Exploring Dividend Stocks In Germany Including MPC Münchmeyer Petersen Capital And Two Others

As global markets experience fluctuations with mixed results among major indices, Germany's DAX index remains relatively stable, reflecting a cautious optimism in the European market. This backdrop sets an interesting stage for investors considering dividend stocks in Germany, where stability and consistent returns become even more appealing amidst broader market uncertainties. In this environment, understanding the characteristics that define a good dividend stock is crucial. Investors should look for companies with a strong track record of profitability and dividend payments, particularly those that demonstrate resilience during economic shifts and maintain robust fundamentals.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.18% | ★★★★★★ |

Edel SE KGaA (XTRA:EDL) | 6.49% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.74% | ★★★★★★ |

Südzucker (XTRA:SZU) | 6.50% | ★★★★★☆ |

MLP (XTRA:MLP) | 4.67% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.54% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.13% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.92% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.00% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.25% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

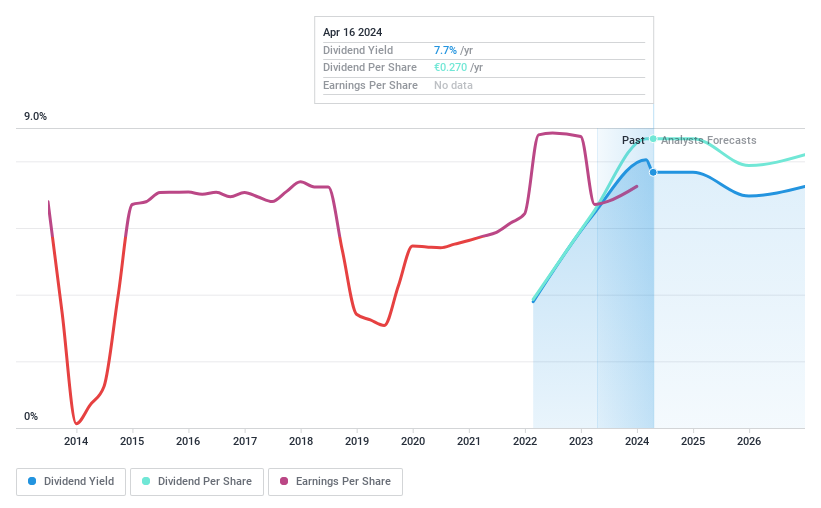

MPC Münchmeyer Petersen Capital

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MPC Münchmeyer Petersen Capital AG operates as a publicly owned investment manager, with a market capitalization of approximately €142.40 million.

Operations: MPC Münchmeyer Petersen Capital AG generates revenue primarily through Management Services (€30.83 million) and Transaction Services (€7.73 million).

Dividend Yield: 6.7%

MPC Münchmeyer Petersen Capital AG, with a recent leadership change appointing Constantin Baack as CEO, reported a significant earnings increase in Q1 2024 to EUR 5.88 million from EUR 3.72 million year-over-year. Despite trading at 60.1% below estimated fair value and having a reasonable payout ratio of 72.6%, the company's dividend track record remains unstable, with dividends covered by both earnings and cash flows (Cash Payout Ratio: 73.6%). The firm has increased its dividend payments recently but has been distributing dividends for only two years, raising questions about the sustainability and reliability of future payouts in the context of its short dividend-paying history and modest annual earnings growth forecast at 1.85%.

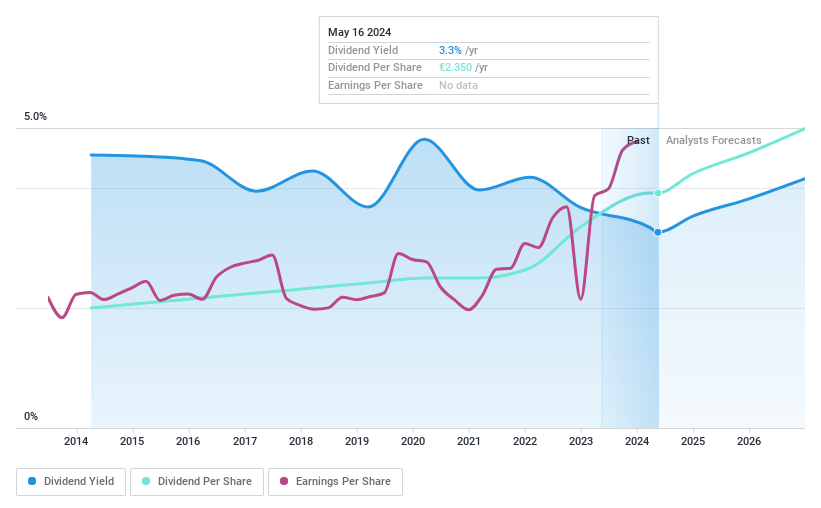

Talanx

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Talanx AG is a global provider of insurance and reinsurance products and services, with a market capitalization of approximately €19.03 billion.

Operations: Talanx AG operates primarily in the insurance and reinsurance sectors globally.

Dividend Yield: 3.2%

Talanx AG, demonstrating a robust dividend profile, pays a consistent dividend of 3.19%, supported by a strong cash flow coverage with a low cash payout ratio of 7.5%. Despite dividends being covered by earnings and cash flows (Payout Ratio: 37.9%), its yield is lower than the top quartile in Germany's market at 4.6%. Recent financials show substantial growth, with Q1 net income rising to €572 million from €423 million year-over-year, affirming its ability to sustain dividends amidst varying market conditions.

Navigate through the intricacies of Talanx with our comprehensive dividend report here.

Our valuation report unveils the possibility Talanx's shares may be trading at a discount.

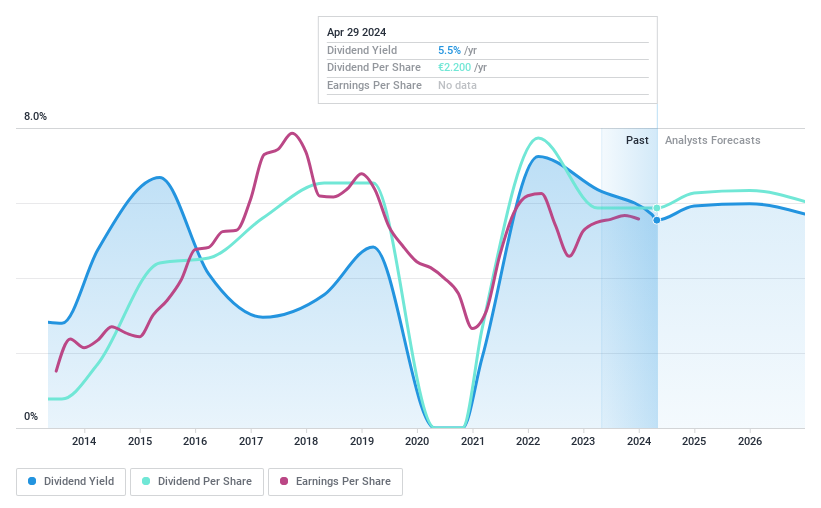

WashTec

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: WashTec AG specializes in car wash solutions across Germany, Europe, North America, and the Asia Pacific with a market capitalization of approximately €548.68 million.

Operations: WashTec AG generates €98.39 million in revenue from North America and an additional €393.63 million from adjustments across its segments.

Dividend Yield: 5.4%

WashTec AG, facing challenges in covering its dividend with a 106.6% payout ratio, reported a slight decrease in quarterly and annual earnings. Despite this, the company maintains a dividend of €2.20, appealing with a 5.37% yield but marked by historical volatility and unreliability over the past decade. Recent sales dipped to €100.76 million from €109.17 million year-over-year for Q1 2024, reflecting potential pressures on financial sustainability despite a modest annual earnings growth forecast of 11.96%.

Seize The Opportunity

Embark on your investment journey to our 29 Top Dividend Stocks selection here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:MPCK XTRA:TLX and XTRA:WSU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance