Euronext Paris Showcases Three Stocks That Could Offer Hidden Value

Amidst a generally positive trend in European markets, with France's CAC 40 Index recently climbing by 1.67%, investors are keenly observing potential opportunities that might be hiding in plain sight. In this context, identifying undervalued stocks becomes particularly pertinent as it allows investors to potentially capitalize on discrepancies between current market prices and intrinsic values within the bustling Euronext Paris.

Top 10 Undervalued Stocks Based On Cash Flows In France

Name | Current Price | Fair Value (Est) | Discount (Est) |

Airbus (ENXTPA:AIR) | €130.98 | €239.75 | 45.4% |

Vente-Unique.com (ENXTPA:ALVU) | €15.55 | €29.98 | 48.1% |

Kaufman & Broad (ENXTPA:KOF) | €27.20 | €52.92 | 48.6% |

Lectra (ENXTPA:LSS) | €27.95 | €43.16 | 35.2% |

Wavestone (ENXTPA:WAVE) | €52.40 | €88.60 | 40.9% |

MEMSCAP (ENXTPA:MEMS) | €5.24 | €8.53 | 38.6% |

Vivendi (ENXTPA:VIV) | €9.834 | €15.54 | 36.7% |

Tikehau Capital (ENXTPA:TKO) | €21.35 | €32.29 | 33.9% |

Thales (ENXTPA:HO) | €151.95 | €254.51 | 40.3% |

Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €3.84 | €6.72 | 42.9% |

Here's a peek at a few of the choices from the screener

Esker

Overview: Esker SA is a company that operates a cloud platform for finance and customer service professionals both in France and internationally, with a market cap of approximately €1.07 billion.

Operations: The company generates its revenue primarily through its Software & Programming segment, which accounted for €190.92 million.

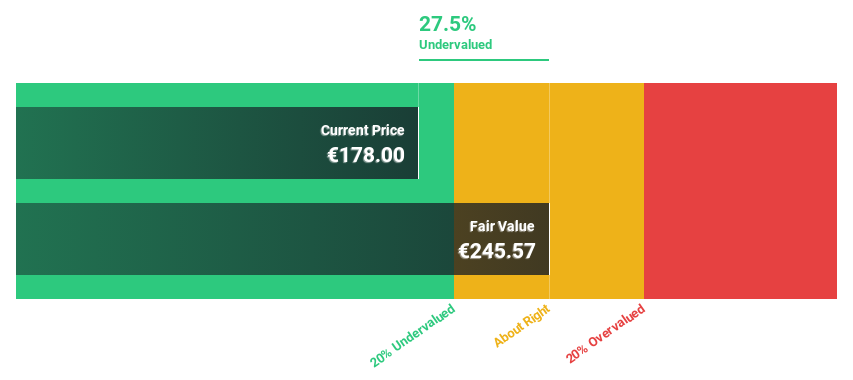

Estimated Discount To Fair Value: 26.3%

Esker is currently trading at €180.6, significantly below its estimated fair value of €244.97, indicating a potential undervaluation based on discounted cash flow analysis. With earnings expected to grow by 25.76% annually over the next three years and a projected high return on equity of 32.8%, Esker's financial health appears robust compared to the broader French market's slower growth rates. However, recent events include a 15% dividend cut, reflecting cautious capital management amidst its expansion and leadership changes aimed at enhancing governance and sustainability practices.

According our earnings growth report, there's an indication that Esker might be ready to expand.

Unlock comprehensive insights into our analysis of Esker stock in this financial health report.

Antin Infrastructure Partners SAS

Overview: Antin Infrastructure Partners SAS is a private equity firm focused on infrastructure investments, with a market capitalization of approximately €2.03 billion.

Operations: The firm's revenue is primarily derived from its asset management segment, totaling €282.87 million.

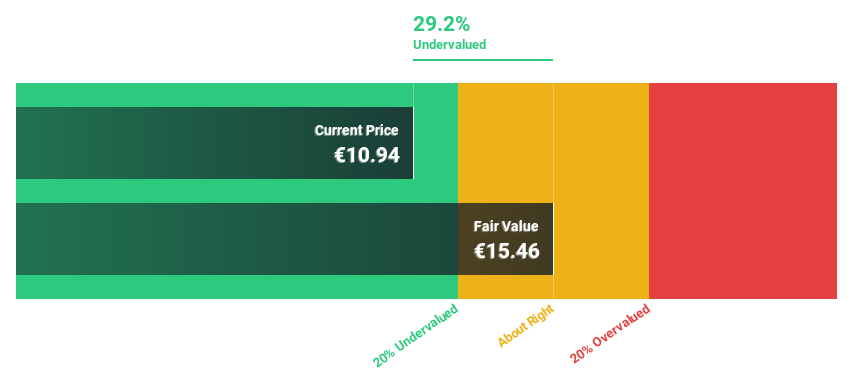

Estimated Discount To Fair Value: 27.1%

Antin Infrastructure Partners SAS, priced at €11.32, is considered undervalued against a fair value estimate of €15.53 based on discounted cash flow analysis. The company recently became profitable and is expected to see earnings grow by 25.88% annually over the next three years, outpacing the French market's growth. Despite this positive outlook, its dividend coverage by earnings and cash flows remains weak, with recent distributions including a total annual dividend of €0.71 per share.

Vivendi

Overview: Vivendi SE is a global entertainment, media, and communication company based in France with a market capitalization of €10.08 billion.

Operations: Vivendi's revenue is primarily generated through Canal + Group (€6.06 billion), followed by Havas Group (€2.87 billion), Lagardère (€0.67 billion), Gameloft (€0.31 billion), Prisma Media (€0.31 billion), Vivendi Village (€0.18 billion), and New Initiatives (€0.15 billion).

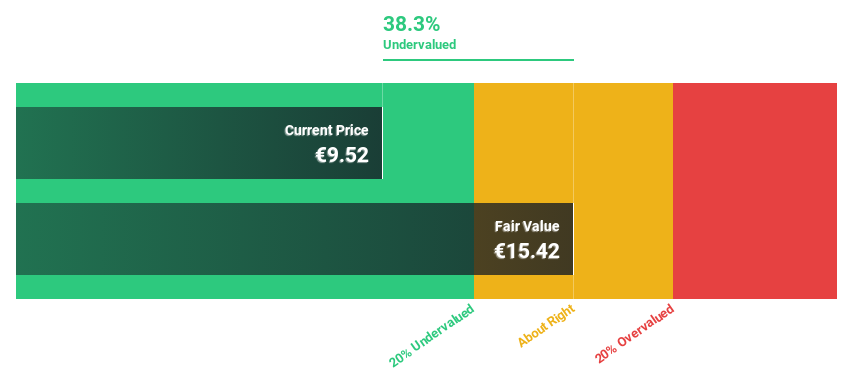

Estimated Discount To Fair Value: 36.7%

Vivendi SE, currently priced at €9.83, is perceived as undervalued with a fair value estimate of €15.54 based on discounted cash flow analysis. The company's earnings are expected to grow by 29.26% annually, significantly outperforming the French market's forecast growth rate. Despite an unstable dividend history and a low forecast return on equity of 6%, recent revenue growth to €4.28 billion in Q1 2024 and consensus analyst predictions suggest potential for stock price appreciation.

Make It Happen

Reveal the 14 hidden gems among our Undervalued Euronext Paris Stocks Based On Cash Flows screener with a single click here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ALESK ENXTPA:VIV and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance