Everything we thought we knew about free trade is wrong

“I’m a free trader,” said Donald Trump, in his speech announcing his candidacy. That was in June 2015. Since then, he’s been singing a very different tune. Sounding more like a flannel-wearing protester than the ruthless tycoon of The Apprentice, Trump now says the US needs “fair trade, not free trade.” The fact that America imports nearly $800 billion more in goods than it exports is a “politician-made disaster,” he said in a big speech on trade in June 2016, adding, “It is the consequence of a leadership class that worships globalism over Americanism.”

This isn’t exactly original. Bernie Sanders made it a theme of his campaign too, and there have been Trumps of yesteryear—Pat Buchanan and Ross Perot in the 1990s, for instance. Look further back in history and you’ll find plenty more. But Trump is the first free trade-bashing populist to win the White House. His protectionist rhetoric fired an insurgence of blue-collar voters in Pennsylvania, Wisconsin, and Michigan, states long counted as Democrat strongholds. Anti-trade resentment has clearly been seething among vastly more Americans than it did 20 years ago.

And here’s the thing. Trump’s supporters are right to distrust the pro-free trade fanaticism of America’s political mainstream. Starting with Ronald Reagan, one after another, American presidents of both parties have oversimplified and overemphasized the benefits of free trade, without pausing to study its costs, and who was paying them—or even how exactly free trade is supposed to grow the US economy in the first place. The intellectual and political leadership didn’t see the lasting damage of their knee-jerk free trade zealotry for the same reason that they didn’t see the moment of political payback approaching: because they didn’t think to look for it.

That lapse has now invited a populist demagogue into the White House, promising that tariffs and tough new deals will bring back low-skilled manufacturing jobs. Trump has correctly identified a problem. But by focusing only on free trade deals he risks repeating the very mistakes that conjured him forth in the first place.

The origins of our free trade obsession

Portrait of David Ricardo by Thomas Phillips, circa 1821.

Let’s, for a moment, forget the world of fake tans and power ties, and go back to an era of neckcloths and breeches, and the birth of our present-day obsession with free trade.

The godfather of free trade, David Ricardo, was a cool guy. A Sephardic Jew of Portuguese descent born in the Netherlands, he was the third of 17 children. He learned markets from his father, a stockbroker, for whom he began apprenticing when he was just 14. In his early 20s, he eloped with a Quaker woman, and converted to Unitarianism, prompting his parents to disown him. Ricardo struck out on his own, building a successful bond trading business.

He was in his mid-30s in 1815 when Napoleon staged a dramatic return from exile, and gave a second try at dominating Europe. On June 18, an alliance of British, Belgian, Dutch, and German soldiers squared off against Napoleon at the Battle of Waterloo, in present-day Belgium. Ricardo dispatched an observer to watch the battle from a distance. Once the winner became clear, the observer rode to a nearby packet ship en route to London to share the news. Ricardo promptly sold off his British Treasury bonds (after informing the British government). Other traders assumed the French had won and dumped their Treasuries too. Ricardo then swept up British bonds for cheap—a coup of market manipulation that turned Ricardo enormous profits.

Ricardo retired from trading shortly thereafter, turning instead to a career in British politics. He also dabbled in economic theory—a pastime he picked up after devouring a copy of Adam Smith’s The Wealth of Nations while holidaying in Bath in 1799. In time, Ricardo pioneered some of the foundational concepts of classical economics. Of all of these, comparative advantage is the most deeply revered. (In fact, Nobel laureate economist Paul Samuelson once declared it the only theory in economics that is both true and non-trivial.)

Its origins riff off of Smith’s principle of division of labor, which in the global trade context, is commonly known as “absolute advantage.” Smith’s idea states that for economies to make the most of their limited number of workers, they should specialize in making whatever they can produce most efficiently, trading any surplus production for other goods they need.

Paul Samuelson once declared comparative advantage the only theory in economics that is both true and non-trivial. The “comparative” part—which Ricardo pioneered in 1817—adds to Smith’s idea a counterintuitive twist. Instead of focusing on whatever goods it makes more efficiently than other countries, a trading nation should specialize in making the thing for which it has the lowest opportunity cost. In other words, it should reject making products that offer it less gain than the product it does choose, even if it’s the most efficient manufacturer of both.

Here’s how it works. Imagine a world with two countries—let’s say Portugal and England—and two commodities, wine and cloth. If Portugal’s workers focus entirely on wine, they can produce 200 barrels in a week; if they make only cloth, they’ll manufacture 600 bolts. England’s labor force, meanwhile, can make a maximum of 50 barrels of wine per week, or 500 bolts of cloth. If both countries split their workforces between making both commodities, and declined to trade, they would have a combined output of 675 units (125 barrels of wine and 550 bolts of cloth).

Clearly, Portugal has the absolute advantage in both cloth and wine. However, Portugal has a lower opportunity cost in making wine: It must sacrifice only three bolts of cloth to make a single barrel of wine, compared with England’s opportunity cost of 10 bolts. If the two countries trade, Portuguese winemakers will soon realize that English clothmakers will give them more cloth for each of their barrels than they can get at home, and vice-versa. Portugal’s comparative advantage then, is in winemaking, while England’s is cloth. By specializing, their combined output—700 units (200 barrels of wine and 500 bolts of cloth)—is greater than if each country stuck to making both commodities and not trading.

This is the magic of comparative advantage. Even though England was less efficient than Portugal at producing both wine and cloth, the surplus generated by specializing and trading makes both countries better off. It guarantees that free trade “lifts all boats.” This typically means each can benefit from imports that are of higher quality, greater variety, and are relatively cheaper, and from increased consumption of their exports. International free trade theory ultimately rests on this Ricardian bedrock: Free trade is a win-win, and not a zero-sum, proposition. It’s a seductive idea.

What Ricardo missed…

The dynamic Ricardo posited is powerful because these forces do usually work the way he describes. It explains why production of labor-intensive products like toys shifted from countries where labor is relatively scarce, like the US, to those teeming with workers, most obviously China. For countries like the US, having workers toil making low-value toys is a huge opportunity cost when they could be employed in high-margin industries, like medical device manufacturing, that involve heaps of investment—since a relative abundance of capital is the US’s comparative advantage.

But that’s only part of the picture. Sometimes free trade isn’t a win-win at all. When a business shuts down due to its country’s loss of comparative advantage in that industry, people lose their jobs. Finding work in an entirely different sector is seldom as peachy as Ricardo’s model makes it seem.

This is a big reason why “comparative advantage doesn’t benefit everyone or even most people,” says Dean Baker, founder of the Center for Economic Policy research and author of Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer. In fact, says Baker, “the majority of people are losers.”

“You can’t take a spinning jenny and wave a Harry Potter wand over it and get a wine press out of it. It’s simply nonsense.”

In a way, the same goes for the factories that are now no longer needed. Countries that have invested in physical plant to manufacture one thing will seldom be able to use it to make something else, notes Steve Keen, economics professor at Kingston University London, and author of Debunking Economics.

“What Ricardo imagined was you could easily move the capital from one country to another, and you simply can’t do it,” Keen says. “You can’t take a spinning jenny and wave a Harry Potter wand over it and get a wine press out of it. It’s simply nonsense.”

Ricardo’s defining economic principle has another limitation that’s overlooked by proponents of free trade, who so often talk about it prescriptively, as though it were a recipe for growth. Comparative advantage offers a great description of how the market will shift around countries’ finite resources as they respond to the cheapening of production abroad. But, says Keen, it tells us very little about what economies must do to keep growing. And as Baker points out, next to nothing about how to actually improve people’s living standards.

What then, beyond Ricardian market forces, creates prosperous, dynamic economies? One place to look for clues is in America’s own history textbooks: the stupendous surge in productivity that powered the postwar American economic miracle for three decades.

America’s recipe for prosperity

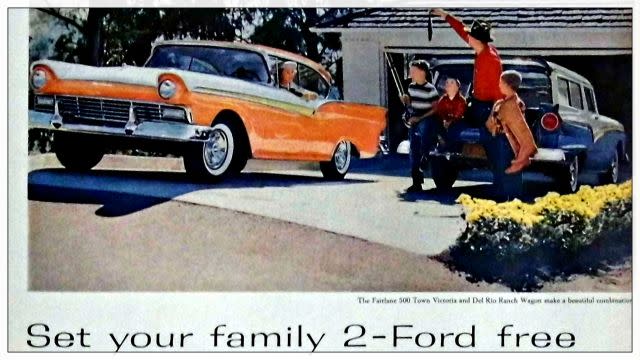

A 1957 Ford ad in Life Magazine.

This golden age of US growth is what Trump harkens back to in his “Make America Great Again” slogan—and the era was indeed great. Each generation could be confident that their children would be better off than they were. US workers with only a high school education could expect to move their families to the suburbs, fill their homes with shiny new appliances, and their garages with one—or maybe even two—cars. Factory workers lived alongside accountants.

The era between 1945 and 1975 is what economists Claudia Goldin and Robert Margo have termed the Great Compression (pdf). During this time, incomes of the best-paid American workers grew at a slower pace than those of middle- and lower-income households, creating rare equality among different socioeconomic classes.

Ironically, these halcyon days have their roots in two darker events, The Great Depression and World War II, as economist Robert Gordon explains in The Rise and Fall of American Growth. Despite the devastation the Great Depression wreaked on the US economy, it led to New Deal reforms that encouraged unions, boosting real wages at the same time as it shrank working hours. Xenophobic policies typified by the Chinese Exclusion Act kept out immigrants, making low-skilled native workers more valuable. A protectionist trans-Atlantic trade war that broke out in 1930 helped seal off the US to trade until after the war ended.

In other words, the blossoming of America’s middle class happened in a period in which Ricardian free trade applied hardly at all.

US growth during this era was also buoyed by astonishing increases in productivity. Some of it was thanks to firms’ spending on efficiency-boosting equipment; investment leapt between the years of 1937 to 1941. However, it was also due to the US government’s support of industry. When the war hit, the US government invested heavily in things like aeronautics. The sum of the new capital equipment it installed during the war was worth about half of the private-sector capital stock that existed before the war, according to Gordon.

Even after the war, the US continued its heavy investment in military technology, which kept on boosting US productivity. In fact, its emphasis on military-related spending led to the creation of computers and, eventually, the internet.

America’s growth engine

Pennsylvania Congressman William Scranton shakes the hand of a steelworker at the Jessop Steel Co. plant Washington, PA, in 1962.

The conditions that made so much of this growth possible were based on the theories of another foundational economist, John Maynard Keynes, that government policy should focus on full employment—keeping everyone employed. When times are good and business is booming, the government should collect a surplus of taxes so that when the inevitable downturns hit, it could shelter workers from the brutalities of the business cycle, running a deficit to boost jobs during private-sector retrenchment. The government should also use tax policy and regulation to keep the interests of workers and business owners aligned, and to try to keep either from having more power than the other.

Why would the government do this? The Keynes-based policies of the postwar era were designed with the understanding that workers were also consumers—a fundamental engine of demand. Making sure they had enough money in their pockets to buy goods kept the economy chugging along. (This is a different approach to growth from Ricardo’s model, which focuses on boosting the supply of goods and services, with little thought about who will buy them.) The fact that the economy in those post-war years was almost exclusively driven by domestic demand made it much easier to align the fortunes of companies with those of their workers. Even as real wages crept higher, encouraging companies to invest in automation, those that lost their jobs had a strong social safety net that let them keep consuming as they looked for new work, encouraging businesses to keep investing. And robust growth thanks to fabulous productivity gains made jobs plentiful.

So what became of trade between nations during those years? Did trade simply fade from the economic picture? In some sense, yes. From 1950 to the mid-70s, exports and imports each hovered around 5% of America’s GDP. These days each equals closer to 15%.

But though it had little role in driving the rapid improvements in American living standards, trade was still very much part of the mix, as we shall see.

America on top—for a while

The Matsushita Electric Appliances Company Totsuka factory in 1965, when refrigerator manufacturing was one of Japan’s hottest industries.

After World War II had laid waste to Europe and Asia, the US emerged as the world’s lone economic power. To help rebuild its Cold War allies’ economies—and reward countries for opposing communism—the US government led what was known as “redistributive” trade policies, slashing tariffs and opening its vast consumer market to their exports, while allowing them to protect their own infant industries. US companies exited the markets for everything from shoes and TV sets to steel. In other words, this free-trade diplomacy wasn’t free at all.

In fact, the countries that industrialized during this time—Japan, Korea, and Germany, for instance—built up the scale, technology, and quality that lets them dominate manufacturing sectors like automaking and shipbuilding to this day.

By the 1970s, a new American economic orthodoxy took hold. That’s when the double-whammy of inflation and unemployment prompted US policymakers to begin rejecting Keynes’ ideas in favor of the philosophies of Milton Friedman and other economists. Starting with Reagan in the early 1980s, a rigid allegiance to the belief that markets alone promote efficiency—and therefore boost prosperity—led US policymakers to chisel away at the institutions that had long kept unemployment down and income fairly evenly distributed. Ricardo’s generally useful, if narrowly applicable, model was a crucial pillar of this larger ideology.

By the time Clinton became president, America’s free-trade crusade—backed by the IMF—broadened beyond simply slashing trade barriers, into clearing the path for foreign investment. Though it bore scanty resemblance to the simple model that Ricardo sketched out, its prophets—a.k.a. Davos Man, free-marketeers, the Washington Consensus—still touted free trade deals as benefiting all. When Trump blames US leaders for favoring “globalism” over “Americanism,” it’s this world order he is condemning. The North American Free Trade Agreement (Nafta) is its watershed.

Nafta and the free trade bait-and-switch

President Bill Clinton enthusing about Nafta in 1993.

“Nafta is the worst trade deal maybe ever signed anywhere, but certainly ever signed in this country,” Trump has said repeatedly throughout his campaign.

The thing is, Nafta—the trade pact signed in 1994 between the US, Canada and Mexico—wasn’t really that concerned with trade at all.

Conceived by Reagan, Nafta was sold to the public as the creation of a unified market of 360 million consumers. Increased demand from Mexico was projected to create an additional 170,000 US jobs, and as Mexican demand for US exports picked up, create a trade surplus of between $7 billion and $ 9 billion. Long-term growth in Mexican incomes was supposed to ease illegal immigration to the US.

By the late 1980s and early 1990s, however, when Nafta was being drawn up first by George H.W. Bush, then by Bill Clinton—the Keynesian presumption that workers are also consumers had long since been jettisoned. Tellingly, the most crucial focus of its many thousands of pages was on installing legal protections that encouraged and protected American corporate investment (which for Mexico marked a departure from its 1980s policies more focused on nurturing local industry and human capital).

Nafta—and many free trade agreements that followed it—opened up Mexico to corporate capital, while enshrining weak labor protections and environmental standards. By facilitating “race-to-the-bottom” offshoring, it did little to boost the skills base or purchasing power of Mexico’s consumer class.

In at least one sense, however, Nafta worked: Investment gushed into Mexico.

But as US corporate capital flowed south, American factories shuttered—and those jobs weren’t replaced for a long time, if ever. In 1993, the US-Mexico trade balance came in at $1.7 billion. The balance soon swung negative, where it remains; last year, its deficit exceeded $60 billion.

US policymakers and economists shouldn’t have been so befuddled about Nafta’s effects. Ricardo’s comparative advantage worked exactly as it should within the parameters agreed to in Nafta.

Why then did Nafta not encourage Mexican consumption of US goods? One huge rationale of the trade deal was that consumption would rise relatively quickly as Mexico’s middle class families’ incomes gradually caught up with those of their northern neighbor’s. However, Mexico isn’t keeping up. Real per-capita GDP has risen 24% since 1993, according to the World Bank; the US’s has climbed 39% over the same period. Meanwhile, Mexico’s poverty rate remains almost unchanged since 1994. Its economy’s comparative advantage—its reliance on low-skilled labor—made it hard for Mexico to raise living standards, which would have spurred its consumption of US goods and investment in efficiency-increasing technologies. Meanwhile, inflows of cheap US corn left millions of Mexican agricultural workers jobless, helping push many to migrate to the US—often illegally—in search of work.

Though you’ll often hear people say that Nafta let Mexicans steal American jobs, this rhetoric distracts from a far more fundamental dynamic of trade—that workers in all countries benefit from rules that prevent corporations from exploiting them. Without these, companies have little incentive to invest in their workers and boost their technology, spurring growth for everyone. And while those focusing on the benefits of Ricardian free-trade praise the “efficiencies” gained from keeping labor cheap, they ignore that most of this investment didn’t actually boost productivity and living standards all that much.

This self-defeating policy wasn’t necessary. For instance, a few years later, the US signed a textiles trade deal with Cambodia that specified worker rights and protections linking improved labor standards with increased quotas. The agreement boosted compliance with labor protections without hurting exports or job growth (pdf, p. 15). In other words, the agreement tilted the balance of power between capital and labor slightly less in favor of corporations—the opposite of what Nafta achieved.

Despite its many flaws, Nafta set the stage for the US-led multilateral trade pacts that followed. In addition to opening up developing nations to the fickle flows of global capital, US negotiators demanded excessively lengthy patent, licensing, and copyright protections that enriched corporate giants in pharmaceuticals, entertainment, and information technology, says CEPR’s Baker—at the expense of both American consumers and its trading partners’ industries. And despite the careful attention to those details, American leaders consistently avoided confronting a problem that, not long after Nafta, began warping the US economy into the unstable mess that brought Trump to power.

Along came China

Chinese workers from the Capital Steel Plant hold their helmets aloft as they perform in front of the Forbidden City in 1999.

Trump’s biggest trade bugbear of all is China, mostly because its leaders “cheat” by manipulating its currency—a sin he threatens to punish with a 45% tariff on certain Chinese goods.

“Currency manipulation” sounds kind of dastardly—and, indeed, it can be. In fact, it’s one of the main factors responsible for creating imbalances of trade and capital flow among countries that show up, for example, on the other side of the ledger of the US’s chronic and ever-deepening trade deficit.

Running a trade deficit isn’t necessarily bad—provided a country is doing so for the right reasons. Under standard trade theory, says CEPR’s Baker, foreign investment should flow into poorer countries. By definition, bringing in more capital than you’re sending out to the rest of the world entails importing more goods than you export. And for a developing country, this makes sense; foreign investors are getting higher returns on growth, and as the developing country builds up its manufacturing base, it has to buy everything from abroad that it doesn’t yet have the ability to make.

But that’s not what’s been going on in the global economy for the last 15 or 20 years. Take a look at China. When the Middle Kingdom began building up its industrial base, throughout the 1990s and 2000s, is was doing the exact opposite: sending more capital abroad—to the US, mainly—than was coming into China, and exporting more than it imported.

Just as Trump has said, China did this in no small part by manipulating its currency, the yuan. China—along with 20 or so other surplus-running countries—kept its currencies cheaper than market prices, which made its exports extra-competitive and US exports relatively pricier everywhere.

Since it let China sell more goods abroad than it otherwise would, currency manipulation artificially boosts China’s employment—and, as a result, hurt US employment. A recent paper (pdf) by economist David Autor and colleagues estimated that this contributed to the loss of 2.4 million American jobs between 1999 and 2011. According to the Economic Policy Institute, a left-leaning think tank, the China-made goods the US imported through Walmart alone displaced or eliminated some 400,000 jobs between 2001 and 2013.

But there was a cost to China, too. Chinese consumers and businesses lose purchasing power since imported goods cost more. And these days, that’s the biggest concern—not just for China, but also for the entire global economy. After decades of currency manipulation and other policies that overtaxed Chinese consumers, the country is struggling to revive consumption as an engine of growth.

The strange case of the missing global middle class

But if other countries have “stolen” American jobs, why aren’t their workers spending more buying Made in the USA? The upshot of deepening integration of global markets seems to be that workers everywhere are seeing less of the fruits of their labor. As their incomes rise at a slower pace than their economy grows, households keep spending less than everyone expects.

Our out-of-whack global system is responsible for another of our era’s big oddities: The fact that Americans can keep buying so much stuff, even as their jobs are disappearing and wages are stagnating. That can also be explained by currency manipulation. When other countries undervalue their currencies by buying dollars, they force America to borrow. In other words, surplus countries essentially loan Americans money to buy their exports.

That might sound nice for the US, but it isn’t. Since America is already flush with capital, that easy money doesn’t flow into productive investments; it blows up bubbles in stock and housing markets. In the late 1990s and mid-2000s, first tech investors and then home owners took on the debt. Since the bursting of the 2007 housing bubble, the US government has shouldered the borrowing burden instead.

The Age of Inequality

A U.S. flag is stuck in the broken window of a building on the grounds of the now-closed Bethlehem Steel mill in Bethlehem, Pennsylvania.

“Free trade” has been a nifty symbol of American economic fortunes throughout the ages—a tool of Cold War diplomacy, part of the market-fundamentalist mania of the 1980s, a Trojan Horse for globalized finance in the 1990s. Nowadays, it’s a source of inequality.

The hallmark of the Great Compression, the golden age of American growth, was equality in income. At work, the interests of bosses and employees aligned because, in that era where Keynesian logic prevailed, paying workers well enough that they could keep consuming fueled America’s booming growth. The notion seems alien these days, when the top 10% of American earners bring in almost nine times as much income as the bottom 90%, on average.

Trump blames greedy multinational companies like Ford and Carrier for deviously exploiting free trade, shipping good American jobs to Mexico and China and undercutting American wages. Is free trade to blame?

In Ricardo’s model, every country is relatively more efficient at something; one country’s shift to making wine frees up its trading partner to focus on cloth. So even as Americans lost jobs to Mexico and Asia, the free market should soon create better-paying work in the US’s comparative advantage sectors. This explains why globalization has been kind to those with the college degrees needed to thrive in America’s new industries. Just as the Ricardian model predicted, the US labor force shifted toward higher-productivity services—computing, telecommunications, and other high-tech industries. Throughout the 1980s and 1990s, the share of workers going on to college stagnated, heating up demand for their relatively scarce skills. Unlike much of manufacturing, many of these higher-paying services jobs were sheltered from immigrant competition by either visa restrictions or licensing requirements, driving wages higher still, says CEPR’s Baker.

What about the rest of America’s workers, though? As prophesied, productivity has indeed continued to surge in manufacturing—the sector that once powered middle-class growth—thanks to leaps in automation and America’s push into high-skilled, state-of-the-art manufacturing. But as robots have replaced humans, the number of manufacturing jobs has flattened. The higher-value jobs that were supposed to replace those lost to China never materialized; instead came low-wage service jobs. And as the combination of automation and offshoring stifled demand for low-skilled factory workers, wage growth stalled—or even fell.

Mainstream economists and even the US government (pdf, p.3) would argue that this is a one-sided and overly bleak portrayal of the US manufacturing worker’s plight. After all, according to Ricardian theory, one huge way Americans gain from trade is through cheaper prices of goods made in places with an abundance of unskilled labor, like China.

For the 55-year-old former machine toolist who now earns minimum wage hauling boxes in a Walmart warehouse, it must rankle to be told cut-price tube socks from China have made him better off. But there’s more than condescension to be outraged about. What economists seldom explain is that the only way for the US to gain from cheaper production in China is by giving up those same jobs at home, according to Ricardo’s model, and employing laid-off workers in more sophisticated, better-paying jobs.

Why hasn’t this come to pass? Ricardo didn’t account for what might happen when another country devalues its currencies against the dollar, forcing the US to run a chronic current account deficit. When this occurs, some of the cheapness of imported goods enjoyed by American consumers doesn’t come from comparative advantage. These supposed “gains from trade” result from one country suppressing its people’s purchasing power in exchange for propping up employment. The US gets the opposite: excessive consumption and job loss. Until those imbalances readjust, America’s trade deficit will persist—and so will joblessness among its lower-skilled workers.

This isn’t just conjecture. As the much-lauded paper by Autor and colleagues showed, the impact of Chinese exports has tended to concentrate geographically—and last way longer than economic models anticipated. It’s not simply that a factory town losing its plant lets go of workers; rising unemployment and underemployment hurts other local businesses too. Over time, the promise of the American dream—that each generation will live better than the next—fades.

America’s two major political parties disagree on many things, but they generally agree on the wisdom of free trade. Yet they seldom, if ever, consider the US government’s responsibility to strive for full employment and redistribute wealth to the “losers” of free trade. The cheaper import prices high-skilled US workers enjoyed as low-skill manufacturing jobs shifted overseas came at the expense of America’s poorer, less-educated workers and taxpayers, thanks to the many thousands forced into early retirement or service jobs with no benefits. Neither party cottoned on to the fact that their policies were serving a minority of the country’s workers, at the expense of the rest.

Until, that is, Trump ran for office on an extended tirade against free trade, vowing to revive American growth through protectionism. And, of course, won.

What now?

Trump talking to workers at the Carrier plant in Indianapolis.

Trump’s victory highlights the dangers of misinterpreting Ricardo’s theory. For decades, free-enterprise enthusiasts oversimplified the implications of his model, encouraging policymakers to ignore its consequences, and assuring them that free trade always created jobs. That has left the global economy—and American politics—dangerously unstable.

So does that mean that Trump is right in his anti-free trade crusade? No, says Dani Rodrik, economist at Harvard University.

“Trump is correct about the malaise that lower and middle class voters feel, but I cannot think of a single trade policy of his that I agree with. He is deluded in thinking that he can bring manufacturing jobs back to the US by changing trade policies,” Rodrik says. “And his belligerent, unilateralist tone on trade policy will do more harm than good.”

In this sense, Ricardian analysis is right: The jobs America lost in the last half-century would inevitably have been shed due to comparative advantage, as US productivity climbed. To bring them back now would cost the US economy enormously.

By focusing on tariffs and a global tug of war over factory jobs that doesn’t actually exist, Trump now risks a “politician-made disaster” himself. Just as free trade itself didn’t cause America’s lost jobs and stagnant wages, neither will restricting it fix those problems. Winning global cooperation on exchange rates would help—a lot. But ultimately, to make free trade fair again, instead of “bringing back jobs,” America’s new president should also invest in creating new ones.

Ford advertisement image courtesy of Joe Haupt via Flickr, licensed under CC-By-SA 2.0 (image has been cropped).

Sign up for the Quartz Daily Brief, our free daily newsletter with the world’s most important and interesting news.

More stories from Quartz:

Yahoo Finance

Yahoo Finance