Exploring Dividend Stocks On Euronext Amsterdam In May 2024

As of May 2024, the Euronext Amsterdam, like many global markets, reflects a complex interplay of economic indicators and investor sentiment. Amidst this backdrop, dividend stocks continue to attract attention for their potential to offer steady returns in a fluctuating market environment. In this context, understanding the fundamentals that contribute to a robust dividend-paying stock is crucial for investors seeking resilience and consistent income from their portfolios.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Acomo (ENXTAM:ACOMO) | 6.56% | ★★★★★☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.73% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 4.67% | ★★★★☆☆ |

Koninklijke KPN (ENXTAM:KPN) | 4.35% | ★★★★☆☆ |

Koninklijke Heijmans (ENXTAM:HEIJM) | 4.31% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Acomo

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Acomo N.V. is a company that sources, trades, processes, packages, and distributes both conventional and organic food ingredients for the food and beverage industry across Europe, North America, and other international markets, with a market capitalization of approximately €519.50 million.

Operations: Acomo N.V. generates its revenue primarily through five segments: Tea (€120.62 million), Edible Seeds (€257.29 million), Food Solutions (€24.07 million), Spices and Nuts (€429.96 million), and Organic Ingredients (€436.38 million).

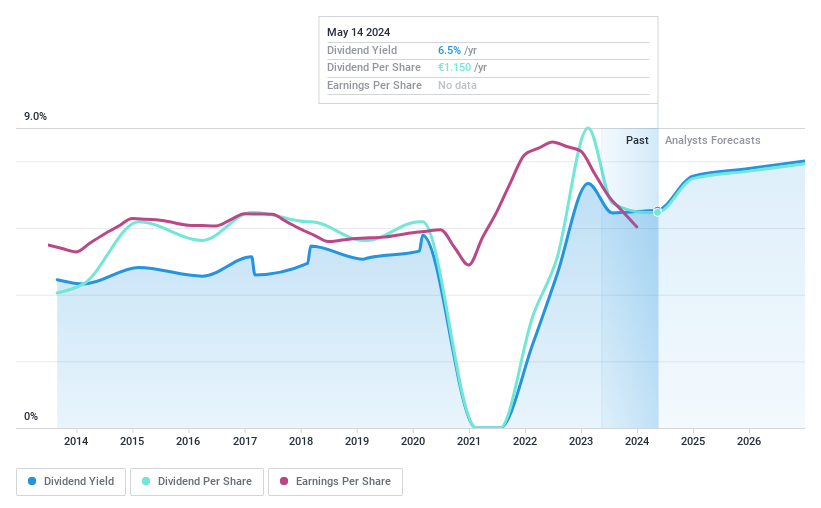

Dividend Yield: 6.6%

ACOMO's dividend yield of 6.56% ranks in the top 25% in the Dutch market, reflecting its appeal to income-focused investors. Despite trading at 52.9% below its estimated fair value, which suggests potential undervaluation, investors should be cautious due to its unstable and unreliable dividend history over the past decade, including significant annual drops. However, both earnings (payout ratio: 85.7%) and cash flows (cash payout ratio: 26.1%) currently cover dividend payments adequately, though high debt levels persist as a financial concern.

Koninklijke Heijmans

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. is a Dutch company involved in property development, construction, and infrastructure projects both domestically and internationally, with a market capitalization of approximately €553.95 million.

Operations: Koninklijke Heijmans N.V. generates revenue through several segments, including Real Estate (€411.79 million), Van Wanrooij (€124.76 million), Infrastructure Works (€800.03 million), and Construction & Technology (€1.08 billion).

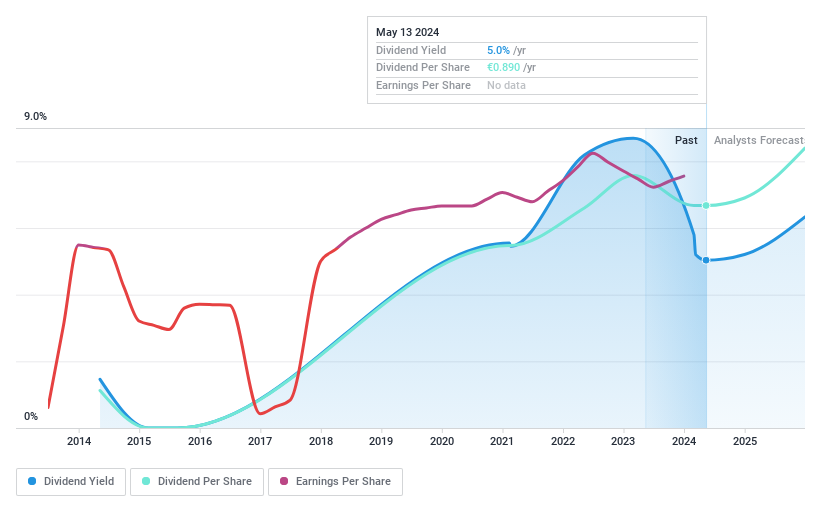

Dividend Yield: 4.3%

Koninklijke Heijmans reported a stable net income of €60 million and sales growth to €2.12 billion in 2023, maintaining earnings per share at €2.4. Despite a dividend yield of 4.31%, which is below the Dutch market's top quartile, its dividends are well-supported by a conservative payout ratio of 37.1% and cash flows with a payout ratio at 59%. However, the dividend track record over the past decade has been marked by volatility and unreliability, reflecting potential concerns for long-term stability in dividend payments.

Koninklijke KPN

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke KPN N.V. is a Dutch company offering telecommunications and IT services, with a market capitalization of approximately €13.54 billion.

Operations: Koninklijke KPN N.V. generates revenue primarily through three segments: Business (€1.84 billion), Consumer (€2.93 billion), and Wholesale (€0.70 billion).

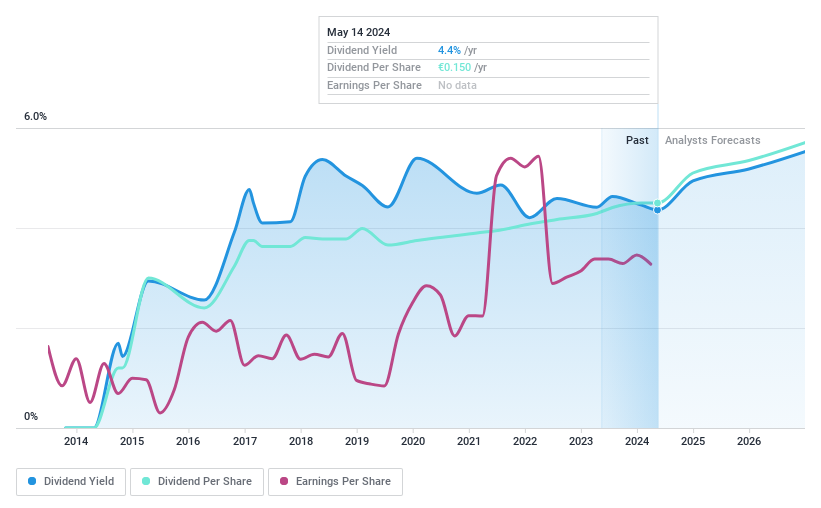

Dividend Yield: 4.4%

Koninklijke KPN reported a slight decrease in Q1 2024 net income to €174 million from €196 million year-over-year, with sales rising to €1.38 billion. Despite a high debt level and unstable dividend history, dividends have grown over the last decade. The dividends are currently supported by earnings and cash flows, with payout ratios of 78.4% and 59.6% respectively. However, its dividend yield of 4.35% trails behind the top Dutch dividend payers' average of 5.58%.

Get an in-depth perspective on Koninklijke KPN's performance by reading our dividend report here.

Our valuation report here indicates Koninklijke KPN may be undervalued.

Taking Advantage

Discover the full array of 5 Top Euronext Amsterdam Dividend Stocks right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:ACOMO ENXTAM:HEIJM and ENXTAM:KPN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com