Europe is finally starting to get some inflation

Reuters/Denis Balibouse

Inflation in the eurozone is finally starting to pick-up, albeit slowly, according to the latest data released by Eurostat on Friday morning.

Eurostat's preliminary Consumer Price Index reading for July showed inflation of 0.2% in the month, up from 0.1% in June, and above the consensus forecast of 0.1% growth predicted by economists.

On a year-to-year basis core consumer prices grew by 0.9%, against a forecast of 0.9%, and a previous reading of the same number.

Core prices are an important measure because they strip out the most volatile items — things like fuel and food prices, which are subject to volatility.

Here's what Eurostat had to say alongside the data release:

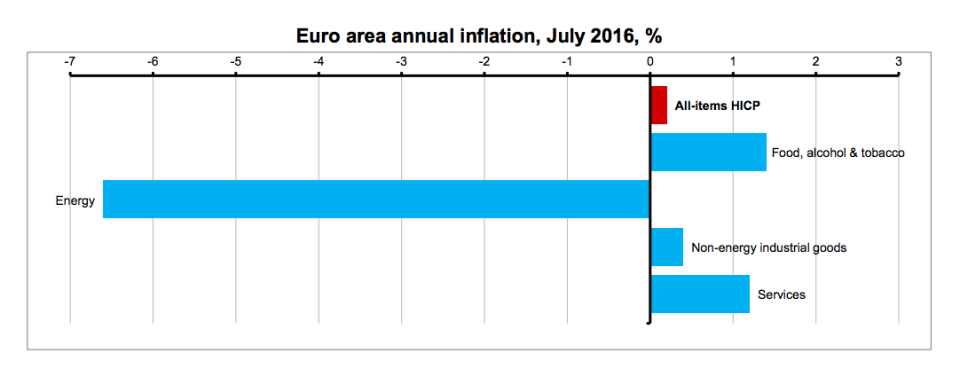

"Looking at the main components of euro area inflation, food, alcohol & tobacco is expected to have the highest annual rate in July (1.4%, compared with 0.9% June), followed by services (1.2%, compared with 1.1% in June), non-energy industrial goods (0.4%, stable compared with June) and energy (-6.6%, compared with -6.4% in June)."

And here's the chart:

Reuters/Denis Balibouse

The eurozone has been flirting with price deflation for the past year or so, largely hovering just above zero since early 2015. As a result, Friday's slight pick up is likely to be welcomed across the continent, and is likely to be used by the European Central Bank as evidence that its monetary policy measures — namely unprecedented bond buying, and negative interest rates — are doing their job and stimulating price growth.

NOW WATCH: A self-made millionaire describes the financial mistakes to avoid if you want to get rich by 30

See Also:

Yahoo Finance

Yahoo Finance