Exploring Les Docks des Pétroles d'Ambès -SA Plus Two More Premier French Dividend Stocks

The French stock market has shown resilience with a 1.7% increase over the past week and a notable climb of 4.2% in the last year, with earnings expected to grow by 11% annually. In this buoyant environment, investors may find particular value in dividend stocks like Les Docks des Pétroles d'Ambès -SA, which along with two other premier French companies, offer potential for steady income and long-term growth prospects.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 7.79% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.69% | ★★★★★★ |

Teleperformance (ENXTPA:TEP) | 2.89% | ★★★★★☆ |

Equasens Société anonyme (ENXTPA:EQS) | 2.39% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 2.78% | ★★★★★☆ |

Vicat (ENXTPA:VCT) | 5.77% | ★★★★★☆ |

Trigano (ENXTPA:TRI) | 2.33% | ★★★★★☆ |

Legrand (ENXTPA:LR) | 2.32% | ★★★★★☆ |

TotalEnergies (ENXTPA:TTE) | 5.29% | ★★★★★☆ |

Thermador Groupe (ENXTPA:THEP) | 2.58% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Les Docks des Pétroles d'Ambès-SA is a French company specializing in the storage and transportation of petroleum products, with a market capitalization of approximately €47.7 million.

Operations: Les Docks des Pétroles d'Ambès-SA generates its revenue primarily through the provision of pipeline services, amounting to nearly €18 million.

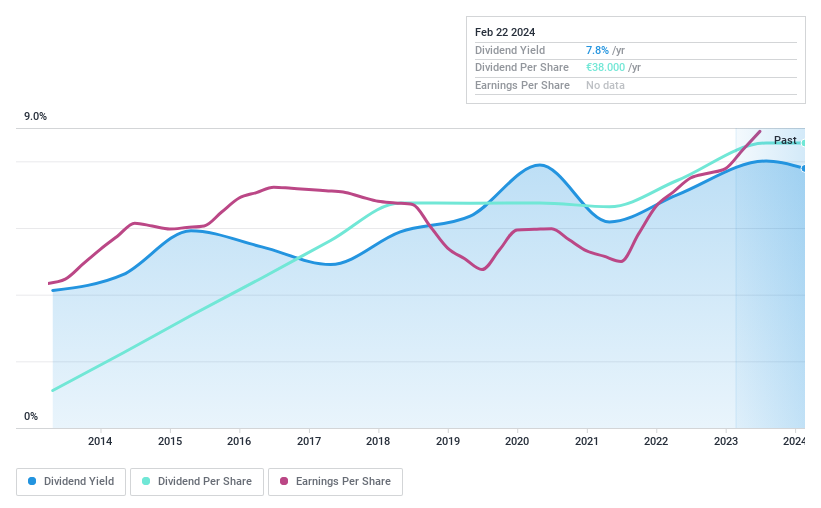

Dividend Yield: 7.8%

Les Docks des Pétroles d'Ambès (ENXTPA:DPAM) presents a robust dividend profile, underscored by a decade of reliable and stable dividend payments. The company's financial health is reinforced by its debt-free status, which has been maintained over the past five years, and its dividends are well-covered with a payout ratio of 76.9% from earnings and 60.8% from cash flows. DPAM's profitability is on an upward trajectory, with net profit margins improving to 26.9%, and recent earnings growth outpacing the five-year average. Although it may not be the foremost choice for dividend seekers in France, DPAM's solid fundamentals and consistent dividend growth position it as a noteworthy consideration for income-focused investors.

Recognizing undervalued stocks is just the first step. To effectively track your investment's performance and make informed decisions, consider utilizing Simply Wall St's portfolio tool.

CBo Territoria (ENXTPA:CBOT)

Simply Wall St Dividend Rating: ★★★★★★

Overview: CBo Territoria SA is a French company specializing in urban planning and development, as well as property development and investment, with a market capitalization of approximately €129 million.

Operations: CBo Territoria SA generates its revenues primarily through real estate promotion, contributing €64.9 million, and property development activities, adding another €24.3 million.

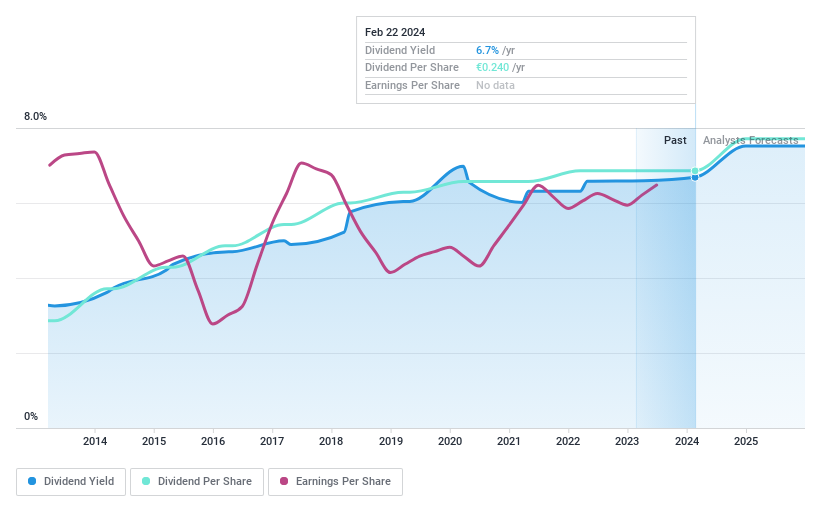

Dividend Yield: 6.7%

CBo Territoria (ENXTPA:CBOT) exhibits a mixed dividend landscape. The company has demonstrated a commitment to reducing its debt, with the ratio dropping significantly over five years, enhancing its financial stability. Earnings have grown consistently, albeit at a slower pace recently, which may affect future dividend growth. Despite this slowdown and a slight contraction in profit margins year-over-year, CBOT maintains healthy coverage of dividends through both earnings and cash flows—evident from its modest payout ratios—and has kept dividends stable over the past decade. The high net debt to equity ratio warrants caution; however, operating cash flow sufficiently covers debt obligations. While CBOT's revenue is projected to dip in the coming years, it continues to offer one of the higher yields among French stocks and reliable payouts that could appeal to income investors seeking steadiness rather than aggressive growth.

Unlock comprehensive insights into our analysis of CBo Territoria stock in this dividend report.

As we consider this stock's potentially hidden value, intelligent investors employ tools like Simply Wall St's portfolio feature for insights and ongoing assessment of their holdings.

Trigano (ENXTPA:TRI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Trigano S.A. is a European company specializing in the design, manufacture, and sale of leisure vehicles for both private and professional use, with a market capitalization of approximately €2.9 billion.

Operations: Trigano S.A. generates the majority of its revenue from leisure vehicles, accounting for €2.9 billion, complemented by a smaller segment in leisure equipment with revenues of €191.6 million.

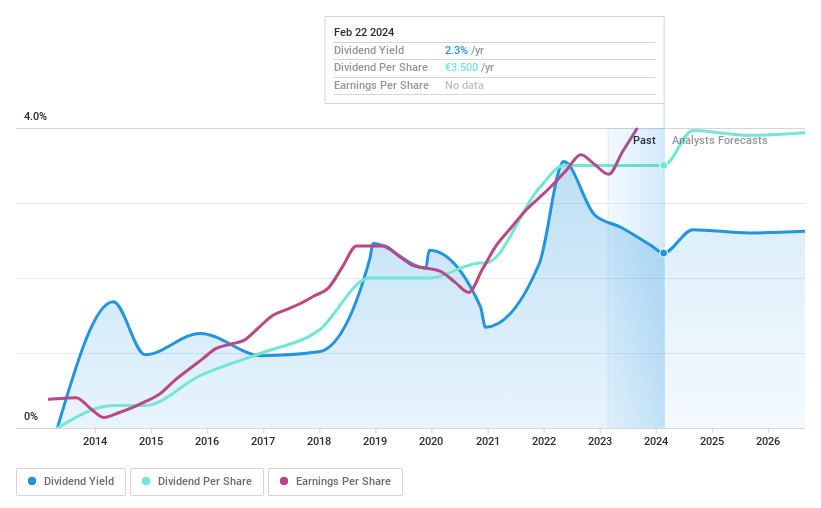

Dividend Yield: 2.3%

Trigano presents a nuanced picture for dividend investors, with its debt significantly reduced and comfortably surpassed by cash reserves, reflecting a robust balance sheet. Earnings have shown consistent growth over the last five years, supporting an increasing dividend trend that has been stable for the past decade. The dividends are well-protected by both earnings and cash flow, indicated by low payout ratios. However, Trigano's yield is modest in comparison to France's top dividend payers and future profit growth is expected to be modest without significant acceleration.

Navigate through the intricacies of Trigano with our comprehensive dividend report here.

Our valuation report unveils the possibility Trigano's shares may be trading at a discount.

After identifying this stock as a potential bargain, streamline your investment strategy and monitor its progress with the comprehensive analytics provided by Simply Wall St's portfolio tool.

Where To Now?

Harness the power of the Simply Wall St screener to navigate the landscape of France's dividend stocks with ease and insight. Dive into all 29 of the Top Dividend Stocks we have identified here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance