Exploring JUSUNG ENGINEERINGLtd And Two More KRX Growth Stocks With Substantial Insider Ownership

The South Korean stock market has experienced a slight decline of 1.4% over the last week, though it maintains a positive trajectory with an annual increase of 4.2%. In this environment, where earnings are expected to grow by 28% annually, stocks like JUSUNG ENGINEERING Ltd that combine growth potential with high insider ownership may offer appealing opportunities for informed investors.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

Modetour Network (KOSDAQ:A080160) | 12.4% | 45.6% |

ALTEOGEN (KOSDAQ:A196170) | 26.7% | 73.1% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

Innosimulation (KOSDAQ:A274400) | 28.2% | 112.5% |

UTI (KOSDAQ:A179900) | 34.2% | 122.7% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 74.2% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

HANA Micron (KOSDAQ:A067310) | 19.8% | 67.2% |

Enchem (KOSDAQ:A348370) | 21.3% | 105.6% |

Techwing (KOSDAQ:A089030) | 18.7% | 102.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

JUSUNG ENGINEERINGLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: JUSUNG ENGINEERING Co., Ltd. is a global provider of semiconductor, display, solar, and lighting equipment based in South Korea, with a market capitalization of approximately ₩1.60 billion.

Operations: The company generates ₩284.75 billion in revenue from its semiconductor equipment and services segment.

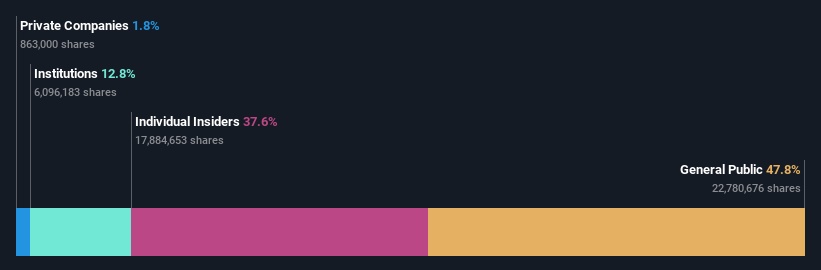

Insider Ownership: 37.6%

Earnings Growth Forecast: 39.1% p.a.

JUSUNG ENGINEERING Ltd. is poised for significant growth, with revenue and earnings expected to outpace the South Korean market at 21.6% and 39.1% per year, respectively. Despite a highly volatile share price recently, analysts remain optimistic, projecting a substantial 40.3% potential increase in stock price. However, concerns include lower profit margins compared to last year and large one-off items affecting financial results, which could impact the quality of earnings.

UTI

Simply Wall St Growth Rating: ★★★★★★

Overview: UTI Inc., with a market cap of ₩604.38 billion, specializes in the research, development, manufacturing, and sales of smartphone camera windows and sensor glasses both domestically in South Korea and internationally.

Operations: The company generates its revenue from the development and sales of smartphone camera windows and sensor glasses across domestic and international markets.

Insider Ownership: 34.2%

Earnings Growth Forecast: 122.7% p.a.

UTI Inc., a South Korean company, is on track to achieve profitability within three years, with expected revenue growth of 103.6% per year, significantly outpacing the market's 10.2%. This rapid expansion is supported by recent private placements totaling KRW 80 billion, indicating strong investor confidence and bolstering its financial position for future growth. However, the company faces challenges with a highly volatile share price and no substantial insider buying in the past three months.

Intellian Technologies

Simply Wall St Growth Rating: ★★★★★★

Overview: Intellian Technologies, Inc. specializes in providing satellite antennas and terminals both domestically in South Korea and globally, with a market capitalization of approximately ₩712.58 billion.

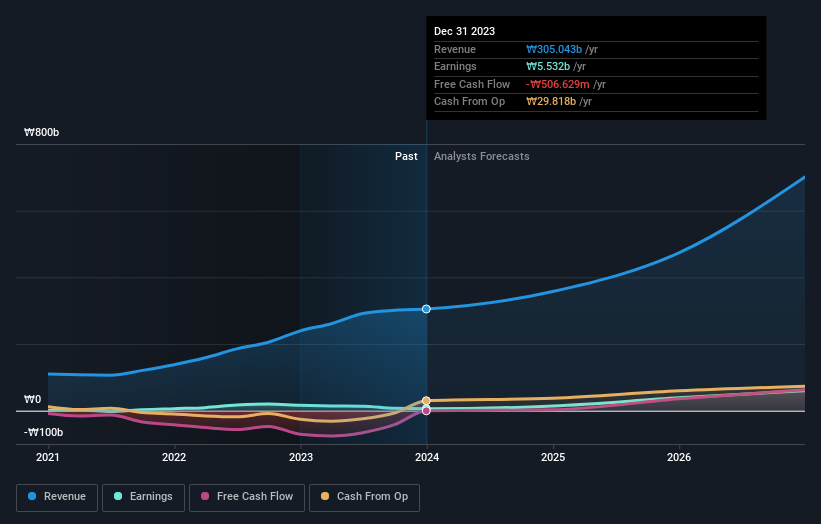

Operations: The company generates ₩305.04 billion from sales of telecommunication equipment.

Insider Ownership: 18.9%

Earnings Growth Forecast: 59.8% p.a.

Intellian Technologies, a South Korean company, is poised for robust growth with earnings expected to increase by 59.8% per year and revenue projected to rise by 25.9% annually, both significantly outpacing the market averages. Despite trading at 68.9% below its estimated fair value and recent share buybacks totaling KRW 2.77 billion, concerns persist due to a decline in profit margins from last year and shareholder dilution over the past year.

Next Steps

Dive into all 82 of the Fast Growing KRX Companies With High Insider Ownership we have identified here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A036930 KOSDAQ:A179900 and KOSDAQ:A189300.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance