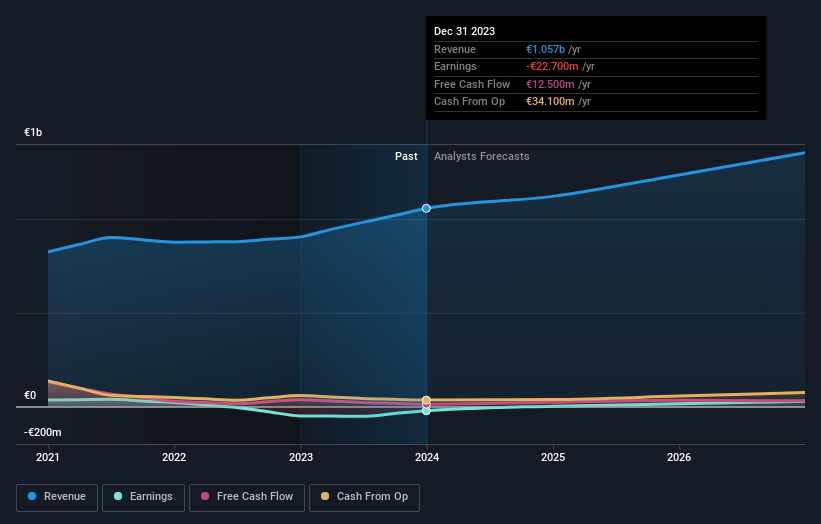

Operations: The company generates €1.06 billion from its computer services segment.

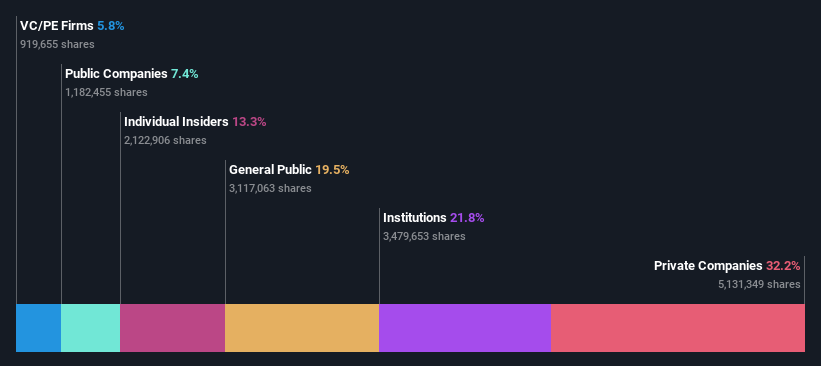

Insider Ownership: 16.2%

Solutions 30 SE, a French growth company, is trading at 34.7% below its estimated fair value and is expected to become profitable within the next three years. Despite its highly volatile share price, recent contracts like the significant Fluvius deal to upgrade Flanders' electricity network underscore robust business expansion prospects. Analysts predict a substantial 21.6% potential increase in stock price and forecast earnings growth of 99.79% per year, signaling strong future performance amidst operational progress in key European markets.

VusionGroup

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. operates in Europe, Asia, and North America, offering digitalization solutions for commerce with a market capitalization of approximately €2.58 billion.

Operations: The company generates its revenue by providing digitalization solutions across Europe, Asia, and North America.

Insider Ownership: 13.3%

VusionGroup S.A., a French growth company with high insider ownership, has shown impressive financial performance with its earnings increasing significantly over the past year. Recent reports indicate a surge in sales to €801.96 million and net income to €79.77 million for the full year ended December 31, 2023. The company's revenue and earnings are expected to grow at rates above the French market average, with forecasts suggesting robust annual growths of 24.3% and 25.8%, respectively. Despite these strengths, VusionGroup's share price has been highly volatile over the past three months.

Make It Happen

Access the full spectrum of 21 Fast Growing Euronext Paris Companies With High Insider Ownership by clicking on this link.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTPA:OVH ENXTPA:S30 and ENXTPA:VU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance