Exploring Loomis And Two More Leading Dividend Stocks In Sweden

As global markets navigate through fluctuating inflation rates and interest rate adjustments, Sweden's market remains a focal point for investors seeking stability through dividend stocks. Amid these conditions, understanding the fundamentals of robust dividend-paying companies becomes crucial in selecting stocks that can potentially offer both stability and steady income.

Top 10 Dividend Stocks In Sweden

Name | Dividend Yield | Dividend Rating |

Betsson (OM:BETS B) | 6.17% | ★★★★★☆ |

Zinzino (OM:ZZ B) | 3.82% | ★★★★★☆ |

Loomis (OM:LOOMIS) | 4.21% | ★★★★★☆ |

HEXPOL (OM:HPOL B) | 3.08% | ★★★★★☆ |

Duni (OM:DUNI) | 4.59% | ★★★★★☆ |

Skandinaviska Enskilda Banken (OM:SEB A) | 5.65% | ★★★★★☆ |

Nordea Bank Abp (OM:NDA SE) | 8.15% | ★★★★★☆ |

Husqvarna (OM:HUSQ B) | 3.33% | ★★★★☆☆ |

Bahnhof (OM:BAHN B) | 3.92% | ★★★★☆☆ |

AB Traction (OM:TRAC B) | 4.10% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Loomis

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Loomis AB operates in providing comprehensive solutions for the handling, storage, distribution, payment processing, and recycling of cash and other valuable items, with a market capitalization of approximately SEK 20.87 billion.

Operations: Loomis AB generates its revenue primarily through two segments: Europe and Latin America, which brings in SEK 13.86 billion, and the United States of America, contributing SEK 15.17 billion.

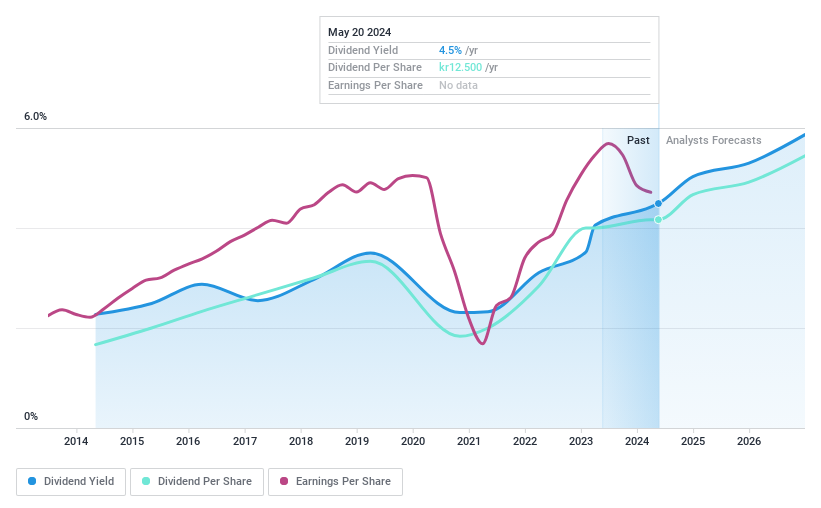

Dividend Yield: 4.2%

Loomis AB has recently increased its dividend to SEK 12.50 per share, with a payout expected by May 14, 2024. Despite this increase, the company's dividends have shown volatility over the past decade. Loomis maintains a cash payout ratio of 32.6%, suggesting dividends are well-covered by cash flows; however, its earnings coverage shows a higher payout ratio of 61.2%. Additionally, Loomis initiated a share repurchase plan valued at SEK 200 million starting May 7, which could impact future dividend sustainability and capital structure adjustments aimed at financing acquisitions and optimizing capital allocation.

New Wave Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: New Wave Group AB operates in designing, acquiring, and developing brands and products across corporate, sports, gifts, and home furnishings sectors globally, with a market capitalization of SEK 15.42 billion.

Operations: New Wave Group AB generates revenue through three primary segments: Corporate (SEK 4.68 billion), Sports & Leisure (SEK 3.82 billion), and Gifts & Home Furnishings (SEK 0.87 billion).

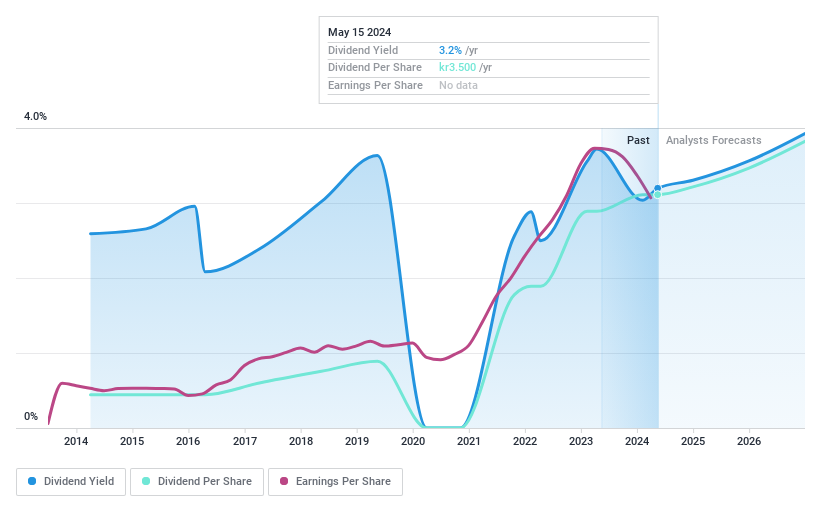

Dividend Yield: 3%

New Wave Group's recent dividend of SEK 3.50 per share, split across two dates, reflects a challenging backdrop with a first-quarter sales drop to SEK 1.99 billion from SEK 2.14 billion year-over-year and reduced net income of SEK 121.3 million. Despite these figures, the dividend is supported by a low payout ratio of 45.6% and cash payout ratio of 42.6%. However, its dividend history over the past decade has been marked by instability and volatility, complicating its attractiveness as a stable dividend stock in Sweden's competitive market where higher yields are common.

Click here to discover the nuances of New Wave Group with our detailed analytical dividend report.

Our valuation report unveils the possibility New Wave Group's shares may be trading at a discount.

Solid Försäkringsaktiebolag

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Solid Försäkringsaktiebolag operates in the non-life insurance sector, offering products to private individuals across Sweden, Denmark, Norway, Finland, and other European countries, with a market capitalization of approximately SEK 1.56 billion.

Operations: Solid Försäkringsaktiebolag generates revenue through three main segments: Product (SEK 328.53 million), Assistance (SEK 339.51 million), and Personal Safety (SEK 423.71 million).

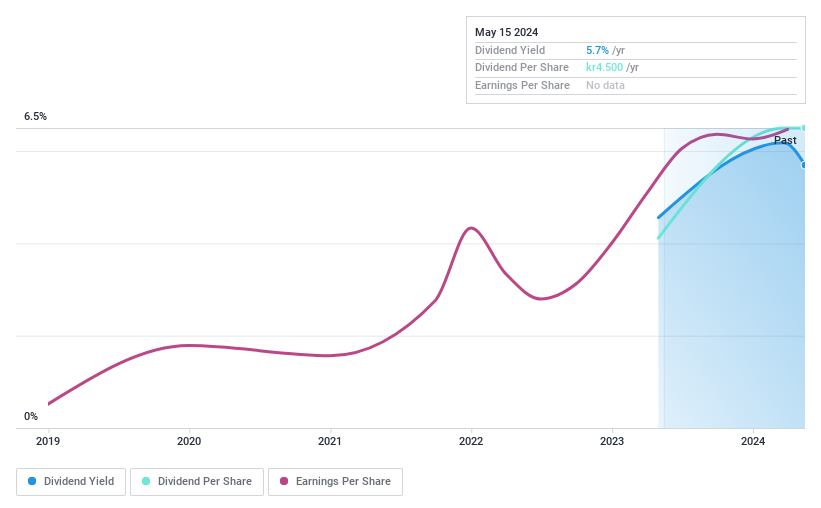

Dividend Yield: 5.3%

Solid Försäkringsaktiebolag recently increased its dividend to SEK 4.50 per share, demonstrating a commitment to shareholder returns with a total payout of SEK 82.84 million. The company's earnings have grown, reporting a net income of SEK 45.04 million for Q1 2024, up from SEK 41.51 million the previous year. Despite this growth and a dividend yield in the top quartile for Sweden at 5.31%, concerns about the sustainability of these payments linger due to an unstable dividend history and only recent initiation of payouts.

Summing It All Up

Click this link to deep-dive into the 21 companies within our Top Dividend Stocks screener.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include OM:LOOMIS OM:NEWA B and OM:SFAB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance