EXGEN: DOK Project Drill Results

Figure 1

Figure 2

Figure 3

Figure 4

Figure 5

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

VANCOUVER, British Columbia, Jan. 19, 2024 (GLOBE NEWSWIRE) -- ExGen Resources Inc. (TSX.V: EXG; OTC: BXXRF) (“ExGen”, the “Company”) is pleased to provide an update on its DOK project in northern British Columbia which is currently under option to Mountain Boy Minerals Ltd. Under the terms of the option Mountain Boy may acquire a 60% interest in the DOK claims by paying $230,000 and issuing 1,500,000 shares to ExGen and by spending $2,500,000 on the DOK claims by January 2026.

Jason Riley, CEO of ExGen commented: “We are encouraged to see the drilling program at Telegraph advance the project and its potential for the discovery of a large porphyry system comparable to other deposits within the Golden Triage. We look forward to the 2024 exploration season and the next steps for the project.”

In a news release dated January 17 ,2024, Mountain Boy reported assays from drill holes DOK2023-02 and DOK2023-03. It noted that these holes partially define an area of interest for 2024 drilling and that the step-out drilling confirms a a large copper-gold porphyry system. Highlights included:-

A 700-meter step out from drill hole DOK2023-01 intersects several copper-gold intervals.

Drilling spans 3.3 kms of the open ended Dok Trend.

3DIP Geophysics provides guidance for next round of drilling.

Mountain Boy reported “The third hole from the 2023 program successfully expanded the strike-length and width of mineralization along the Dok Trend. The hole cut several copper-gold intercepts including 21 meters of 0.68% Cu Eq and 8.6 meters of 0.57% Cu Eq. (Table 1).

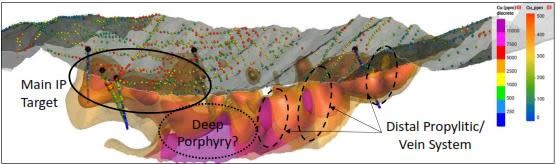

Lawrence Roulston, CEO, stated: “These initial holes have confirmed the presence of a porphyry hydrothermal system spanning at least 3.3 kilometers. This is a large, complex, multi-phase system is located in the same geological setting as four other world class deposits located in the area. Significant exploration potential exists along the Dok Trend. This premise is supported by drilling, a continuous induced polarization (IP) chargeability anomaly, fertile porphyry intrusive units, and anomalous copper and gold in soil geochemistry. Continued compilation of the drilling results together with the late-season 3DIP and other geological information will provide a basis for vectoring toward the core of the system with subsequent drilling.”

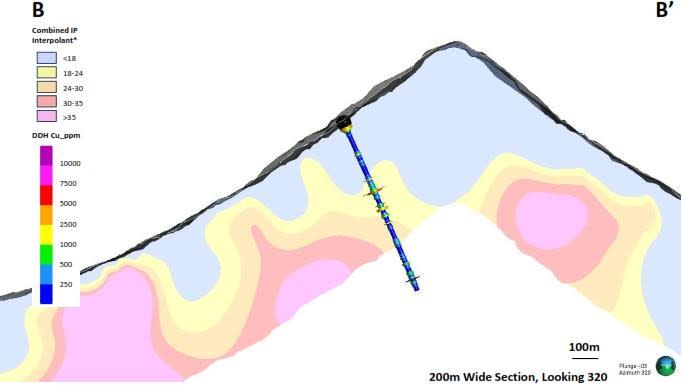

DOK2023-03 targeted a moderate IP chargeability anomaly, underneath an outcrop which returned high-grade grab samples including 3.22% copper with 4.62 g/t gold. The hole was placed along the most easterly line from the 2012 IP program and the 2023 3DIP data had not been collected. Table 1 highlights the significant assays from the hole.

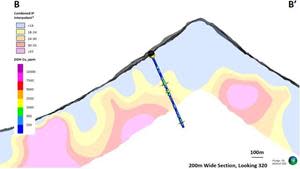

This hole encountered sedimentary-volcanic Stuhini host rocks, post mineral rhyolitic dykes and several variably mineralized monzonite dykes. Potassium feldspar and secondary biotite alteration is noted in several phases of the monzonite dykes. Of note are the five monzonite dykes up to 1 metre wide encountered between 230.9 and 237.7 metres. Clots of secondary coarse biotite and potassium feldspar is clearly recognizable and assays of up to 3.14 % occur within the dyke. The section hosting the dykes assayed 0.57% Cu Eq over 8.6 metres (Figures 1, 2, and 3).

Table 1 – Highlighted assay results from drill hole DOK2023-03

Drill Hole | From | To | Width |

| Cu (%) | Au (gpt) | Ag (gpt) | Mo (ppm) | Cu Eq (%) |

DOK2023-03 | 5.0 | 26.0 | 21.0 | metres of | 0.23 | 0.16 | 35.30 | 5.25 | 0.67 |

including | 11.0 | 14.0 | 3.0 | metres of | 0.22 | 0.148 | 229.00 | 7.1 | 2.37 |

|

|

|

|

|

|

|

|

|

|

DOK2023-03 | 192.9 | 196.2 | 3.3 | metres of | 0.18 | 0.05 | 1.64 | 1.95 | 0.23 |

including | 192.9 | 193.5 | 0.7 | metres of | 0.41 | 0.077 | 5.35 | 2.7 | 0.52 |

|

|

|

|

|

|

|

|

|

|

DOK2023-03 | 229.1 | 237.7 | 8.6 | metres of | 0.46 | 0.06 | 6.99 | 7.17 | 0.57 |

including | 232.7 | 237.7 | 5.0 | metres of | 0.70 | 0.09 | 11.2 | 4.36 | 0.87 |

including | 232.7 | 233.6 | 0.9 | metres of | 1.60 | 0.23 | 13.3 | 6.11 | 1.90 |

including | 233.3 | 233.6 | 0.3 | metres of | 3.14 | 0.05 | 27.4 | 9.21 | 3.42 |

|

|

|

|

|

|

|

|

|

|

DOK2023-03 | 279.8 | 299.0 | 19.3 | metres of | 0.15 | 0.08 | 1.15 | 5.24 | 0.22 |

|

|

|

|

|

|

|

|

|

|

DOK2023-03 | 533.4 | 534.3 | 0.9 | metres of | 0.58 | 0.234 | 2.86 | 3.8 | 0.79 |

The copper equivalent calculation utilizes the standard equation and is based on current (January 11, 2024) spot metal prices of copper at US$3.78 per pound, gold at US$2,032 per ounce, silver at US$23.03 per ounce, and molybdenum at $19.50 per pound. Recoveries are set at 100% for all metals for purposes of the copper equivalent calculation as no metallurgical test data is available. Cu Eq is used for illustrative purposes only and does not imply that the metals are economically recoverable.

Figure 1 - DK2023-03 from 229.1 to 237.7 meters yielding 8.6 meters of 0.57 Cu Eq (%).

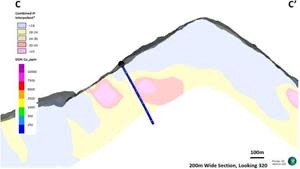

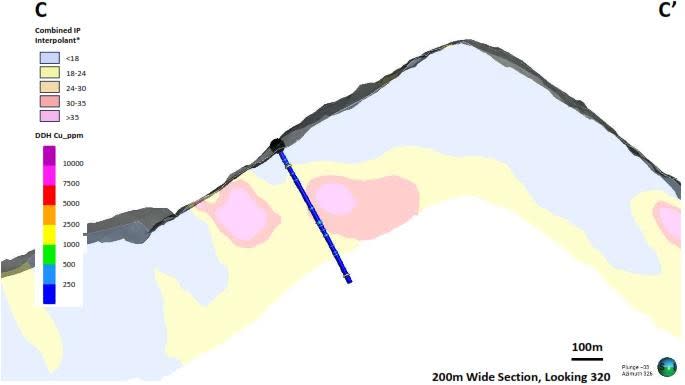

DOK2023-02 (Figure 2 and 4) tested the Red Creek zone, 3 km southeast of DOK2023-01 and was the first hole drilled in that area. The hole encountered low grade copper and gold mineralization from surface to 500 meters and zones of up to 30% disseminated and semi-massive pyrite mineralization. DOK2023-02 is surmised to be within the peripheral zone of a magmatic hydrothermal porphyry system, based on both vertical and lateral distribution of porphyry related trace elements; significant sericite, silica, and chlorite alteration; and multi-percent pyrite.

DOK2023-02 demonstrates that the magmatic hydrothermal footprint at Telegraph extends for several kilometers and that the Dok and Red Creek areas have the potential to host several porphyries. The drill hole mainly intersected the sedimentary-volcanic host rocks and did not intersect any fertile intrusive units, which are an important contributor to increased copper values.

Moving forward, MTB is working with the Mineral Deposit Research Unit at the University of British Columbia (MDRU) to characterize the many porphyritic intrusive phases encountered in drilling and on surface with the objective of identifying the more fertile phases of intrusions and develop a better understanding of the geology overall.

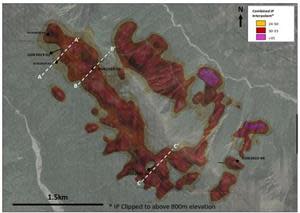

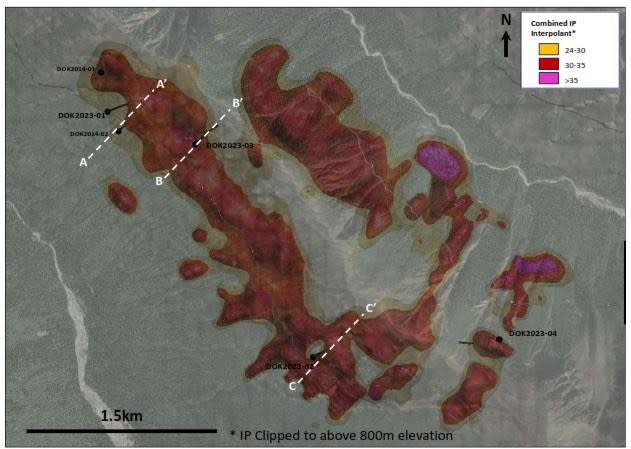

MTB contracted Dias Geophysical to conduct a 16 line-km 3D Induced Polarization (“3DIP”) ground geophysical survey which links the previously completed 2022 3DIP and the 2012 IP surveys. The three surveys are currently being integrated. Initial interpretations show a significant northwest-southeast trending chargeability anomaly (Figure 2 and 5). This anomaly is interpreted to map out the extent of the Dok Ridge sulphide-bearing hydrothermal system which extends at least 5 km. These systems host or have significant potential to host porphyry copper-gold mineralization. DK2023-01 and DK2023-03 are at the northwest end of the chargeability anomaly. The trace of the chargeability anomaly shown in Figure 2 suggests the extent of untested prospective ground. Initial 2024 plans include further soil sampling along the north facing slope of Dok Ridge where several large IP chargeability anomalies occur, in particular those that overly mapped structures. Additional future work would include drilling of selected targets (Figure 5).

Figure 2 - Plan view of chargeability merged from the 2014, 2022 and 2023 IP surveys. The merged data has not been leveled by a geophysicist and is for illustrative purposes only. Cross sections B-B’, and C-C’ in figures 3 and 4, respectively.

Figure 3: Cartoon Cross Section through drill hole DK-2023-003 and chargeability. The merged data is from 3 programs, conducted in 2012, 2022 and October of 2023. It has not been leveled by a geophysicist and is for illustrative purposes only.

Figure 4: Cartoon Cross Section through drill hole DK-2023-002 and chargeability. The merged data is from 3 programs, conducted in 2012, 2022 and October of 2023. It has not been leveled by a geophysicist and is for illustrative purposes only.

Figure 5: Long section through 2023 drilling with merged IP data plotted sub-surface, darker pinks representing higher chargeability.

Lucia Theny, Vice President, Exploration, noted: “Our first ever drill program at Telegraph successfully delivered results supporting our thesis that the Dok target area has significant room to grow and that there is potential for the discovery of large porphyry systems comparable to other deposits within the Golden Triangle. We look forward to continued drilling in 2024 at this underexplored porphyry district within the prolific Golden Triangle.”

Property Ownership

The Telegraph project is located within the traditional territory of the Tahltan First Nation. MTB has a 100% interest in 23,989 ha, an option to acquire a 100% interest in 2,972 ha and an option to acquire a 60% interest in 7,478 ha from ExGen Resources Inc. (Dok Option, which covers a portion of the Dok Trend). The recent drilling was conducted on the Dok Option property.

QA/QC

Analytical work for samples was completed by ALS Canada Ltd, with sample preparation and geochemical analyses in North Vancouver, BC. Core samples were fine crushed before a 250-gram split was pulverized to better than 85% passing 75 microns. Gold was determined for core samples by the PGM-ICP24 procedure which involves fire assay preparation using a 50-gram charge with an inductively coupled plasma-atomic emission spectroscopy finish (“ICP-AES”). Soil samples were dry screened at 180 microns, with analysis conducted on the fine fraction. Gold was determined for soil samples by the Au-ICP21 method, which involves fire assay preparation with a 30-gram charge followed by an ICP-AES finish. Multi-element data for 48 elements was determined for all samples by the ME- MS61 procedure, which involves a four-acid digestion followed by ICP-AES and inductively coupled plasma-mass spectrometry.

Rigorous procedures are in place regarding sample collection, chain of custody and data entry. Certified assay standards, duplicate samples and blanks are routinely inserted into the sample stream of diamond drill samples to ensure integrity of the assay process. All diamond drill samples included in this news release have passed the QA/QC procedures as described above. Core was sampled using a diamond saw, with half of each interval sent to the lab for analysis, and the other half retained.

Results referenced in this release represent highlight results only. Below detection values for gold and copper have been encountered in drilling, rock, and soil samples in these target areas.

The technical disclosure in this release has been read and approved by Andrew Wilkins, B.Sc., P.Geo., a qualified person as defined in National Instrument 43-101.”

QUALIFIED PERSON

Kieran Downes, Ph.D., P. Geo., a Qualified Person as defined by National Instrument 43-101, has reviewed and verified the technical information provided in this release.

ABOUT EXGEN RESOURCES INC.

ExGen, formerly Boxxer Gold Corp, is a project accelerator that seeks to fund exploration and development of our projects through joint ventures and partnership agreements. This approach significantly reduces the technical and financial risks for ExGen, while maintaining the upside exposure to new discoveries and potential cash flow. The company intends to build a diverse portfolio of projects across exploration stages and various commodity groups. ExGen currently has 5 projects in Canada and the US.

For more information on ExGen please contact ExGen Resources Inc.

Jason Tong |

|

|

|

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Information: This news release contains certain forward-looking information. All statements included herein, other than statements of historical fact, are forward-looking information and such information involves various risks and uncertainties. There can be no assurance that such information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such information. In particular, this news release contains forward-looking information in relation to: the observations made on drill core from the diamond drilling program on the Empire Mine Project; the further exploration and development of the Empire Mine Project; the exploration and development strategy of the Empire Mine Project, including the exploration program, drilling, mine development, and permitting. There can be no assurance that such information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such information. There can be no assurance that the development of the Empire Mine Project will be completed, and if development is completed, that such development will result in a producing mine. In the forward looking information contained in this news release, ExGen has made numerous assumptions, based upon practices and methodologies which are consistent with the mineral industry. In addition, ExGen has assumed: the continued market acceptance of its joint venture partnership model; the ability of ExGen and its partners to raise future equity financing, if needed, at prices acceptable to ExGen or its partners; ExGen's current and initial understanding and analysis of the Empire Mine Project; the ability of ExGen or third parties to discover viable exploration targets and the results of exploration on the Empire Mine Project; the ability of Phoenix to explore and develop the Empire Mine Project; the cost of exploration, including sampling, drilling and assaying, on the Empire Mine Project, the costs of developing the Empire Mine Project and the costs and the ability of Phoenix to produce a feasibility study in compliance with NI 43-101; and ExGen's general and administrative costs remaining sustainable. While, ExGen considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies. Additionally, there are known and unknown risk factors which could cause ExGen's observations, actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein. Known risk factors include, among others: the possibility that the analytical results from future core sampling does not return significant grades of copper, gold, silver, zinc, lead or any other molybdenum by-products; uncertainties relating to interpretation of drill results and the geology; continuity and grade of mineralization; there is no certainty that the ongoing work programs will result in significant or successful exploration of the Empire Mine Project or development of the Empire Mine Project into a producing mine; uncertainty as to the actual results of exploration and development or operational activities; uncertainty as to the availability and terms of future financing; uncertainty as to timely availability of permits and other governmental approvals; ExGen may not be able to comply with its ongoing obligations regarding its properties; the early stage development of ExGen and its projects, and in particular, the Empire Mine Project; general business, economic, competitive, political and social uncertainties; capital market conditions and market prices for securities, junior market securities and mining exploration company securities; commodity prices, in particular copper, gold, silver, and zinc prices; competition; changes in project parameters as plans continue to be refined; accidents and other risks inherent in the mining industry; lack of insurance; delay or failure to receive board or regulatory approvals; changes in legislation, including environmental legislation, affecting ExGen; conclusions of economic evaluations; and lack of qualified, skilled labour or loss of key individuals. A description of additional assumptions and risk factors used to develop such forward-looking information that may cause actual results to differ materially from forward-looking information can be found in ExGen's disclosure documents on the SEDAR website at www.sedar.com. Although ExGen has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. ExGen does not undertake to update any forward-looking information except in accordance with applicable securities laws.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/72e712ba-9183-4b93-aebd-e58110bd1f0f

https://www.globenewswire.com/NewsRoom/AttachmentNg/2e3a8172-21b1-47c2-b56c-15741a0b664e

https://www.globenewswire.com/NewsRoom/AttachmentNg/c355ad6f-0980-421a-9c49-bf6110627ad2

https://www.globenewswire.com/NewsRoom/AttachmentNg/084868cd-ace5-4003-a1a6-0bb0018faf4c

https://www.globenewswire.com/NewsRoom/AttachmentNg/d5595312-5ec0-4e9f-b7ef-b52cc681cfe6

Yahoo Finance

Yahoo Finance