Exploring Three ASX Dividend Stocks For Your Investment Portfolio

The Australian market has shown robust growth, up 8.7% over the past year, with earnings expected to grow by 14% annually. In this promising environment, dividend stocks can be particularly appealing for investors looking for potential income combined with growth opportunities.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Lindsay Australia (ASX:LAU) | 6.59% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 5.04% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 3.91% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.54% | ★★★★★☆ |

Eagers Automotive (ASX:APE) | 7.09% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.61% | ★★★★★☆ |

Fortescue (ASX:FMG) | 7.54% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.14% | ★★★★★☆ |

Ricegrowers (ASX:SGLLV) | 7.61% | ★★★★☆☆ |

Macquarie Group (ASX:MQG) | 3.33% | ★★★★☆☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Ampol

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ampol Limited, with a market capitalization of A$8.47 billion, operates in the purchase, refining, distribution, and marketing of petroleum products across Australia, New Zealand, Singapore, and the United States.

Operations: Ampol Limited generates revenue through three primary segments: Z Energy (A$5.51 billion), Convenience Retail (A$5.99 billion), and Fuels and Infrastructure (A$33.63 billion).

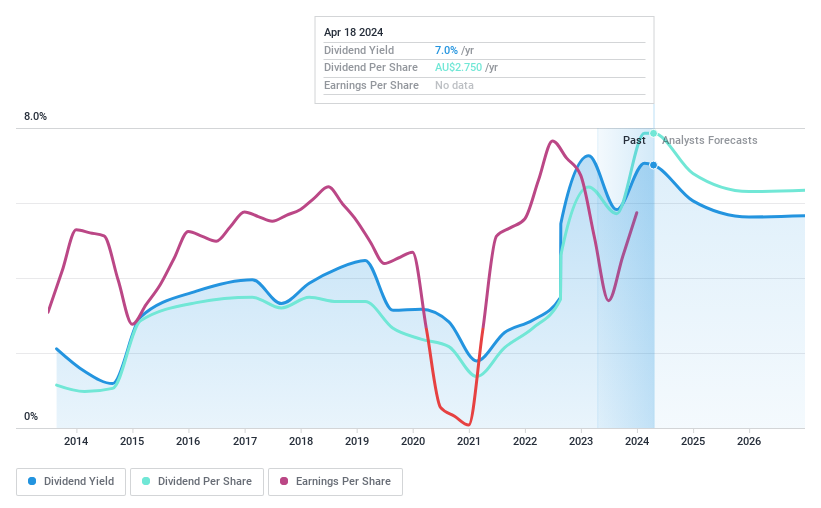

Dividend Yield: 7.8%

Ampol's dividend yield stands at 7.76%, placing it in the top 25% of Australian dividend payers. However, its high payout ratio of 93.3% and a cash payout ratio of 68.6% indicate that while dividends are currently covered by cash flows, they are not well supported by earnings, suggesting potential sustainability issues. Despite trading at a significant discount to estimated fair value and expecting an earnings growth of 8.79% annually, Ampol's dividend history has been marked by volatility over the past decade. Recent executive changes could signal shifts in strategy or stability moving forward.

Click here and access our complete dividend analysis report to understand the dynamics of Ampol.

The valuation report we've compiled suggests that Ampol's current price could be inflated.

NRW Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NRW Holdings Limited, operating in Australia, offers a range of contract services to the resources and infrastructure sectors with a market capitalization of approximately A$1.36 billion.

Operations: NRW Holdings Limited generates revenue primarily through three segments: Mining (A$1.49 billion), MET (A$739.07 million), and Civil (A$593.62 million).

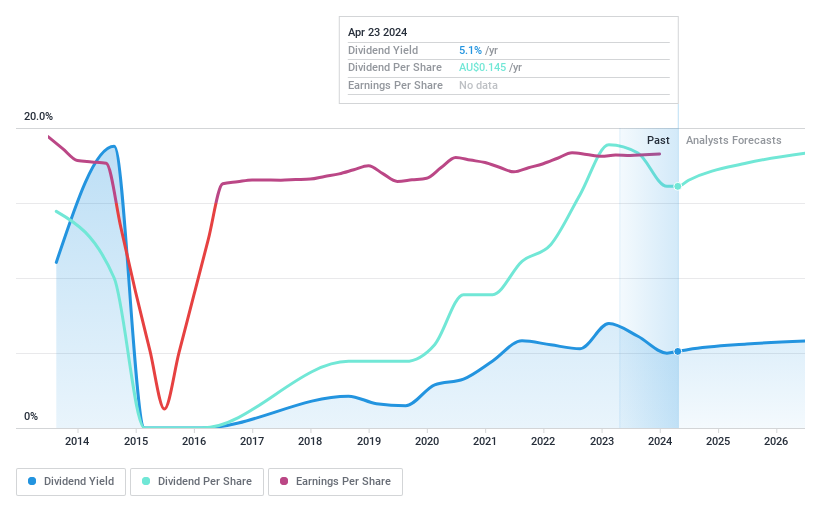

Dividend Yield: 4.8%

NRW Holdings offers a dividend yield of 4.85%, lower than the top quartile of Australian dividend stocks. Despite this, its dividends are well-supported, with a payout ratio of 74% and a cash payout ratio of 68.6%, indicating sustainability from both earnings and cash flow perspectives. The stock trades at a 28.5% discount to estimated fair value, suggesting potential undervaluation relative to intrinsic worth. However, investors should note the volatility in its dividend history over the past decade, reflecting some level of uncertainty in future payouts despite recent growth in earnings at an annual rate of 15.8%.

Sonic Healthcare

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sonic Healthcare Limited, a provider of medical diagnostic services to various health sectors, has a market capitalization of approximately A$11.76 billion.

Operations: Sonic Healthcare Limited generates revenue primarily through its Laboratory and Radiology segments, with A$7.12 billion from Laboratory services and A$0.84 billion from Radiology services.

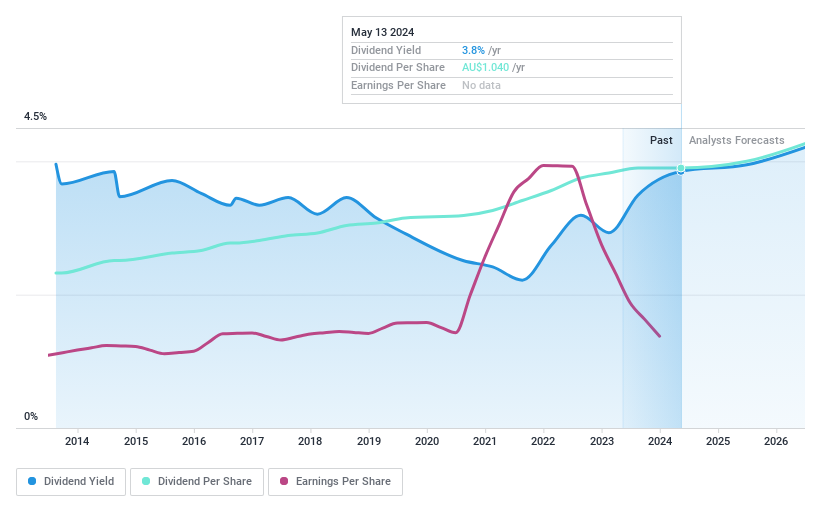

Dividend Yield: 4.3%

Sonic Healthcare shows a stable dividend history over the past decade, with a current yield of 4.3%, which is below the top Australian dividend payers' average of 6.36%. Although dividends have grown, they are poorly covered by both earnings and cash flow, with payout ratios at 98% and cash payout ratio at 87.5%, respectively. The stock is trading at a significant discount of 53.9% below its estimated fair value, suggesting potential undervaluation despite recent challenges like shareholder dilution and a drop in profit margins from 11.7% to 6%.

Summing It All Up

Access the full spectrum of 28 Top ASX Dividend Stocks by clicking on this link.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:ALD ASX:NWH and ASX:SHL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance