Examining Bank of Georgia Group And Two Other Leading Dividend Stocks

As the United Kingdom braces for its upcoming parliamentary election, the market exhibits a cautious stance, with the FTSE 100 showing signs of hesitancy in its recent movements. In such times of market uncertainty, dividend stocks like Bank of Georgia Group can offer investors potential stability and regular income streams, aligning well with current economic conditions.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.25% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 6.87% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.53% | ★★★★★☆ |

DCC (LSE:DCC) | 3.51% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.28% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.89% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.85% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.36% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.22% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.79% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

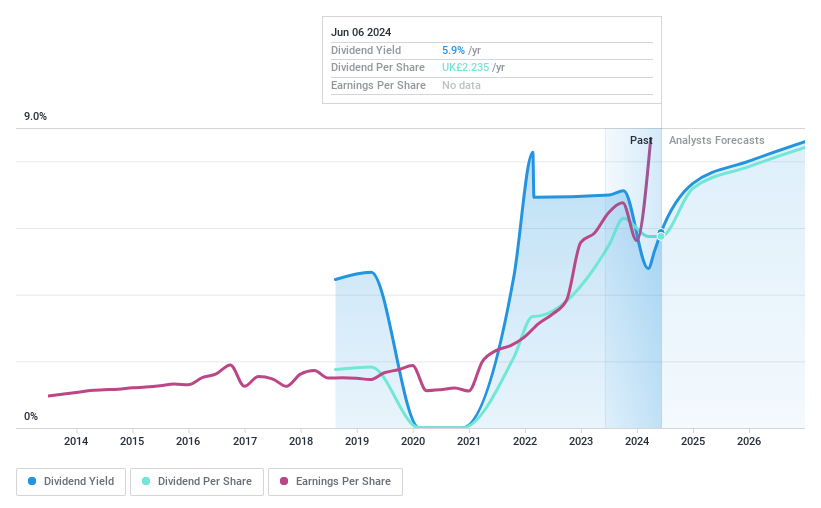

Bank of Georgia Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Georgia Group PLC operates primarily in the banking and financial services sectors, focusing on the Georgian and Armenian markets, with a market capitalization of approximately £1.70 billion.

Operations: Bank of Georgia Group PLC generates its revenue primarily from banking and financial services in Georgia and Armenia.

Dividend Yield: 5.8%

Bank of Georgia Group PLC recently declared a final dividend of GEL 4.94 per share, reflecting its commitment to returning value to shareholders despite a history of volatile dividends. With a payout ratio at 25.6%, the dividend appears sustainable, supported by substantial net income growth in Q1 2024 to GEL 1,036.24 million from GEL 300.05 million year-over-year. However, analysts predict an average earnings decline of 4.5% annually over the next three years, posing potential challenges for future dividend stability and growth.

M&G Credit Income Investment Trust

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: M&G Credit Income Investment Trust plc focuses on investing in a diversified portfolio of public and private debt instruments, with a market capitalization of approximately £139.28 million.

Operations: M&G Credit Income Investment Trust plc generates revenue primarily from its financial services in closed-end funds, totaling £15.36 million.

Dividend Yield: 8.1%

M&G Credit Income Investment Trust recently announced an interim dividend of £0.0215 per share, signaling a commitment to shareholder returns despite a less stable dividend history. The company's dividends are well-supported by earnings and cash flows with payout ratios of 84.8% and 57.4%, respectively. Additionally, the firm became profitable this year, posting net income of £13.31 million, a significant turnaround from last year’s loss of £2.57 million. However, its short dividend-paying history and previous volatility suggest cautious optimism for long-term stability.

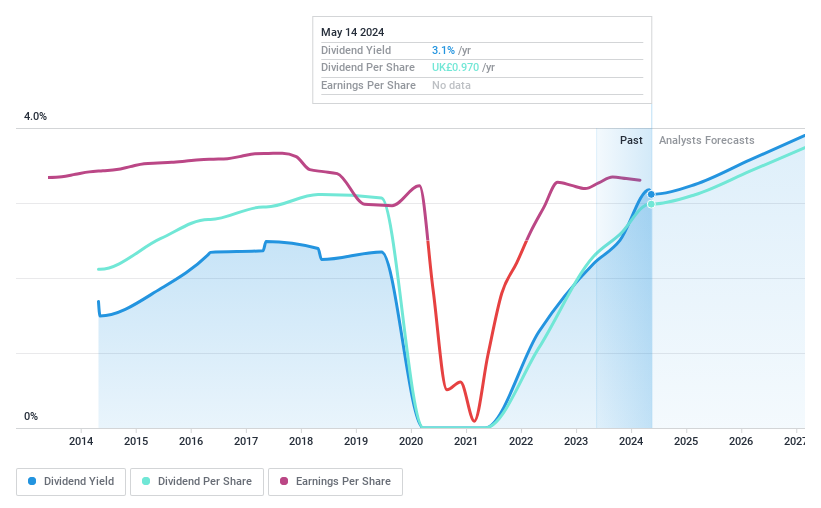

Whitbread

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Whitbread plc is a hospitality company that operates hotels and restaurants primarily in the United Kingdom and Germany, with a market capitalization of approximately £5.32 billion.

Operations: Whitbread plc generates £2.96 billion in revenue from its accommodation, food, and beverage segments.

Dividend Yield: 3.3%

Whitbread plc recently approved a final dividend of 62.9 pence per share, reflecting a commitment to returning value to shareholders amidst modest sales growth of 1% totaling £739 million for the recent quarter. The company also announced a £150 million share buyback program, aiming to enhance shareholder earnings by reducing capital. Despite these positive developments, Whitbread's dividend track record has been unstable over the past decade, with significant annual fluctuations exceeding 20%.

Dive into the specifics of Whitbread here with our thorough dividend report.

The valuation report we've compiled suggests that Whitbread's current price could be quite moderate.

Summing It All Up

Gain an insight into the universe of 57 Top Dividend Stocks by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:BGEO LSE:MGCI and LSE:WTB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance