Examining 3 US Growth Companies With High Insider Ownership And A Minimum 21% Earnings Growth

As the U.S. market experiences a tech selloff with the Nasdaq and S&P 500 trending lower, investors are increasingly turning their attention towards small caps, which have shown resilience and growth potential in uncertain economic times. In this context, examining growth companies with high insider ownership becomes particularly relevant, as these firms often demonstrate strong commitment from their leaders during market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.3% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.1% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Let's review some notable picks from our screened stocks.

Amazon.com

Simply Wall St Growth Rating: ★★★★☆☆

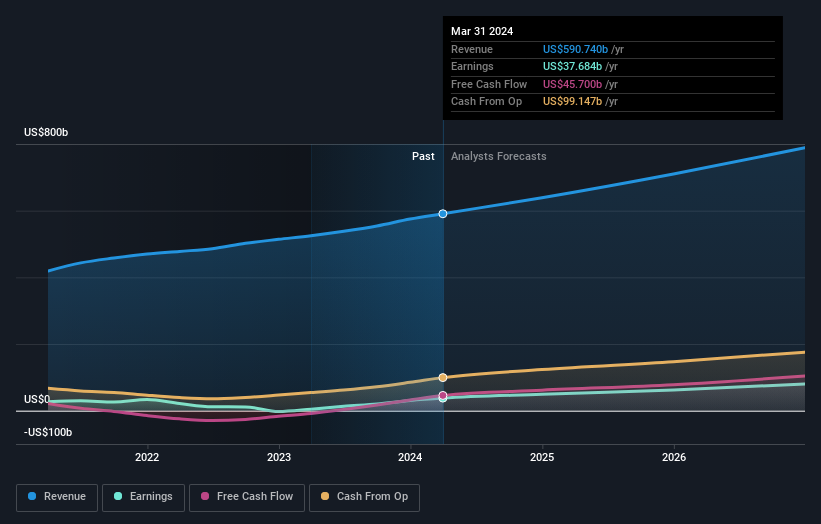

Overview: Amazon.com, Inc. operates as a global online retailer offering consumer products, advertising services, and subscriptions through both digital and physical store formats, with a market capitalization of approximately $2.07 trillion USD.

Operations: The company generates revenue through three primary segments: North America ($362.29 billion), International ($134.01 billion), and Amazon Web Services (AWS) ($94.44 billion).

Insider Ownership: 10.8%

Earnings Growth Forecast: 21.3% p.a.

Amazon.com has demonstrated robust growth, with earnings surging by 777.6% over the past year and expected to grow significantly at 21.3% annually over the next three years, outpacing the US market forecast of 14.8%. However, its Return on Equity is projected to be relatively low at 18.1% in three years. Despite trading at a substantial discount of 35.1% below estimated fair value, insider trading activity has been minimal recently, indicating potential concerns about future growth sustainability or market conditions. Additionally, recent collaborations with Exscientia using AWS for drug discovery highlight Amazon's strategic expansion into AI and cloud services which may influence future performance dynamics.

Super Micro Computer

Simply Wall St Growth Rating: ★★★★★★

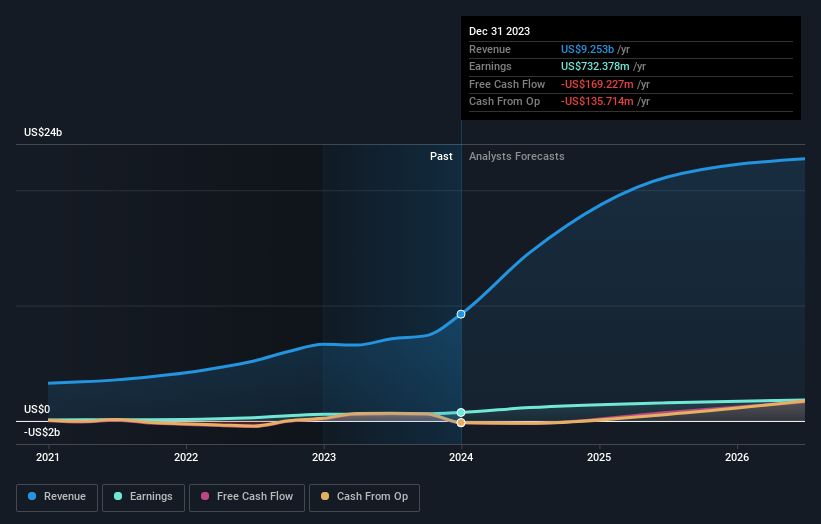

Overview: Super Micro Computer, Inc. specializes in developing and manufacturing high-performance server and storage solutions with a modular and open architecture, operating globally with a market cap of approximately $52.44 billion.

Operations: The company generates its revenue primarily from the development and provision of high-performance server solutions, totaling approximately $11.82 billion.

Insider Ownership: 14.3%

Earnings Growth Forecast: 40.1% p.a.

Super Micro Computer, with high insider ownership, is navigating mixed market signals. Recently, it has been added to the Russell 1000 Growth Index while being removed from several smaller indices. This shift reflects its evolving market stance amid substantial growth in revenue and earnings—24% and 40.1% per year respectively, outpacing broader US market trends. Despite this positive trajectory, share price volatility remains a concern. The company's focus on expanding liquid-cooled data centers aligns with increasing demand for energy-efficient AI computing solutions, potentially bolstering long-term growth despite current market adjustments.

Palantir Technologies

Simply Wall St Growth Rating: ★★★★☆☆

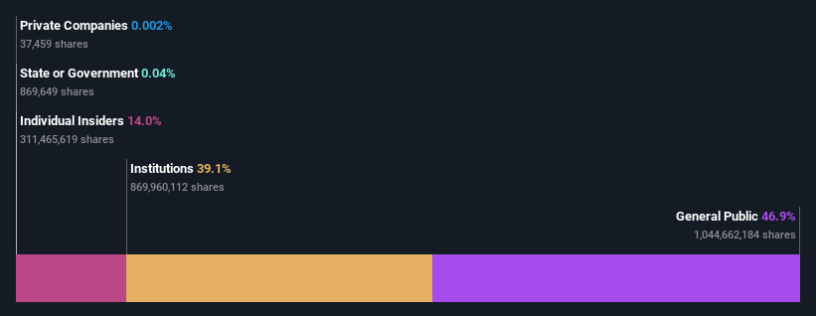

Overview: Palantir Technologies Inc. specializes in developing software platforms for the intelligence community, aiding in counterterrorism efforts across the US, UK, and globally, with a market capitalization of approximately $60.99 billion.

Operations: The company generates revenue through two primary segments: Commercial, which brought in $1.07 billion, and Government, contributing $1.27 billion.

Insider Ownership: 13.5%

Earnings Growth Forecast: 24% p.a.

Palantir Technologies, a company with high insider ownership, is actively expanding its influence in the AI and data analytics sectors through significant partnerships and government contracts. Recent strategic alliances with Oracle enhance its AI platform's reach across Oracle’s extensive cloud infrastructure, promising to boost AI initiatives globally. Additionally, a $19 million contract with ARPA-H underscores Palantir's pivotal role in advancing health outcomes by providing robust data infrastructures for critical health research and operations. While these developments highlight Palantir’s growth potential and strategic positioning within tech-intensive sectors, it is crucial to note that the company’s revenue growth forecast at 15.9% per year slightly lags behind some high-growth benchmarks but still outpaces the general US market forecast of 8.8%.

Next Steps

Explore the 178 names from our Fast Growing US Companies With High Insider Ownership screener here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:AMZN NasdaqGS:SMCI and NYSE:PLTR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance