EV Stocks Surge: Are They Back?

Many themes have been present in the market over the last several years, keeping investors busy and trying to find the next ‘big thing.’ In particular, the dominant story over the previous year has been the AI frenzy, causing many related stocks to see outsized moves.

But recently, the EV theme has regained some life, with stocks such as Tesla TSLA and Rivian Automotive RIVN enjoying strong price action following solid delivery numbers.

Let’s take a closer look at what’s been driving the share outperformance.

Tesla Bounces Back

Tesla shares faced pressure to start the year, bringing about considerable scrutiny. However, the stock has fully regained its mojo over the last month, gaining nearly 40% compared to a 4% gain from the S&P 500.

Image Source: Zacks Investment Research

Shares popped in today’s session following the release of its delivery/production data. The EV leader's Q2 deliveries reached 444k, and EVs produced totaled 411k. The results pleased investors, though it’s worth noting that deliveries were down a modest 4.1% on a year-over-year basis.

Margins will undoubtedly be in focus for the company’s quarterly release, which is expected on July 17. Recent margin pressures have been a focus among investors, helping explain the stock’s slow start to 2024.

Image Source: Zacks Investment Research

Rivian Posts Strong Deliveries

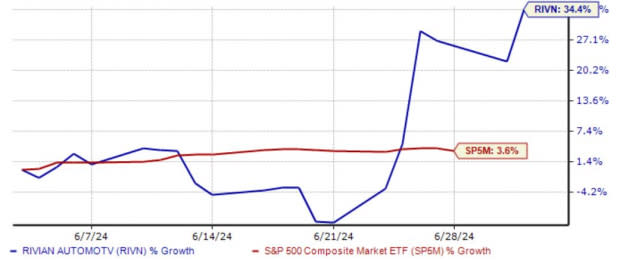

Rivian Automotive similarly saw positivity following the release of its delivery numbers, helping build on recent strength. Up 34% over the last month, the stock has finally begun to enjoy buying pressure, though it’s worth noting that shares are still down 30% YTD.

Image Source: Zacks Investment Research

Concerning the numbers, the company produced roughly 9.6k vehicles and delivered approximately 13.8k, in line with Rivian’s expectations. Undoubtedly boding positive, the company also reaffirmed its annual production guidance of roughly 57k vehicles.

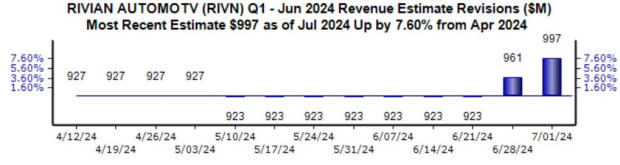

The company’s next quarterly release is scheduled for August 6 after the market’s close. Analysts have taken their sales expectations higher over the recent weeks, with the $997 million expected well above the $923 million expected near the end of June.

Image Source: Zacks Investment Research

Bottom Line

The EV theme has emerged slightly over the last week or so thanks to positive delivery numbers from Tesla TSLA and Rivian Automotive RIVN.

It reflects a considerable change in sentiment overall, particularly considering the slow starts that many EV stocks had in 2024.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance