Exploring 3 High Growth Tech Stocks in Japan

Japan’s stock markets have seen a notable rise, with the Nikkei 225 Index gaining 3.1% and the broader TOPIX Index up 2.8%, driven by a weakening yen following the U.S. Federal Reserve's significant rate cut. As investors navigate these market dynamics, identifying high-growth tech stocks that can capitalize on favorable economic conditions becomes crucial for potential investment success.

Top 10 High Growth Tech Companies In Japan

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Hottolink | 50.99% | 61.55% | ★★★★★★ |

Material Group | 17.82% | 28.74% | ★★★★★☆ |

Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

Medley | 24.98% | 30.36% | ★★★★★★ |

Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

ExaWizards | 21.96% | 75.16% | ★★★★★★ |

Money Forward | 20.68% | 68.12% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

OMRON

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare businesses with a market cap of ¥1.27 trillion.

Operations: OMRON Corporation generates revenue primarily from its Industrial Automation Business (¥373.70 billion), Healthcare Business (¥150.40 billion), Social Systems, Solutions and Service Business (¥156.85 billion), and Devices & Module Solutions Business (¥143.69 billion). The company focuses on diverse sectors including industrial automation, healthcare, social systems, and device solutions globally.

OMRON's trajectory in the high-tech sector of Japan, particularly within automation and healthcare solutions, underscores a nuanced growth narrative. With an anticipated revenue increase of 5.6% annually, OMRON is outpacing the broader Japanese market's 4.2% growth rate. This is complemented by a robust forecast in earnings growth pegged at 46.2% annually over the next three years, signaling potential shifts towards profitability despite current unprofitability challenges. The firm's commitment to innovation is evident from its R&D spending trends which are critical for sustaining its competitive edge in a rapidly evolving industry landscape. Looking ahead, while OMRON faces hurdles due to its present lack of profitability, its strategic focus on sectors like electronic components for healthcare devices positions it well amidst growing global health tech demands. The company’s recent earnings call highlighted these areas as significant contributors to future revenue streams, potentially catalyzing its transition into profitable terrains. Such dynamics illustrate OMRON’s resilience and adaptability in harnessing cutting-edge technologies to refine its market stance.

Unlock comprehensive insights into our analysis of OMRON stock in this health report.

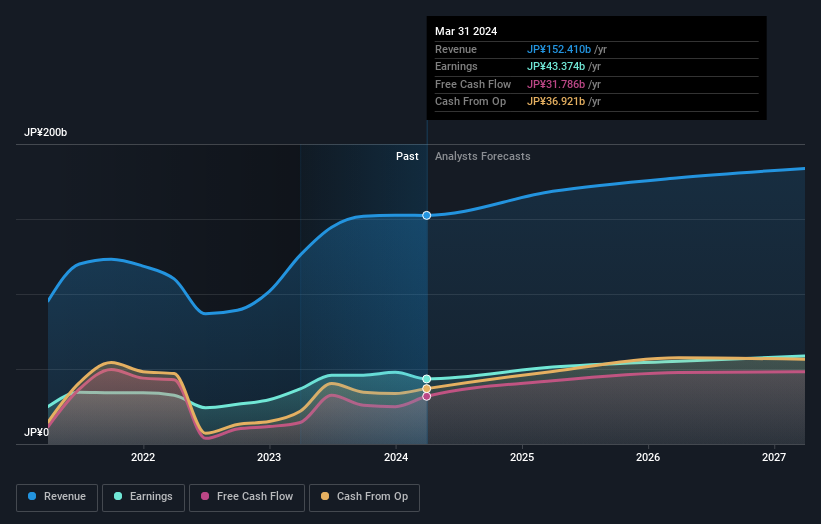

Explore historical data to track OMRON's performance over time in our Past section.

Taiyo Yuden

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Taiyo Yuden Co., Ltd. develops, manufactures, and sells electronic components in Japan, China, Hong Kong, and internationally with a market cap of ¥374.38 billion.

Operations: The company generates revenue primarily from its Electronic Components Business, which accounts for ¥331.17 billion.

Taiyo Yuden demonstrates a compelling growth trajectory in Japan's tech sector, with earnings expected to surge by 26.2% annually, outpacing the broader market's 8.6% forecast. This growth is supported by a robust increase in revenue, projected at 6.9% yearly, which exceeds the Japanese market average of 4.2%. The firm’s strategic disposal of treasury stock for restricted stock remuneration underscores its proactive governance approach, aligning closely with shareholder interests and corporate accountability. Moreover, Taiyo Yuden's significant investment in R&D is pivotal for maintaining its competitive edge and fostering innovation within its core business segments. These financial and strategic maneuvers position Taiyo Yuden favorably within a dynamic industry landscape, suggesting promising prospects despite a highly volatile share price observed over recent months.

Get an in-depth perspective on Taiyo Yuden's performance by reading our health report here.

Evaluate Taiyo Yuden's historical performance by accessing our past performance report.

Capcom

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is a global company involved in the planning, development, manufacturing, sales, and distribution of home video games, online games, mobile games, and arcade games with a market cap of ¥1.38 trillion.

Operations: Capcom generates revenue primarily from Digital Content, which accounts for ¥103.38 billion, followed by Amusement Facilities at ¥20.09 billion and Amusement Equipment at ¥10.34 billion. The company is involved in the planning, development, manufacturing, sales, and distribution of various game formats both in Japan and internationally.

Capcom, navigating through a dynamic tech landscape, has demonstrated resilience with a projected revenue growth of 9.6% annually, outstripping Japan's market average of 4.2%. This performance is underpinned by robust R&D investments which have escalated to significant figures, ensuring continuous innovation and competitiveness in gaming and digital content sectors. Despite a challenging past with earnings contraction of 23.3% last year, the forecasted annual earnings growth rate at an optimistic 14.5% suggests recovery and potential leadership in entertainment technology. Capcom's strategic focus on high-quality game development is further evidenced by its recent earnings call revelations and proactive adjustments ahead of the Q1 2025 report set for July 29th, positioning it as a noteworthy contender in Japan’s high-tech arena despite some volatility in share price over recent months.

Dive into the specifics of Capcom here with our thorough health report.

Gain insights into Capcom's historical performance by reviewing our past performance report.

Taking Advantage

Click through to start exploring the rest of the 121 Japanese High Growth Tech and AI Stocks now.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:6645 TSE:6976 and TSE:9697.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com