Examining Three Indian Exchange Stocks With Estimated Intrinsic Discounts Ranging From 33.2% To 40.1%

The Indian stock market has shown remarkable resilience, remaining stable over the last week and achieving a robust 45% growth over the past year with earnings expected to grow by 16% annually. In such a thriving market, identifying undervalued stocks can be particularly rewarding as they may represent opportunities for significant intrinsic value relative to their current trading prices.

Top 10 Undervalued Stocks Based On Cash Flows In India

Name | Current Price | Fair Value (Est) | Discount (Est) |

Updater Services (NSEI:UDS) | ₹285.50 | ₹476.60 | 40.1% |

Allied Digital Services (NSEI:ADSL) | ₹161.02 | ₹229.61 | 29.9% |

Vedanta (NSEI:VEDL) | ₹442.10 | ₹636.19 | 30.5% |

Mahindra Logistics (NSEI:MAHLOG) | ₹481.45 | ₹804.09 | 40.1% |

Strides Pharma Science (NSEI:STAR) | ₹954.40 | ₹1520.38 | 37.2% |

TV18 Broadcast (NSEI:TV18BRDCST) | ₹41.62 | ₹69.84 | 40.4% |

Delhivery (NSEI:DELHIVERY) | ₹398.15 | ₹611.98 | 34.9% |

PVR INOX (NSEI:PVRINOX) | ₹1451.70 | ₹2224.00 | 34.7% |

Camlin Fine Sciences (BSE:532834) | ₹106.80 | ₹156.65 | 31.8% |

Godrej Properties (NSEI:GODREJPROP) | ₹3066.55 | ₹4592.04 | 33.2% |

Let's explore several standout options from the results in the screener

Godrej Properties

Overview: Godrej Properties Limited focuses on real estate construction and development in India, with a market capitalization of approximately ₹855.64 billion.

Operations: The company generates its revenue primarily from real estate development, amounting to ₹29.95 billion, with a smaller contribution from the hospitality sector at ₹0.41 billion.

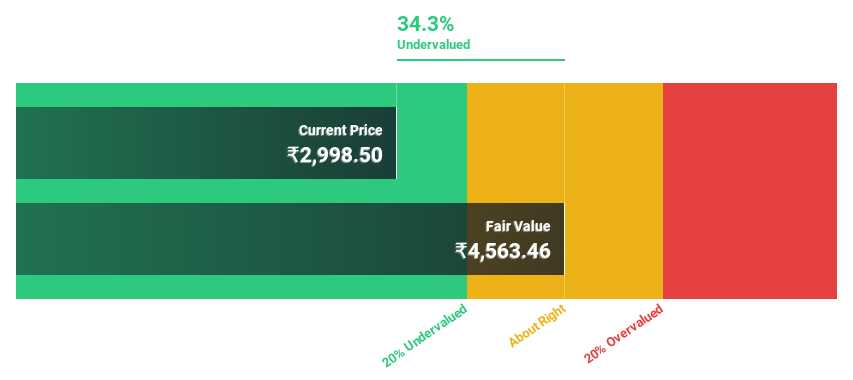

Estimated Discount To Fair Value: 33.2%

Godrej Properties, priced at ₹3066.55, is considerably undervalued with a fair value estimate of ₹4592.04, reflecting a 33.2% discount. Despite some financial results being impacted by large one-off items, the company has demonstrated robust growth with earnings increasing by 28.7% annually over the past five years and expected to grow significantly in the next three years. However, its debt is poorly covered by operating cash flow which poses a risk to its financial stability.

Mahindra Logistics

Overview: Mahindra Logistics Limited operates in India and globally, offering integrated logistics and mobility solutions with a market capitalization of approximately ₹35.34 billion.

Operations: The company generates revenue primarily through two segments: Supply Chain Management at ₹51.78 billion and Enterprise Mobility Services at ₹3.28 billion.

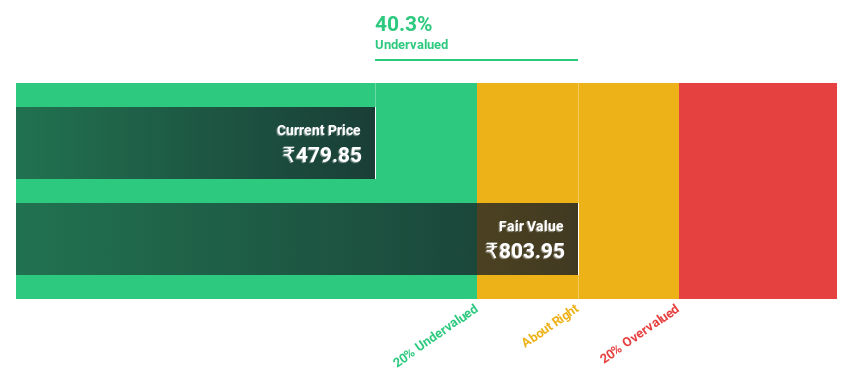

Estimated Discount To Fair Value: 40.1%

Mahindra Logistics, valued at ₹481.45, trades below its fair value estimate of ₹804.09, indicating significant undervaluation based on discounted cash flows. Despite a challenging fiscal year with a net loss of INR 547.4 million and issues covering interest payments from earnings, the company is poised for recovery with expected profitability and revenue growth outpacing the Indian market average in the next three years. Recent strategic joint ventures aim to enhance service offerings to Japanese automotive sectors in India, potentially bolstering future cash flows.

PVR INOX

Overview: PVR INOX Limited operates as a theatrical exhibition company, involved in the exhibition, distribution, and production of movies across India and Sri Lanka, with a market capitalization of approximately ₹140.13 billion.

Operations: The company generates revenue primarily through movie exhibitions, which accounted for ₹60.71 billion, and other activities including movie production and distribution, contributing ₹3.17 billion.

Estimated Discount To Fair Value: 34.7%

PVR INOX, priced at ₹1451.7, is significantly undervalued against a fair value estimate of ₹2224 based on discounted cash flows. Despite trading 34.7% below its fair value and expected to become profitable within three years, its revenue growth forecast at 11.3% annually is modest compared to the broader market prediction of 20%. Additionally, recent expansions like the launch of new multiplexes in Andhra Pradesh and Rajasthan underline its aggressive growth strategy but highlight a low forecasted return on equity at 9.8%, suggesting potential challenges in generating shareholder returns efficiently.

Where To Now?

Click this link to deep-dive into the 16 companies within our Undervalued Indian Stocks Based On Cash Flows screener.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:GODREJPROPNSEI:MAHLOGNSEI:PVRINOX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance