STOCKS! Europe is popping — but Capita is getting crushed

REUTERS/Albert Gea

Stock markets across Europe are surging on Thursday after a surprise production cut agreement from OPEC pushed oil prices higher.

Europe's major indices popped over 1% at the open on Thursday, but have since pulled back slightly.

Mike van Dulken, head of research at Accendo Markets, says in an emailed statement: "The positive open comes almost entirely courtesy of last night’s surprise OPEC production cut agreement. The news sent oil prices sharply higher and has helped Energy names overnight while buoying sentiment in the general commodity space."

OPEC — the Organization of the Petroleum Exporting Countries — overnight agreed to cap oil production at a range of 32.5-33.0 million barrels per day, reversing the two-year policy of lead member Saudi Arabia of pumping out as much oil as it could.

The news sent oil prices jumping as much as 6% and has had a knock-on effect for stock markets. Here's how the FTSE 100 looks at around 12.40 p.m. BST (7.40 a.m. ET):

REUTERS/Albert GeaShell is the biggest riser on the FTSE, with both its "A" and "B" shares up over 5%, while BP and miners Anglo American and BHP Billiton are all up over 4%.

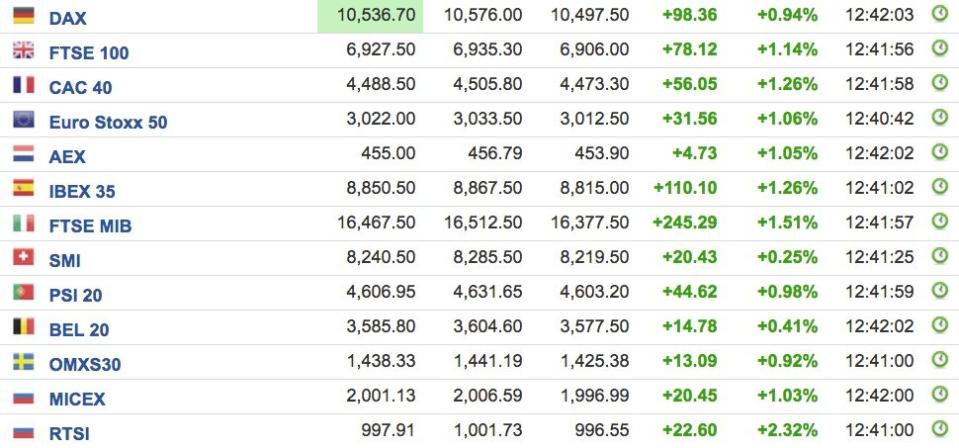

Here's how Europe's other major stock markets look at around 12.40 a.m. BST (7.40 a.m. ET):

REUTERS/Albert GeaDespite big rises across the continent, SpreadEx's financial analyst Connor Campbell says in an emailed statement:

"While the European indices continued to benefit from the reports of an OPEC output deal, Brent Crude itself seemed a bit more sceptical.

"The black stuff has spent the morning teasing a half a percent decline, suggesting that the joy the commodity felt last night doesn’t quite hold up in the cold light of day. That’s not only because OPEC is a notoriously fickle and unreliable institution – in other words, it’s not the first time that the market has heard promises of some kind of cap – but that the new daily output range is more like a freeze than an actual cut in production."

Aside from energy and commodity stocks rising on Thursday morning, Deutsche Bank is a notable climber. The German lender is enjoying its second day of positive gains, after a torrid week that saw shares fall to multi-decade lows amid talks of a government bailout.

Whether the rally is a "dead cat bounce" — where shares rise simply because they've fallen so low that traders think there must be some value there — or the troubled lender has turned a corner remains to be seen.

REUTERS/Albert GeaElsewhere, outsourcing and professional services company Capita is a notable faller, down over 26% on the FTSE 100 after a profit warning.

Capita said in a trading update on Thursday morning that profits for the year are set to be between £535 million and £555 million, down from previous expectations of £613 million. The company blames "continued delays in decision making" among clients, likely due to Brexit.

REUTERS/Albert Gea

NOW WATCH: The extraordinary life of former fugitive and eccentric cybersecurity legend John McAfee

See Also:

German economy minister attacks Deutsche Bank: 'I did not know if I should laugh or cry'

Why Deutsche Bank wants to settle a $14 billion fine as soon as possible

SEE ALSO: Germany is denying it's preparing to bailout Deutsche Bank

DON'T MISS: French regulators are trying to lure British finance firms to Paris after Brexit

Yahoo Finance

Yahoo Finance