Exploring Kinetic Development Group And Two Other Undervalued Small Caps With Insider Action In Hong Kong

Amid a backdrop of global economic shifts and market fluctuations, the Hong Kong stock market has experienced its own unique dynamics. As investors seek value in a complex landscape, identifying undervalued small-cap stocks like Kinetic Development Group becomes particularly compelling.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Xtep International Holdings | 10.7x | 0.8x | 44.30% | ★★★★★★ |

Wasion Holdings | 11.4x | 0.8x | 31.75% | ★★★★☆☆ |

Sany Heavy Equipment International Holdings | 8.0x | 0.7x | -23.28% | ★★★★☆☆ |

China Overseas Grand Oceans Group | 2.9x | 0.1x | -5.83% | ★★★★☆☆ |

Nissin Foods | 14.8x | 1.3x | 39.52% | ★★★★☆☆ |

China Leon Inspection Holding | 9.4x | 0.7x | 29.93% | ★★★★☆☆ |

Transport International Holdings | 11.4x | 0.6x | 44.93% | ★★★★☆☆ |

Giordano International | 8.6x | 0.8x | 36.33% | ★★★☆☆☆ |

Shenzhen International Holdings | 8.2x | 0.8x | 11.67% | ★★★☆☆☆ |

Kinetic Development Group | 4.2x | 1.8x | 15.22% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

Kinetic Development Group

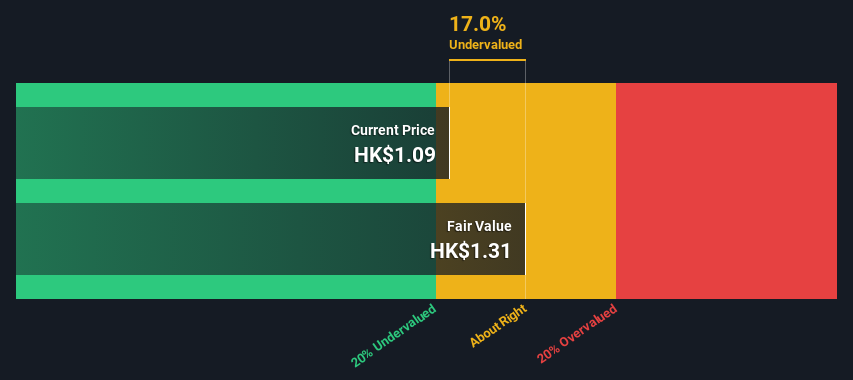

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kinetic Development Group is a company involved in property investment, development, and management, with a market capitalization of approximately CN¥1.07 billion.

Operations: The company has experienced a significant increase in gross profit margin, rising from 9.05% in September 2013 to 59.07% by December 2024, reflecting improved efficiency or higher-margin products. Over the same period, revenue grew from CN¥102.90 million to CN¥4745.07 million, indicating substantial business expansion and increased market presence.

PE: 4.2x

Kinetic Development Group, navigating through a landscape of strategic corporate adjustments and financial distributions, recently approved significant changes to its governance structures and reduced its annual dividend to HK$0.05 per share. Amid these shifts, they also announced a special dividend of HK$0.03 per share, underscoring their ability to return value despite external borrowing as their sole funding source—a higher risk strategy that demands meticulous management. This series of decisions reflects a nuanced approach to maintaining liquidity while fostering shareholder confidence, particularly noted by insider purchases in recent months which signal strong belief in the company's trajectory.

Transport International Holdings

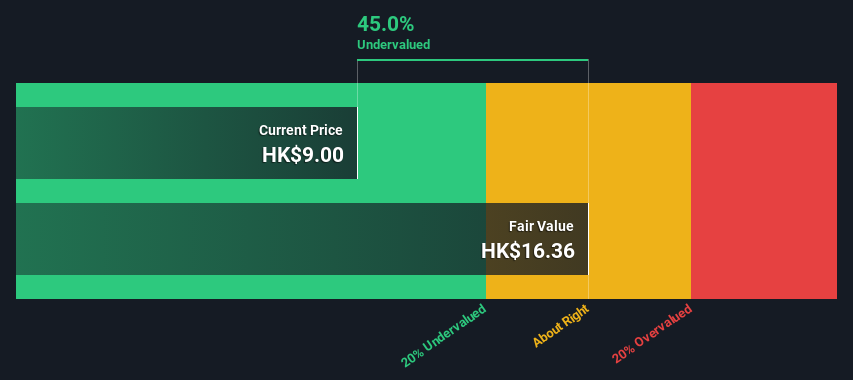

Simply Wall St Value Rating: ★★★★☆☆

Overview: Transport International Holdings operates primarily in franchised bus operations, complemented by interests in property holdings and development, with a business presence marked by a diverse revenue stream.

Operations: Franchised Bus Operation is the dominant revenue contributor at HK$7.57 billion, followed by much smaller segments in Property Holdings and Development and miscellaneous sources. The gross profit margin has shown an upward trend, increasing from 22.29% to 27.93% over recent reporting periods, reflecting improved efficiency or pricing strategies in its main operations.

PE: 11.4x

Transport International Holdings, reflecting a nuanced investment profile, recently saw insider confidence with Winnie J. Ng acquiring 124,000 shares, signaling potential underappreciated value. Despite a decline in net profit margins from 8.3% to 5.1% over the past year and earnings shrinking annually by 14.1%, the company maintains a dividend commitment of HK$0.50 per share as affirmed in May 2024. Leadership changes include appointing Ms. LAU Man-Kwan as alternate director, enhancing its strategic direction with her extensive urban planning experience.

China Overseas Grand Oceans Group

Simply Wall St Value Rating: ★★★★☆☆

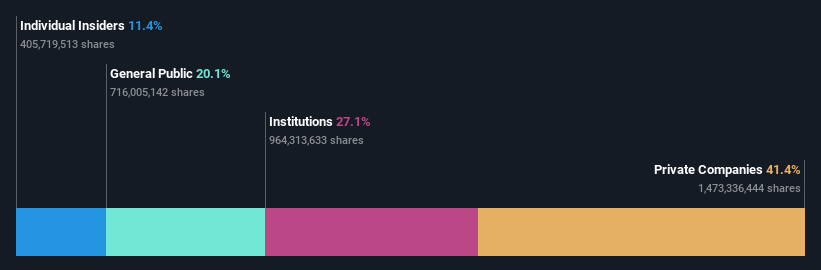

Overview: China Overseas Grand Oceans Group primarily operates in property investment and development, with additional interests in property leasing and other sectors, maintaining a market capitalization of approximately CN¥19.33 billion.

Operations: From property investment and development, which significantly contributes CN¥56.08 billion to total revenue, the company also earns from property leasing, adding an additional CN¥242.46 million. The gross profit margin has shown variability over the periods reviewed, with a notable figure of 25.72% as of the latest data point.

PE: 2.9x

China Overseas Grand Oceans Group Limited, despite its recent auditor and executive changes, remains a focal point for those eyeing potential in Hong Kong's smaller market entities. With a recent insider purchase signaling confidence, the company's financial health is under scrutiny due to high debt levels and reliance on external borrowing—deemed riskier than customer deposits. Moreover, contracted sales figures show a downtrend with a 29.8% drop year-on-year as of May 2024. This backdrop presents both challenges and opportunities for growth-focused investors looking at undervalued prospects.

Next Steps

Delve into our full catalog of 16 Undervalued Small Caps With Insider Buying here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1277 SEHK:62 and SEHK:81.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance