Exploring Exchange Income And Two More Undervalued Small Caps With Insider Action In Canada

As the Canadian market experiences a robust first half of 2024, with notable gains in sectors like technology and utilities, small-cap stocks have shown a more subdued performance. This backdrop sets an intriguing stage for investors to explore opportunities within undervalued small caps that might be poised for growth amidst these broader market movements. In this context, identifying stocks with insider action can provide valuable insights into potential hidden gems in the Canadian landscape.

Top 10 Undervalued Small Caps With Insider Buying In Canada

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Nexus Industrial REIT | 2.4x | 3.0x | 20.97% | ★★★★★★ |

Dundee Precious Metals | 7.9x | 2.7x | 47.55% | ★★★★★☆ |

Primaris Real Estate Investment Trust | 11.3x | 2.9x | 36.61% | ★★★★★☆ |

Russel Metals | 9.1x | 0.5x | 15.71% | ★★★★☆☆ |

Guardian Capital Group | 10.4x | 4.0x | 32.47% | ★★★★☆☆ |

Calfrac Well Services | 2.3x | 0.2x | 6.46% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -94.43% | ★★★★☆☆ |

Bragg Gaming Group | NA | 1.4x | 19.57% | ★★★☆☆☆ |

Gear Energy | 19.8x | 1.4x | 28.95% | ★★★☆☆☆ |

Freehold Royalties | 15.2x | 6.6x | 49.15% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

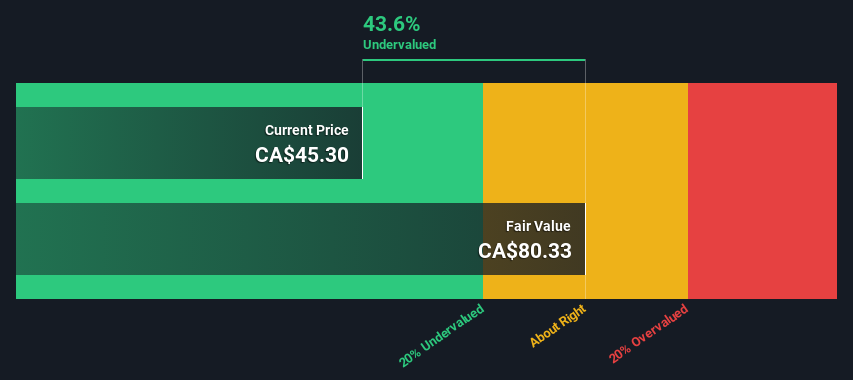

Exchange Income

Simply Wall St Value Rating: ★★★★★☆

Overview: Exchange Income is a diversified corporation operating primarily in the manufacturing and aerospace & aviation sectors, with a market capitalization of approximately CA$1.57 billion.

Operations: Manufacturing and Aerospace & Aviation are the primary revenue streams for Exchange Income, generating CA$1.03 billion and CA$1.54 billion respectively. The company's gross profit margin has shown a trend of fluctuation over recent periods, with the latest recorded at approximately 34.55%.

PE: 17.9x

Exchange Income, a notable player among Canadian small caps, has shown a mix of financial dynamics recently. Despite experiencing a dip in net income from CAD 6.86 million to CAD 4.53 million in the first quarter of 2024, its revenue surged from CAD 526.84 million to CAD 601.77 million over the same period, indicating potential for growth. The company's consistent dividend declarations at CAD 0.22 per share underscore stable cash returns to shareholders amidst this financial flux. Notably, insider confidence is reflected through recent purchases by insiders, signaling optimism about the company's future prospects despite some funding risks due to reliance on external borrowing as its sole source of capital.

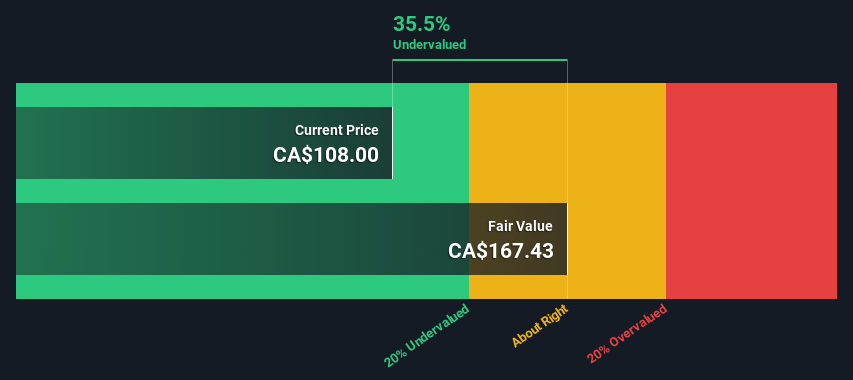

Hammond Power Solutions

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hammond Power Solutions specializes in the manufacture and sale of transformers, with a market capitalization of approximately CA$129.23 million.

Operations: The company generates CA$729.61 million from the manufacture and sale of transformers, with a gross profit margin of 32.49% in the most recent period reported. This indicates an increase in efficiency or pricing power, as the gross profit margin has grown consistently over several periods.

PE: 23.9x

Hammond Power Solutions, a lesser-known entity in the Canadian market, recently showcased its financial resilience despite a dip in net income to CAD 7.95 million from last year's CAD 15.73 million as of Q1 2024. With sales climbing to CAD 190.68 million, reflecting an increase from the previous year, and earnings projected to grow by roughly 19% annually, this company captures attention not just for its financials but also for insider confidence; insiders have recently purchased shares, signaling belief in long-term prospects despite short-term volatility. Further bolstered by a new shelf registration filing on June 20, indicating readiness for capital expansion or debt restructuring, Hammond Power Solutions appears positioned for potential growth amidst market uncertainties.

Click to explore a detailed breakdown of our findings in Hammond Power Solutions' valuation report.

Assess Hammond Power Solutions' past performance with our detailed historical performance reports.

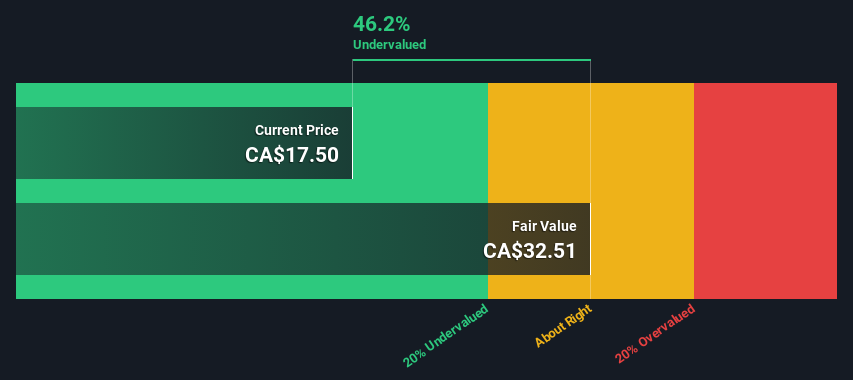

Softchoice

Simply Wall St Value Rating: ★★★★☆☆

Overview: Softchoice is a technology company specializing in IT solutions and services, with a market capitalization of approximately $1.23 billion.

Operations: Direct Marketing generated $777.35 million in revenue, with a notable increase in gross profit margin to 41.82% by mid-2024, reflecting improved cost management despite consistent revenue levels. The company's net income also showed significant growth, reaching $40.47 million during the same period, indicating enhanced profitability and operational efficiency.

PE: 19.0x

Softchoice, a lesser-known yet promising entity in the Canadian market, recently showcased its agility through strategic executive enhancements and insightful conference presentations. Despite a dip in quarterly sales to US$169.76 million and a shift from profit to a net loss of US$1.03 million, the firm declared an increased dividend of CAD 0.13, underscoring management's confidence in its financial health. Notably, insider confidence is evident as they have maintained their shareholdings; such actions often signal strong belief in the company’s future prospects amidst challenging times.

Delve into the full analysis valuation report here for a deeper understanding of Softchoice.

Review our historical performance report to gain insights into Softchoice's's past performance.

Next Steps

Click here to access our complete index of 29 Undervalued TSX Small Caps With Insider Buying.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:EIF TSX:HPS.A and TSX:SFTC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance