Exploring Dividend Stocks On Euronext Amsterdam With Koninklijke Heijmans And Two More

Amidst a backdrop of cautious optimism in European markets, with the pan-European STOXX Europe 600 Index experiencing slight fluctuations, investors are increasingly attentive to opportunities that offer stability and potential income. In this context, dividend stocks on Euronext Amsterdam, such as Koninklijke Heijmans and others, attract those looking for investments that might provide regular income streams in uncertain times.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Acomo (ENXTAM:ACOMO) | 6.66% | ★★★★★☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.68% | ★★★★☆☆ |

Van Lanschot Kempen (ENXTAM:VLK) | 10.00% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 4.56% | ★★★★☆☆ |

Koninklijke KPN (ENXTAM:KPN) | 4.36% | ★★★★☆☆ |

Koninklijke Heijmans (ENXTAM:HEIJM) | 4.38% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

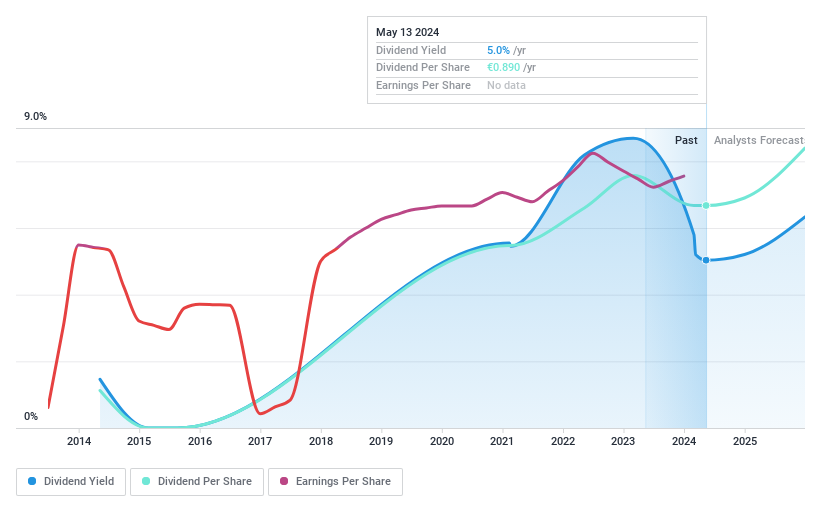

Koninklijke Heijmans

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. operates in property development, construction, and infrastructure sectors primarily in the Netherlands and abroad, with a market capitalization of approximately €544.56 million.

Operations: Koninklijke Heijmans N.V. generates revenue through several key segments: Real Estate (€411.79 million), Van Wanrooij (€124.76 million), Infrastructure Works (€800.03 million), and Construction & Technology (€1.08 billion).

Dividend Yield: 4.4%

Koninklijke Heijmans exhibits a mixed dividend profile. With a payout ratio of 37.1% and cash payout ratio of 59%, its dividends are well-supported by both earnings and cash flow, suggesting sustainability despite the company's volatile share price over the past three months. However, its dividend yield at 4.38% trails behind the top Dutch dividend payers. Additionally, while HEIJM has increased dividends over the last decade, their overall reliability and stability have been inconsistent due to fluctuations in payments.

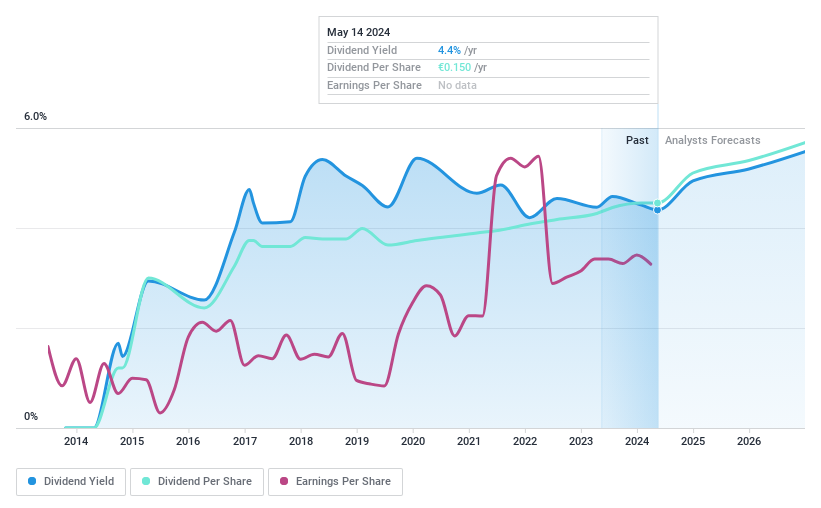

Koninklijke KPN

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke KPN N.V. is a telecommunications and IT service provider in the Netherlands, with a market capitalization of approximately €13.52 billion.

Operations: Koninklijke KPN N.V. generates its revenue primarily from three segments: Consumer (€2.93 billion), Business (€1.84 billion), and Wholesale (€0.70 billion).

Dividend Yield: 4.4%

Koninklijke KPN reported a slight decrease in net income and earnings per share in Q1 2024, with sales increasing to €1.38 billion from €1.34 billion year-over-year. Despite a volatile dividend history over the past decade, KPN's current dividends are supported by earnings and cash flows, with payout ratios of 78.4% and 59.6%, respectively. However, its dividend yield of 4.36% is below the top quartile of Dutch dividend stocks at 5.54%. The recent appointment of PriceWaterhouseCoopers as auditors reflects ongoing governance adjustments.

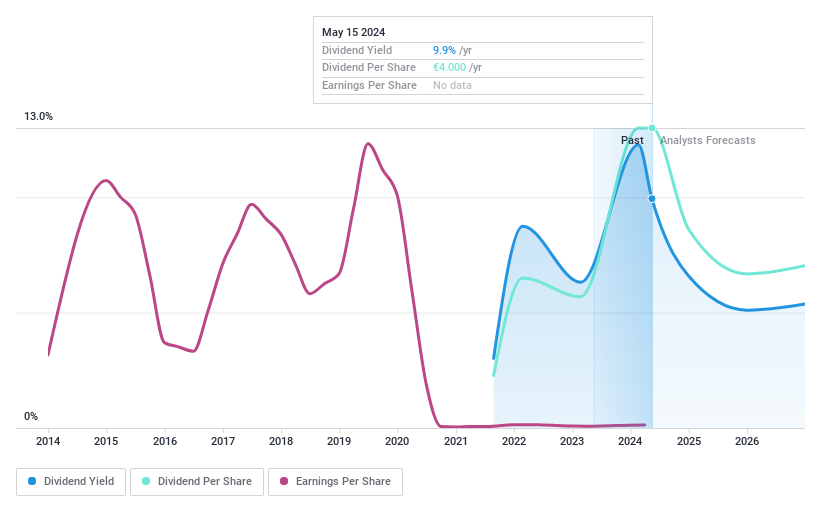

Van Lanschot Kempen

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Van Lanschot Kempen NV, operating both in the Netherlands and internationally, offers a range of financial services with a market capitalization of approximately €1.69 billion.

Operations: Van Lanschot Kempen NV generates revenue primarily through its Investment Banking Clients and Wholesale & Institutional Clients segments, which contribute €41 million and €83.10 million respectively.

Dividend Yield: 10%

Van Lanschot Kempen has shown robust earnings growth of 81.8% over the past year, with forecasts predicting a steady increase. Despite a short dividend history of three years, dividends are well-covered by earnings at a 70.9% payout ratio, expected to remain sustainable at 66.6% in three years. The firm's dividend yield stands at an impressive 10%, placing it among the top quartile in the Dutch market. However, shareholder dilution occurred last year and its dividend track record is not long-standing.

Navigate through the intricacies of Van Lanschot Kempen with our comprehensive dividend report here.

Next Steps

Reveal the 6 hidden gems among our Top Euronext Amsterdam Dividend Stocks screener with a single click here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:HEIJMENXTAM:KPNENXTAM:VLK and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance