Europe and North America EV Charging Infrastructure Market Report 2023: Business Case for Connected Charging Stations Continues to Improve

Installed Base of Connected Charing Points (Europe and North America 2021-2026)

Dublin, Jan. 27, 2023 (GLOBE NEWSWIRE) -- The "EV Charging Infrastructure in Europe and North America - 3rd Edition" report has been added to ResearchAndMarkets.com's offering.

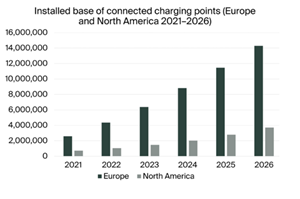

This study investigates the electric vehicle charging infrastructure market in Europe and North America. The total installed base of dedicated charging points in Europe is forecasted to grow at a compound annual growth rate (CAGR) of 34 percent from 4.5 million in 2021 to 19.6 million by 2026. In North America, the analyst estimates that the total installed base of dedicated charging points will increase from 1.4 million in 2021 to reach 6.1 million in 2026, growing at a CAGR of 34 percent. These numbers include both private and public charging points. About 1.6 million of these charging points in the two regions were monitored via cellular connections in 2021.

Highlights from the report:

Insights from 30 executive interviews with market leading companies.

New data on EV charging infrastructure in Europe and North America.

Comprehensive description of the EV charging value chain and key applications.

In-depth analysis of market trends and key developments.

Profiles of 68 companies offering EV charging hardware and software.

Profiles of 32 charge point operators (CPOs).

Market forecasts lasting until 2026.

The number of connected EV charging points in Europe and North America reached an estimated 3.3 million units in 2021. Europe represents the largest share comprising around 2.6 million of these charging points, corresponding to a connectivity penetration rate of 57 percent. In North America, about 0.7 million of the total number of charging points were connected, equivalent to a connectivity penetration rate of 52 percent. Growing at a compound annual growth rate of 40 percent, the number of connected charging points in the two regions is expected to reach 18.0 million in 2026.

The connected EV charging station market is served by a variety of players. The type of companies offering back-office software platforms for charging stations include dedicated charging station management software providers, hardware providers as well as charge point operators (CPOs). The back-office platforms developed in-house by CPOs are in some cases also offered as white-label solutions to other CPOs.

In North America, ChargePoint is a CPO with proprietary hardware and software solutions that additionally offers its solutions to other CPOs. The company is a clear leader in terms of charging points connected to its software platform in North America. Additional companies having a notable number of connected charging stations on their platform in the region include Flo, SemaConnect, EV Connect, Blink Charging, Shell Recharge Solutions and Tesla. ChargePoint and Enel X further account for the majority of the connected home chargers in the region.

Market Trends

Electric Vehicle Market Continues to Grow in Spite of Market Uncertainty

Business Case for Connected Charging Stations Continues to Improve

M&As Drive Consolidation in the EV Charging Landscape

Going Public Gives Access to Growth Capital

Demand for Public and Destination Charging to Increase Rapidly in Europe

Open Architectures Alter the EV Charging Value Chain

A Modular Design Improves the Case for Dc Charging

Car OEMs Offer MSP Services to Lower Barriers to EV Adoption

Fast Charging to Move to More Urban Locations

Heavy Commercial Vehicle Charging Emerges as a New Segment

Executive Summary

1 EV Charging in Europe and North America

2 Charging Technologies and Standards

2.1 Electric vehicle charging

2.1.1 AC and DC

2.1.2 Charging modes and levels

2.1.3 Battery capacity and charging time

2.2 Connector Standards

2.2.1 Type 1/SAE J1772

2.2.2 Type 2

2.2.3 Combined charging system (CCS)

2.2.4 CHAdeMO

2.2.5 North American Charging Standard (Tesla)

2.2.6 GB/T

2.3 Connectivity and management software

2.3.1 Cellular IoT gateways, routers and modems

2.3.2 The open charge point protocol (OCPP)

2.3.3 Charging station management software

2.4 Payment solutions

2.4.1 Mobile payments and RFID tags

2.4.2 ISO 15118

2.4.3 Autocharge

2.4.4 Payment terminals

3 Charge Point Operators

4 Hardware and Software Providers

5 Market Analysis and Trends

A selection of companies mentioned in this report includes

ABB

ABL

ADS-TEC Energy

Alfen

Allego

Alpitronic

Amina Charging

AMPECO

Atlante

Be Charge

Blink Charging

BorgWarner

Bouygues Energies and Services (Bouygues Construction)

BP Pulse

BTC Power (E.ON)

CEZ Group

Charge Amps

Chargecloud

ChargeNode

ChargePoint

Circontrol

ClipperCreek

Compleo Charging Solutions

CTEK

DBT Group

Delta Electronics

Driivz

E-Totem

E.ON Group

Easee

Eaton

Ecotap (Legrand)

Efacec

Ekoenergetyka

Electrify America

Electrify Canada

Elli

Elmec

EnBW

Eneco eMobility

Enel X (Enel Group)

eNovates

Ensto Building Systems (Legrand)

EO Charging

ESB Group

Etrel

EV Connect

EVBox (Engie)

EVgo

EvoCharge (Phillips & Temro)

EVPassport

Evtec

Fastned

Flo

Fortum

Francis Energy

FreeWire Technologies

Freshmile

Garo

Gnrgy

GreenFlux

Greenflux

Heidelberg Amperfied (Heidelberg Druckmaschinen)

Hydro-Quebec

Iberdrola Group

IES Synergy

InductEV

Ingeteam

Innogy

InstaVolt

Ionity

Izivia (EDF)

Jolt Energy

Juice Technology

KEBA

Kempower

Kostad

L-Charge

Last Mile Solutions

Mennekes Group

Mer (Statkraft)

Pod Point (EDF)

Pod Point and Zaptec

Power Dot

Recharge

Rolec Services

Schneider Electric

SemaConnect

Shell Recharge Solutions

Siemens

SK Signet

Smartlab

Teltonika

Tesla

TotalEnergies

Tritium

Vattenfall Group

Virta

Volta Charging

Wallbox

Webasto

Wirelane

Zaptec

For more information about this report visit https://www.researchandmarkets.com/r/2ln928-charging?w=12

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance