Ex-Goldman Banker Teams Up With Lawyers to Target CO2 Market

(Bloomberg) -- As buyers and sellers of carbon credits grapple with signs of a shrinking market, others are seizing the moment.

Most Read from Bloomberg

Wells Fargo Fires Over a Dozen for ‘Simulation of Keyboard Activity’

Tesla Investors Get Behind Musk’s Fight for $56 Billion Pay Deal

Bump Stock Ban Tossed Out by Supreme Court in Gun-Rights Win

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

Luxury Labels Slash Prices 50% to Lure Wary Chinese Shoppers

Jim Bunch, a former managing director at Goldman Sachs Group Inc., has teamed up with law firm Linklaters and London nonprofit Scope 3 Climate Capital to help develop and promote an alternative to carbon credits. The group says it’s in talks with a number of multinationals in industries ranging from technology to steel production.

The goal is to reduce private-sector reliance on carbon credits as a way to meet net zero pledges. Bunch, who co-founded US-based climate consulting firm Impact Delta in 2020, says the idea is to focus on corporate supply chains as these often represent the lion’s share of reported emissions. He says doing so also allows institutional investors to tackle portfolio climate risks that conventional diversification tactics can’t fix.

“Pension funds with 50-year liabilities can’t diversify away carbon,” Bunch said in an interview. “So climate change is an existential threat for their entire liability on the balance sheet.”

The product — known as a sector-transition acceleration contract — is designed to reduce actual emissions in corporate supply chains. That’s in contrast to offsetting them by financing environmental projects, which is how carbon credits work.

The Details:

The product is a sector-transition acceleration contract, or STAC. While a carbon credit is supposed to represent one ton of avoided or removed CO2 from the atmosphere, often through environmental projects in developing countries, a STAC functions as a direct transaction between a company and its supplier. Companies that use STACs essentially reward their suppliers for emissions cuts by, for example, placing money budgeted for credits into escrow accounts, to be released to suppliers once they’ve met climate milestones.

Alex Shopov, head of ESG structured finance at Linklaters, says he and his team have used structured finance and securitization techniques to create a STAC certificate that suppliers can also take “to their bank and pledge as collateral.”

The goal is for STACs to become mainstream, integrated into reporting and verification frameworks like the Greenhouse Gas Protocol and the Science Based Targets initiative, and “maybe even more importantly the transition finance market,” said Chris Perceval, a senior engagement director at S&P Global who serves on the steering committee for the joint venture between Impact Delta and Scope 3 Climate Capital.

He also says now is a good time to target supply chains, as new disclosure regulations result in more data, and as the technology needed to reduce emissions gets better.

Read More: Companies to Get Green Credit, Carbon Offset Accounting Clarity

To address the emissions in their supply chains, companies have so far tended to fall back on the voluntary carbon market on which carbon credits are traded. But after a series of controversies, including allegations of greenwashing at major projects on which such credits are based, that market shrank 22% last year to just $1.1 billion, according to MSCI.

There are currently high-level efforts in place to address the VCM’s risks. These include new US guidelines to restore confidence in the market, which Treasury Secretary Janet Yellen said “can do better” and serve as a “powerful ally” against climate change. The US Commodity Futures Trading Commission also is working on finalizing its guidance on carbon credits, with a rulebook expected by the end of the year.

Wall Street is keen to monetize corporate efforts to cut their reported emissions, whether through carbon credits or other financial products. JPMorgan Chase & Co., Bank of America Corp. and Barclays Plc are among banks to have built out carbon trading and finance desks. Goldman and Mirova, an affiliate of Natixis Investment Managers, have set up funds that invest in green projects and generate in-kind returns in offsets.

STACs fit into a growing effort to produce legally defined financial instruments that can aid the decarbonization of supply chains. The American Bar Association has published model contracts companies can use, while the UK-based Chancery Lane Project provides 160 climate clauses that it says can be immediately slotted into contracts and agreements.

Earlier this year, the European Union passed legislation that mandates companies to create transition plans requiring them to document actual emissions reductions. Lawyers advising companies and banks in the bloc have made clear that carbon credits can’t be used to claim any decline in gross emissions.

Perceval at S&P says there’s still a role for carbon credits to play.

“What we’re trying to do is to find some something that’s just higher in the hierarchy and, that if the economy can’t deliver, then removals could still be part of the implementation plan,” he said.

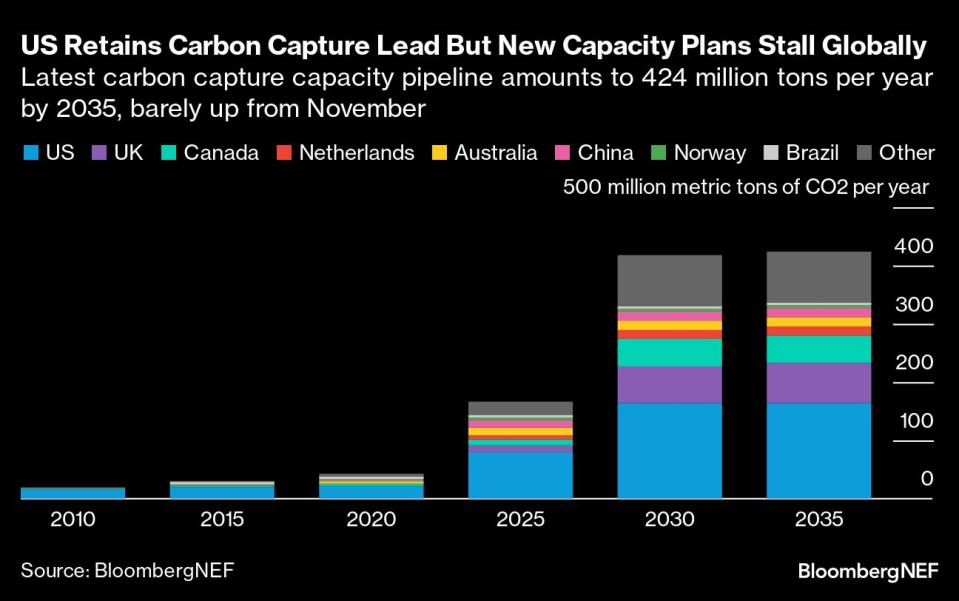

Here’s What BloombergNEF Says on Carbon Capture:

Regulatory uncertainty is starting to bite in the carbon capture market, with barely any new capacity having been added to the pipeline over the past few months.

Click here for the full report.

(Adds S&P comment from seventh paragraph.)

Most Read from Bloomberg Businessweek

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

Israeli Scientists Are Shunned by Universities Over the Gaza War

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance