Exploring Dividend Stocks On Euronext Paris May 2024

Amidst a backdrop of fluctuating European markets, with France's CAC 40 Index experiencing a modest decline last week, investors may find stability and potential income in dividend stocks. Such stocks can be particularly appealing in uncertain times, offering regular returns that could cushion against market volatility.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 6.11% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.42% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.40% | ★★★★★★ |

SCOR (ENXTPA:SCR) | 6.60% | ★★★★★☆ |

Métropole Télévision (ENXTPA:MMT) | 9.19% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.20% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.61% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 3.94% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.72% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.30% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top Euronext Paris Dividend Stocks screener.

We'll examine a selection from our screener results.

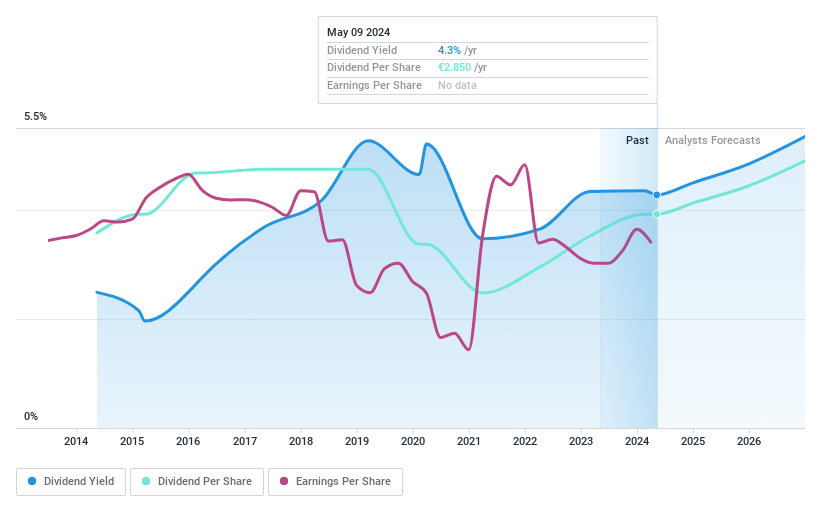

Société BIC

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Société BIC SA is a global company that manufactures and sells stationery, lighters, shavers, and other products, with a market capitalization of approximately €2.81 billion.

Operations: Société BIC SA's revenue is primarily derived from its three main product segments: stationery (€0.84 billion), lighters (€0.83 billion), and shavers (€0.54 billion).

Dividend Yield: 4.2%

Société BIC's dividend track record has been unstable and volatile, with payments fluctuating significantly over the past decade. Despite trading at 59.3% below its estimated fair value, its dividends are reasonably covered by both earnings and cash flows, with payout ratios of 57.5% and 47.7%, respectively. However, the dividend yield of 4.22% is lower than the top quartile of French dividend stocks at 5.11%. Recent initiatives like the launch of BIC® Soleil Escape shave kits show ongoing product innovation but do not directly impact dividend reliability.

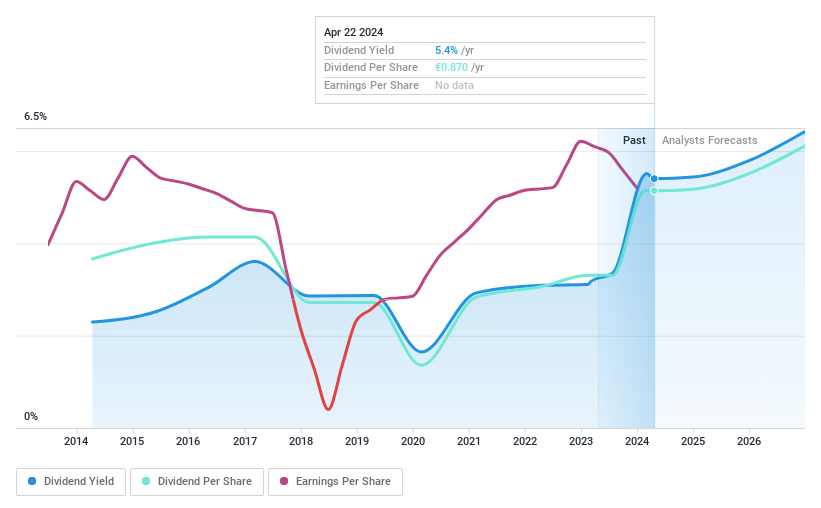

Carrefour

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Carrefour SA operates a diverse range of food and non-food retail stores across multiple formats and channels in Europe, Latin America, the Middle East, Africa, and Asia, with a market capitalization of approximately €11.28 billion.

Operations: Carrefour SA's revenue is primarily generated from three key segments: France (€39.02 billion), Latin America (€22.54 billion), and Europe excluding France (€24.27 billion).

Dividend Yield: 5.3%

Carrefour's dividend history shows inconsistency, with significant fluctuations over the past decade. Despite this, its dividends are well supported by earnings and cash flows, with a payout ratio of 66.8% and a cash payout ratio of 21.5%. Currently, Carrefour's dividend yield stands at 5.34%, placing it in the top quartile of French dividend payers. However, profit margins have declined from last year's 1.7% to 1.1%. On April 24, 2024, Carrefour reported Q1 sales that could influence future financial stability and dividend sustainability.

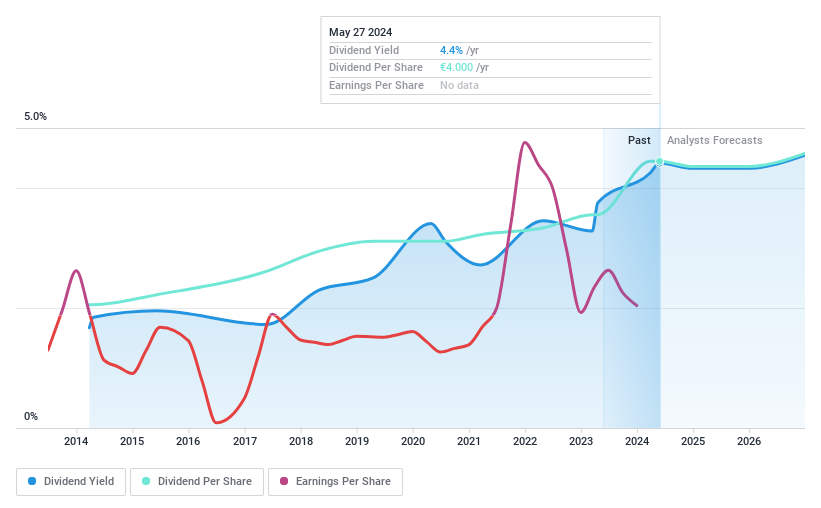

Wendel

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wendel is a private equity firm that specializes in equity financing for middle-market and later-stage companies through leveraged buyouts and acquisitions, with a market capitalization of approximately €3.92 billion.

Operations: Wendel's revenue is primarily generated through five segments: CPI (€128 million), ACAMS (€91.60 million), Stahl (€913.50 million), Scalian (€126.80 million), and Bureau Veritas (€5.87 billion).

Dividend Yield: 4.4%

Wendel's dividends have shown stability and growth over the past decade, despite a current yield of 4.42% which is below the top tier in France. Recent earnings report showed a significant profit increase to €142.4 million with sales reaching €7.13 billion in 2023, suggesting potential for future dividend growth. However, its high payout ratio of 301.9% raises concerns about sustainability, though cash flows are strong with a low cash payout ratio of 14.7%. Wendel also carries high debt levels which could impact financial flexibility.

Unlock comprehensive insights into our analysis of Wendel stock in this dividend report.

Our expertly prepared valuation report Wendel implies its share price may be lower than expected.

Seize The Opportunity

Unlock our comprehensive list of 31 Top Euronext Paris Dividend Stocks by clicking here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:BB ENXTPA:MF and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance