Examining 3 Growth Stocks With Insider Ownership Reaching 25%

As global markets exhibit resilience, with major indices like the Dow Jones and S&P 500 reaching new highs amid easing inflation concerns, investors are keenly observing market trends and economic indicators. In such a climate, growth stocks with substantial insider ownership can be particularly compelling, as high insider stakes often signal confidence in the company's future prospects from those who know it best.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Modetour Network (KOSDAQ:A080160) | 12.3% | 45.6% |

Gaming Innovation Group (OB:GIG) | 22.8% | 36.2% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.4% |

Elliptic Laboratories (OB:ELABS) | 31.4% | 124.6% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Vow (OB:VOW) | 31.8% | 99.3% |

EHang Holdings (NasdaqGM:EH) | 33% | 98.2% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

Adocia (ENXTPA:ADOC) | 12.4% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

Let's dive into some prime choices out of from the screener.

Guan Chong Berhad

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guan Chong Berhad, headquartered in Malaysia, is an investment holding company engaged in the production, processing, marketing, and sale of cocoa-derived food ingredients and products with a market capitalization of approximately MYR 4.47 billion.

Operations: The company generates its revenue primarily from food processing, which accounted for MYR 5.32 billion.

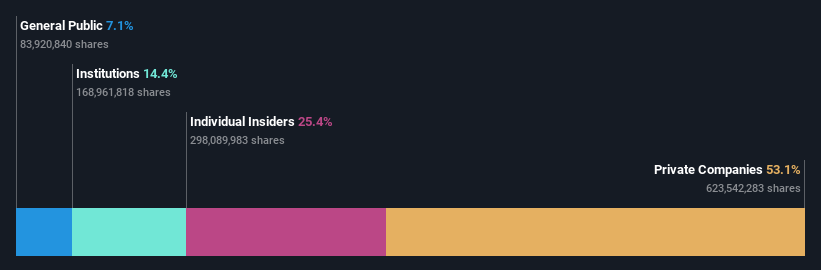

Insider Ownership: 25.4%

Guan Chong Berhad, a Malaysian cocoa manufacturer, reported mixed financial results for 2023 with full-year sales reaching MYR 5.35 billion, up from MYR 4.42 billion the previous year, though net income fell to MYR 101.01 million from MYR 147.41 million. Despite lower profit margins and interest payments not well covered by earnings, the company is expected to see significant earnings growth at an annual rate of 29%, outpacing the Malaysian market forecast of 12.1%. However, its return on equity is predicted to remain low at 13.3% over the next three years.

Upon reviewing our latest valuation report, Guan Chong Berhad's share price might be too optimistic.

Inventec

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Inventec Corporation operates in the development, manufacturing, processing, and trading of computers and related products across Taiwan, the United States, Japan, Hong Kong, Macau, China, and other international markets with a market capitalization of approximately NT$193.72 billion.

Operations: The core business segment generates NT$521.36 billion in revenue, focusing on the development, manufacturing, processing, and trading of computers and related products globally.

Insider Ownership: 17.2%

Inventec Corporation has demonstrated solid financial performance with first-quarter sales rising to TWD 130.51 billion, up from TWD 120.18 billion year-over-year, and net income increasing to TWD 1.09 billion from TWD 880.68 million. The company's earnings are expected to grow at an annual rate of 26.5%, surpassing Taiwan's market average of 18.2%. However, its revenue growth forecast of 10.7% lags behind the significant threshold of 20%, and a dividend yield of 2.74% is poorly covered by cash flows, signaling potential sustainability issues despite robust profit growth projections.

Vercom

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vercom S.A. specializes in developing cloud communications platforms, with a market capitalization of approximately PLN 3.28 billion.

Operations: The company generates revenue primarily through its cloud communications platforms.

Insider Ownership: 10.7%

Vercom S.A. has shown robust growth, with earnings increasing by 125.4% over the past year and revenue rising from PLN 74.86 million to PLN 104.57 million in Q1 2024 alone. Expected to outpace the Polish market, Vercom's earnings are forecasted to grow at 21.1% annually, compared to the market's 14.1%. Despite this strong performance and high insider ownership, its revenue growth projection of 14.4% annually falls short of more aggressive growth benchmarks.

Summing It All Up

Delve into our full catalog of 1501 Fast Growing Companies With High Insider Ownership here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KLSE:GCB TWSE:2356 and WSE:VRC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance