Exploring OVB Holding And Two More Leading Dividend Stocks In Germany

Amidst a backdrop of cautious optimism in European markets, with Germany's DAX index recently marking modest gains, investors continue to seek stable returns in an ever-evolving economic landscape. Dividend stocks, known for their potential to provide regular income and stability, remain a focal point for those looking to balance growth with risk management in such dynamic conditions.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.31% | ★★★★★★ |

Edel SE KGaA (XTRA:EDL) | 6.73% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.74% | ★★★★★★ |

Deutsche Telekom (XTRA:DTE) | 3.42% | ★★★★★☆ |

MLP (XTRA:MLP) | 4.69% | ★★★★★☆ |

INDUS Holding (XTRA:INH) | 4.62% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.02% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 5.07% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.18% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.17% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

OVB Holding

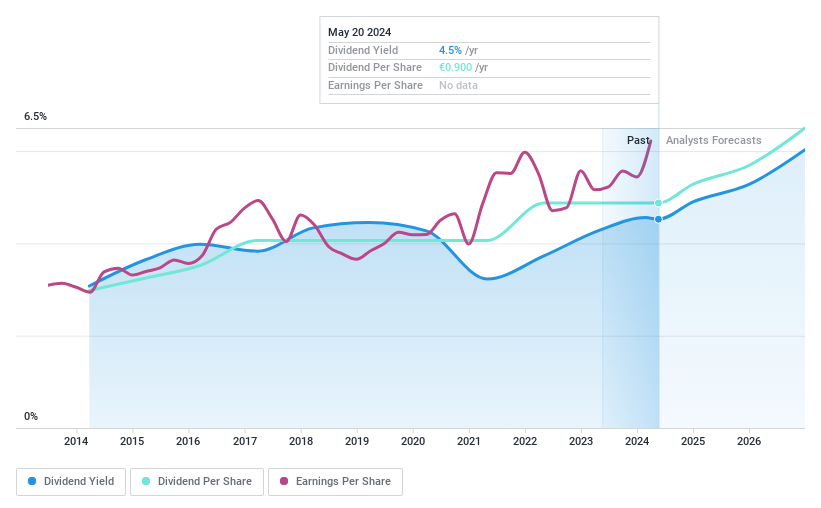

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OVB Holding AG operates as a financial services provider, offering advisory and brokerage services to private households across Europe, with a market capitalization of approximately €293.58 million.

Operations: OVB Holding AG generates its revenue primarily from insurance brokerage, earning €368.28 million in this segment.

Dividend Yield: 4.2%

OVB Holding maintains a stable dividend history, with dividends per share consistent over the past decade and an increase noted in that period. Despite a 78.4% payout ratio indicating earnings cover, the cash payout ratio at 107.3% suggests dividends are not well-supported by cash flows, raising concerns about sustainability. Recent performance shows a 20.5% earnings growth last year with future earnings expected to grow by 5.31% annually. The current dividend yield stands at 4.21%, slightly below the top quartile in Germany's market.

Dive into the specifics of OVB Holding here with our thorough dividend report.

The valuation report we've compiled suggests that OVB Holding's current price could be inflated.

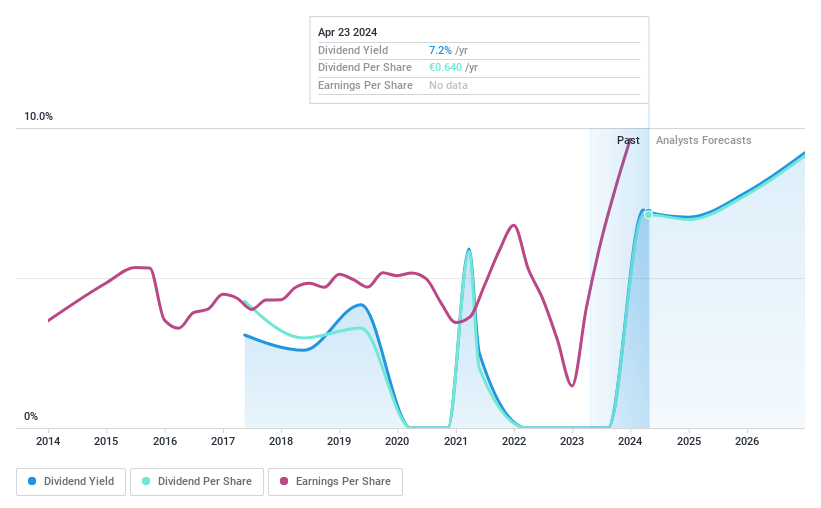

ProCredit Holding

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ProCredit Holding AG operates as a commercial bank offering services primarily to small and medium enterprises and private customers across Europe, South America, and Germany, with a market capitalization of approximately €556 million.

Operations: ProCredit Holding AG generates its revenue primarily through banking services, amounting to €414.50 million.

Dividend Yield: 6.5%

ProCredit Holding's dividends, with a current yield of 6.49%, rank in the top 25% in Germany, supported by a reasonable payout ratio of 33.2%. Despite this, the dividend history is marked by inconsistency over its seven-year payment period. Recent financials show strong growth, with net income rising to €113.37 million in 2023 from €16.5 million the previous year and quarterly earnings also increasing significantly. However, concerns arise from its high bad loans rate at 2.7%, which could impact future stability.

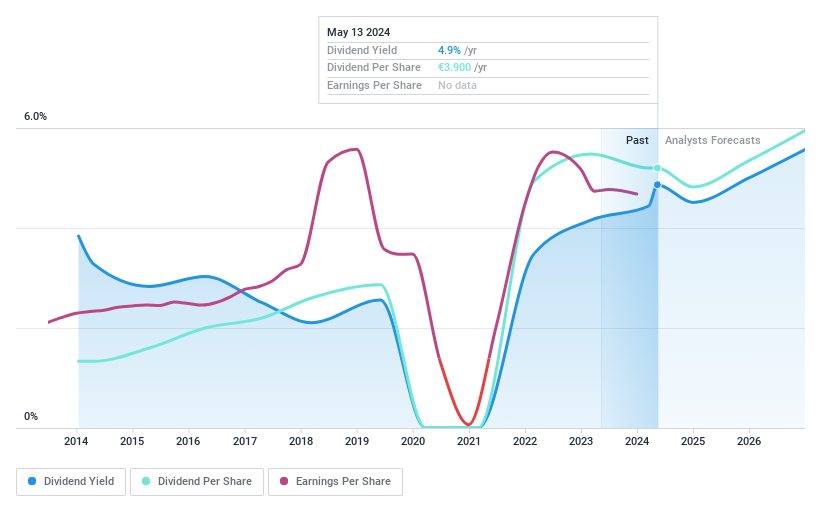

Sixt

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sixt SE operates globally, offering mobility services to both private and business customers through a network of corporate and franchise stations, with a market capitalization of approximately €3.25 billion.

Operations: Sixt SE generates revenue primarily from its operations in Germany (€1.21 billion), Europe excluding Germany (€1.49 billion), and North America (€1.14 billion).

Dividend Yield: 5.1%

Sixt SE's dividend yield of 5.12% places it among the top 25% of German dividend payers. However, its ability to sustain these payments is questionable, as dividends are not well covered by free cash flow or earnings, indicating potential volatility in future payouts. Recent financials reveal a challenging quarter with a net loss of €23.12 million despite growing sales to €780.24 million, suggesting profitability issues that could further impact dividend reliability.

Click here and access our complete dividend analysis report to understand the dynamics of Sixt.

Our expertly prepared valuation report Sixt implies its share price may be lower than expected.

Next Steps

Gain an insight into the universe of 33 Top Dividend Stocks by clicking here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:O4B XTRA:PCZ and XTRA:SIX2.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance