Exploring ASX Dividend Stocks For June 2024

Amidst a challenging week for the ASX200, which saw a general downturn across most sectors, investors might find it increasingly important to consider the stability and potential income from dividend stocks. In times of market volatility and economic uncertainty, particularly influenced by external factors like China's deflationary pressures impacting Australian industries, dividend-paying stocks can offer a semblance of predictability and steady returns. In this context, understanding what constitutes a resilient dividend stock becomes crucial. Factors such as consistent dividend history, strong financial health, and sectors less affected by current economic headwinds are particularly pertinent.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Lindsay Australia (ASX:LAU) | 7.02% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.00% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 3.98% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.84% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.60% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.15% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.70% | ★★★★★☆ |

Fortescue (ASX:FMG) | 8.65% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.13% | ★★★★★☆ |

Ricegrowers (ASX:SGLLV) | 7.75% | ★★★★☆☆ |

Click here to see the full list of 27 stocks from our Top ASX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Ampol

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ampol Limited, operating in Australia, New Zealand, Singapore, and the United States, engages in the purchasing, refining, distribution, and marketing of petroleum products with a market capitalization of approximately A$8.00 billion.

Operations: Ampol Limited generates revenue through three primary segments: Z Energy (A$5.51 billion), Convenience Retail (A$5.99 billion), and Fuels and Infrastructure (A$33.63 billion).

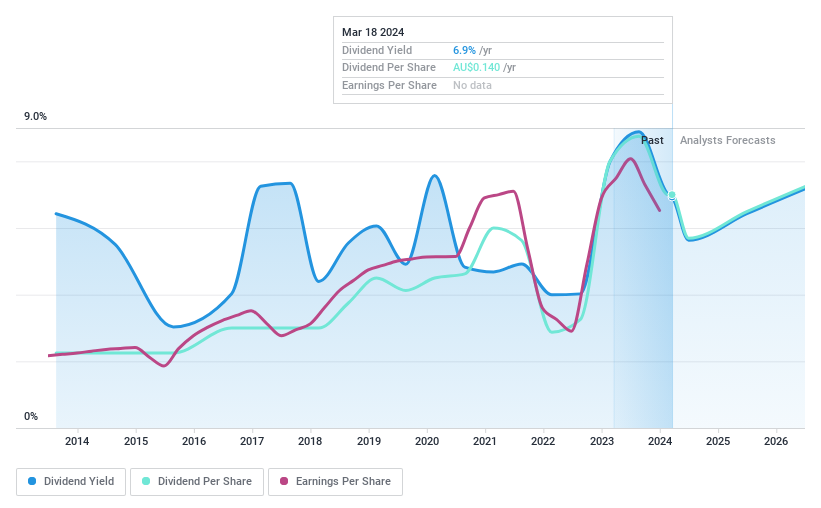

Dividend Yield: 8.2%

Ampol's dividend yield stands at a competitive 8.19%, ranking in the top 25% of Australian dividend payers. However, its dividends have shown volatility over the past decade and are currently under pressure, with a high payout ratio of 93.3% not adequately covered by earnings or free cash flow. Despite trading at 39.1% below estimated fair value and projected earnings growth of 8.79% per year, Ampol's financial stability is compromised by a high debt level, adding risk to its dividend sustainability.

Accent Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Accent Group Limited, operating in Australia and New Zealand, specializes in the retail, distribution, and franchising of lifestyle footwear, apparel, and accessories with a market capitalization of approximately A$1.10 billion.

Operations: Accent Group Limited generates its revenue primarily through its multi-channel retail operations, which focus on performance and lifestyle footwear, amounting to approximately A$1.40 billion.

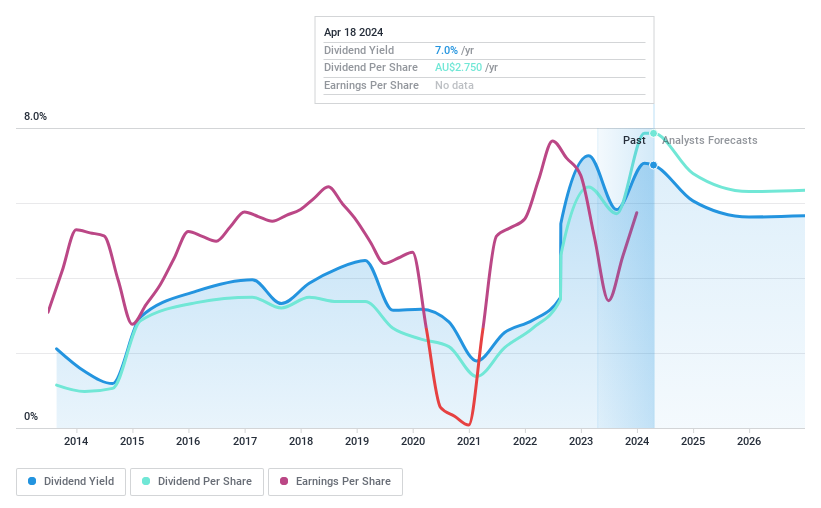

Dividend Yield: 7.0%

Accent Group offers a 7% dividend yield, placing it among the top 25% of Australian dividend payers. Despite this attractive yield, the sustainability of its dividends is questionable with a payout ratio of 107.2%, indicating payments are not well covered by earnings. Dividends have increased over the past decade but have been volatile and unreliable during that period. The stock trades at A$69% below estimated fair value, suggesting potential undervaluation despite financial concerns related to its dividend stability.

JB Hi-Fi

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Hi-Fi Limited operates a retail chain that sells consumer electronics and home products, with a market capitalization of approximately A$6.53 billion.

Operations: JB Hi-Fi Limited generates revenue through three primary segments: The Good Guys (A$2.66 billion), JB Hi-Fi Australia (A$6.57 billion), and JB Hi-Fi New Zealand (A$0.28 billion).

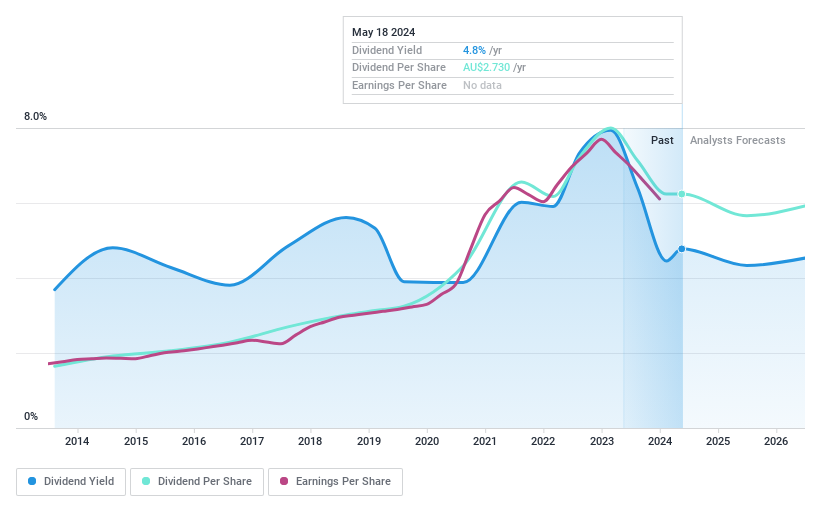

Dividend Yield: 4.5%

JB Hi-Fi maintains a conservative cash payout ratio of 46.8%, ensuring dividends are well-supported by free cash flow, though its dividend yield of 4.49% trails behind the top Australian dividend payers. Recent sales figures show mixed performance across regions, with JB Hi-Fi New Zealand experiencing notable growth. The company's earnings are expected to dip slightly over the next three years, and while dividends have grown over the past decade, their reliability has been inconsistent due to volatility in payments.

Dive into the specifics of JB Hi-Fi here with our thorough dividend report.

Our expertly prepared valuation report JB Hi-Fi implies its share price may be too high.

Where To Now?

Take a closer look at our Top ASX Dividend Stocks list of 27 companies by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:ALD ASX:AX1 and ASX:JBH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance