Exploring Dividend Stocks: Avoid FastPartner And Consider One Better Option

When exploring dividend stocks, it's essential to assess the sustainability of their payouts. High dividend yields can be enticing, but they may also indicate underlying financial challenges if the company's payout ratio is excessively high. This can be a red flag suggesting that dividends might not be sustainable in the long term. FastPartner, for instance, presents such a concern with its elevated payout ratio, making it less attractive for those seeking reliable dividend investments.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Zinzino (OM:ZZ B) | 4.44% | ★★★★★★ |

Betsson (OM:BETS B) | 5.80% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.50% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.39% | ★★★★★☆ |

Axfood (OM:AXFO) | 3.06% | ★★★★★☆ |

Duni (OM:DUNI) | 4.93% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.19% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.52% | ★★★★★☆ |

Avanza Bank Holding (OM:AZA) | 4.45% | ★★★★★☆ |

Bilia (OM:BILI A) | 4.66% | ★★★★☆☆ |

Click here to see the full list of 25 stocks from our Top Dividend Stocks screener.

Underneath we present one of the stocks filtered out by our screen and one to consider sidestepping.

Top Pick

Softronic

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Softronic AB (publ) specializes in providing IT and management services mainly in Sweden, with a market capitalization of approximately SEK 1.16 billion.

Operations: The company generates its revenue primarily through computer services, totaling SEK 834.42 million.

Dividend Yield: 6.1%

Softronic maintains a payout ratio of 86.6%, suggesting its dividend payments are covered by earnings, contrasting with companies whose high ratios indicate risk. However, Softronic's dividends have shown volatility and inconsistency over the past decade, lacking steady growth or stability. Additionally, a high cash payout ratio of 138% raises concerns about sustainability from cash flow perspectives. Despite these challenges, its P/E ratio at 14.3x remains attractive compared to the broader Swedish market average of 22.7x.

One To Reconsider

FastPartner

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: FastPartner AB, a Swedish real estate firm, specializes in developing, owning, and managing both residential and commercial properties with a market capitalization of SEK 13.79 billion.

Operations: The company's revenue is generated through property management across three regions in Sweden, totaling SEK 2.23 billion.

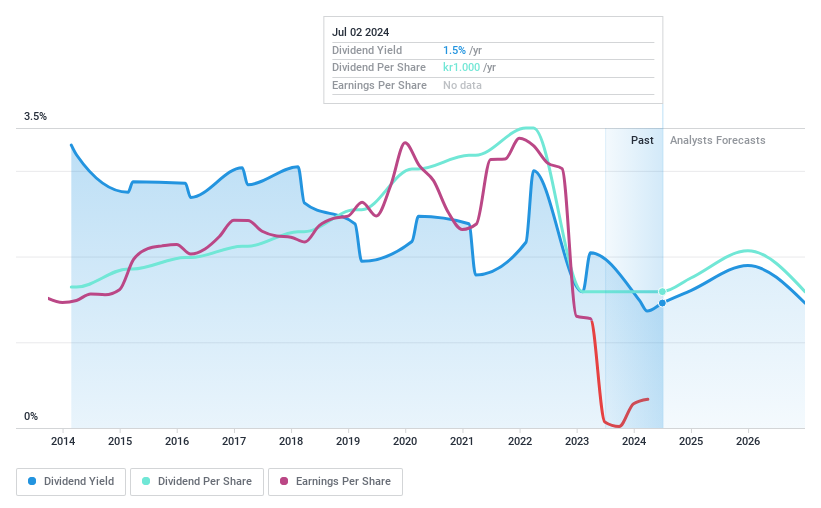

Dividend Yield: 1.5%

FastPartner's dividend yield of 1.46% falls below the top quartile of Swedish dividend stocks at 4.16%, signaling weaker returns for income-focused investors. Despite a low cash payout ratio of 20.4%, suggesting sufficient cash flow coverage, the dividends are poorly supported by earnings and have demonstrated volatility and decline over the past decade, with no profitability underpinning these payments. Recent financials show improved earnings, yet interest coverage remains inadequate, casting doubts on financial stability and dividend reliability.

Taking Advantage

Unlock our comprehensive list of 25 Top Dividend Stocks by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:SOF BOM:FPAR A and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance