Exploring Betsson And Two Other Top Dividend Stocks In Sweden

Amidst a backdrop of fluctuating global markets, Sweden's economic stability and growth prospects continue to attract attention from investors looking for sustainable dividend yields. In this article, we explore three top dividend stocks in Sweden that stand out in the current economic environment, highlighting what makes a good stock choice in relation to consistent performance and potential resilience against market volatility.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 6.25% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 3.74% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.27% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.10% | ★★★★★☆ |

Duni (OM:DUNI) | 4.51% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.19% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.67% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.23% | ★★★★★☆ |

Bilia (OM:BILI A) | 4.45% | ★★★★☆☆ |

AB Traction (OM:TRAC B) | 4.07% | ★★★★☆☆ |

Click here to see the full list of 20 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Betsson

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Betsson AB operates primarily in online gaming across regions including the Nordic countries, Latin America, and Europe, with a market capitalization of SEK 16.47 billion.

Operations: Betsson AB generates its revenue predominantly from its Casinos & Resorts segment, amounting to €974.50 million.

Dividend Yield: 6.2%

Betsson AB has demonstrated a stable capacity to cover its dividend payments, evidenced by a cash payout ratio of 46.9% and an earnings payout ratio of 48.9%. Despite this, the company's dividend track record over the past decade has been marked by volatility and unreliability. Recently, Betsson announced an increase in dividends through two redemption procedures totaling EUR 0.645 per share for 2024, reflecting a commitment to returning value to shareholders amidst fluctuating performance metrics.

Unlock comprehensive insights into our analysis of Betsson stock in this dividend report.

Our valuation report unveils the possibility Betsson's shares may be trading at a discount.

Inwido

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inwido AB (publ) specializes in the development, manufacture, and sale of windows and doors, with a market capitalization of approximately SEK 8.49 billion.

Operations: Inwido AB generates revenue through its e-commerce platform and regional sales, with SEK 1.04 billion from E-Commerce, SEK 4.21 billion in Scandinavia, SEK 1.92 billion in Eastern Europe, and SEK 1.54 billion in Western Europe.

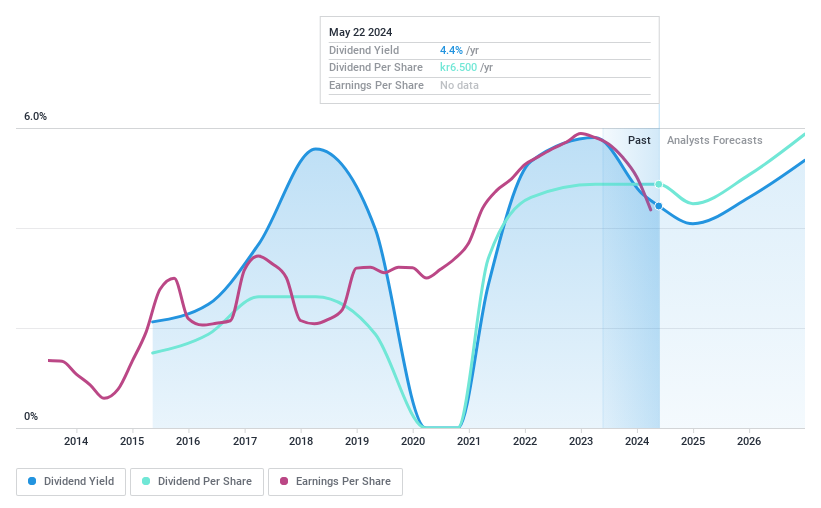

Dividend Yield: 4.4%

Inwido AB, while offering a dividend yield higher than the Swedish market average at 4.44%, shows signs of instability with a history of volatile dividend payments over its 9-year dividend history. Recent AGM decisions confirm a SEK 6.50 per share payout, backed by earnings and cash flows with payout ratios at 63.9% and 62.8% respectively, suggesting sustainability despite recent drops in quarterly sales to SEK 1.81 billion and net income to SEK 21.3 million from significantly higher levels last year.

Click here and access our complete dividend analysis report to understand the dynamics of Inwido.

Upon reviewing our latest valuation report, Inwido's share price might be too pessimistic.

Loomis

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Loomis AB operates in the secure logistics sector, offering services for the handling, storage, recycling, and distribution of cash and valuables with a market capitalization of approximately SEK 20.58 billion.

Operations: Loomis AB generates revenue primarily through its operations in Europe and Latin America, which brought in SEK 13.86 billion, and the United States of America, contributing SEK 15.17 billion, alongside a smaller segment from Loomis Pay totaling SEK 61 million.

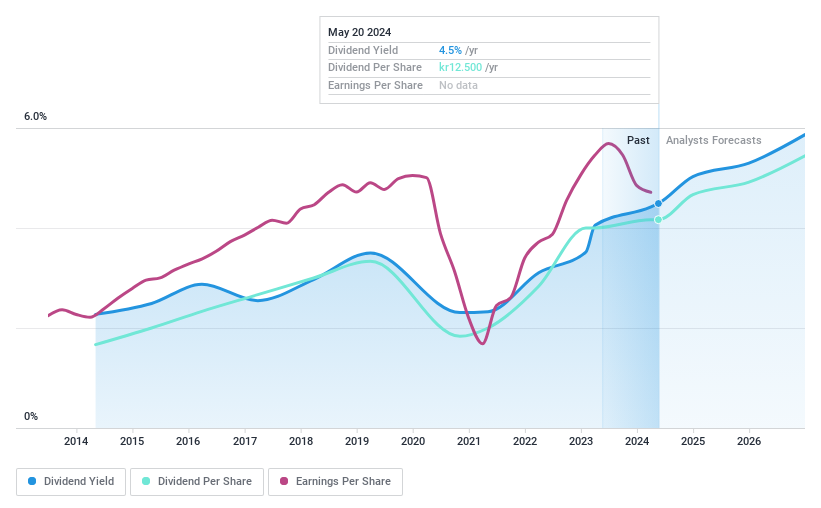

Dividend Yield: 4.3%

Loomis AB, trading significantly below its estimated fair value, offers a dividend yield of 4.28%, ranking in the top quartile of Swedish dividend stocks. Despite a history of fluctuating dividends over the past decade, recent financials show dividends are well-supported by both earnings and cash flows with payout ratios at 61.2% and 32.6% respectively. The company's commitment to shareholder returns is further evidenced by a recent share buyback program and an increased dividend announced during the latest AGM on May 6, 2024.

Seize The Opportunity

Discover the full array of 20 Top Dividend Stocks right here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:BETS BOM:INWI OM:LOOMIS

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance