Exploring High Insider Ownership Growth Companies On Chinese Exchanges With Up To 24% Revenue Growth

As global economic indicators present a mixed landscape with China's manufacturing sector showing signs of contraction, investors are keenly observing market dynamics and potential growth opportunities. In this context, exploring growth companies with high insider ownership on Chinese exchanges becomes particularly relevant, as such firms often exhibit strong alignment between management's interests and shareholder value creation.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.4% | 28.4% |

Arctech Solar Holding (SHSE:688408) | 25.9% | 25.8% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

UTour Group (SZSE:002707) | 23% | 33.1% |

Here we highlight a subset of our preferred stocks from the screener.

Wuxi Chipown Micro-electronics

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Chipown Micro-electronics Limited specializes in the research, development, design, and supply of analog and mixed-signal integrated circuits in China, with a market capitalization of approximately CN¥4.90 billion.

Operations: The company generates revenue primarily through the sale of analog and mixed-signal integrated circuits, totaling approximately CN¥796.64 million.

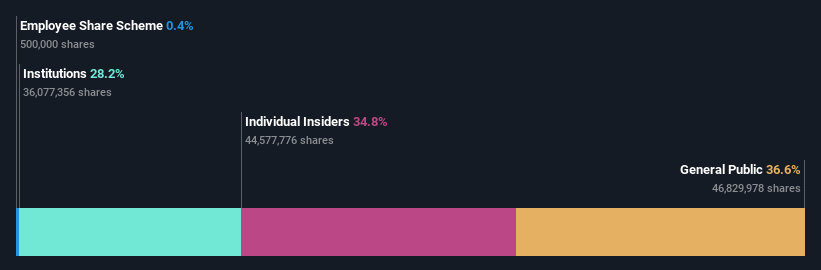

Insider Ownership: 34.8%

Revenue Growth Forecast: 20.1% p.a.

Wuxi Chipown Micro-electronics is expected to see robust growth, with earnings forecasted to increase by 43% annually, outpacing the Chinese market's 22.1%. Despite high insider ownership typically signaling confidence, the company's Return on Equity (ROE) is projected at a low 6.4% in three years. Recent activities include a share buyback program where CNY 47.25 million was spent to repurchase shares, reflecting management’s commitment to enhancing shareholder value despite past shareholder dilution and one-off items impacting financial results.

Shenzhen Fastprint Circuit TechLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Fastprint Circuit Tech Co., Ltd. specializes in manufacturing and selling printed circuit boards (PCBs) both domestically in China and internationally, with a market capitalization of approximately CN¥16.91 billion.

Operations: The company generates revenue primarily through the manufacture and sale of printed circuit boards (PCBs).

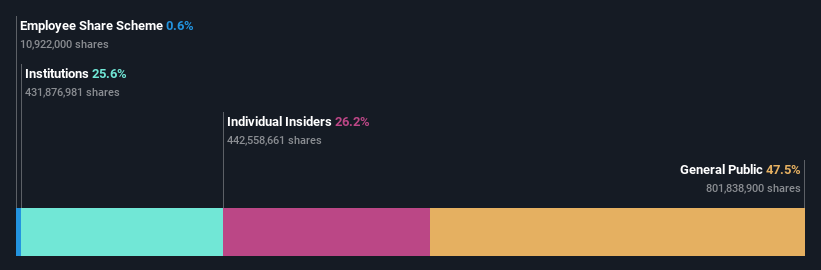

Insider Ownership: 26.2%

Revenue Growth Forecast: 19.3% p.a.

Shenzhen Fastprint Circuit Tech Co., Ltd. is positioned for significant earnings growth, with expectations of a 40.32% annual increase, surpassing the broader Chinese market's 22.1% growth rate. Despite this, its profit margins have declined to 4.2% from last year's 6.2%, and its debt coverage by operating cash flow is weak. Recent corporate actions include a reduced dividend payout of CNY 0.50 per 10 shares and an annual general meeting that addressed various governance and financial plans.

Shenzhen Zhaowei Machinery & Electronics

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Zhaowei Machinery & Electronics Co., Ltd. is a company that specializes in the research, development, production, and sales of precision transmission systems and components with a market capitalization of approximately CN¥10.72 billion.

Operations: The company generates its revenue primarily from the design, manufacture, and sale of precision transmission systems and components.

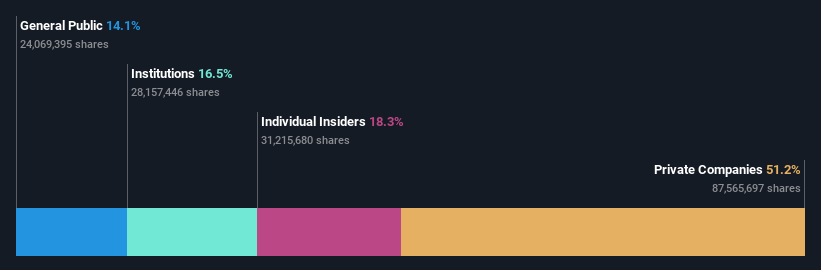

Insider Ownership: 18.3%

Revenue Growth Forecast: 24.3% p.a.

Shenzhen Zhaowei Machinery & Electronics Co., Ltd. demonstrates robust financial performance with a 24.3% forecasted annual revenue growth and a 25.1% expected earnings increase, outpacing the Chinese market averages. Despite these strong growth indicators, its return on equity is projected to be low at 9.9%. Recent dividends were set at CNY 5.50 per 10 shares, reflecting confidence in ongoing profitability as evidenced by substantial year-over-year gains in net income and sales for Q1 2024.

Summing It All Up

Explore the 368 names from our Fast Growing Chinese Companies With High Insider Ownership screener here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688508 SZSE:002436 and SZSE:003021.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance