Exploring Three Dividend Stocks In June 2024

The United States stock market has shown robust growth, climbing 1.2% in the past week and achieving a 21% increase over the last twelve months with earnings expected to grow by 15% annually. In such a thriving economic environment, dividend stocks can be particularly appealing for investors seeking both stability and potential income growth.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.68% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.31% | ★★★★★★ |

Regions Financial (NYSE:RF) | 5.28% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.02% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.95% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.93% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.89% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.20% | ★★★★★★ |

Ennis (NYSE:EBF) | 4.81% | ★★★★★★ |

Southside Bancshares (NasdaqGS:SBSI) | 5.62% | ★★★★★☆ |

Click here to see the full list of 209 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

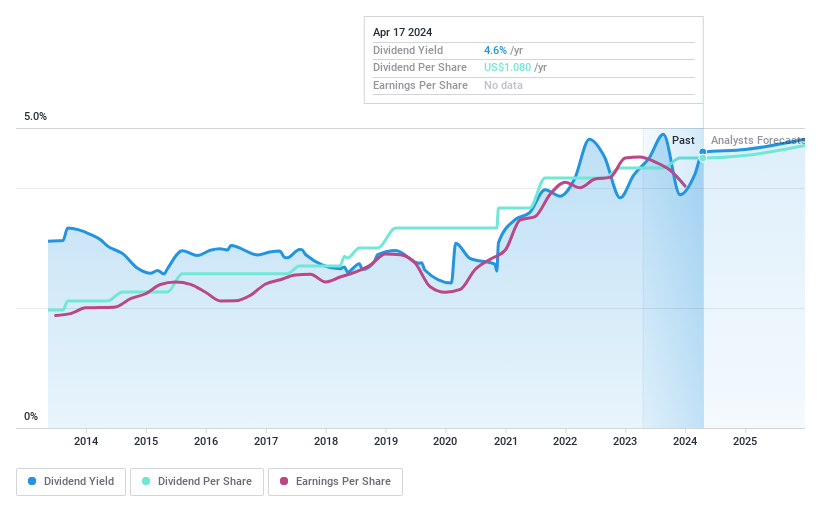

ChoiceOne Financial Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ChoiceOne Financial Services, Inc., functioning as the bank holding company for ChoiceOne Bank, offers banking services to corporations, partnerships, and individuals in Michigan, with a market capitalization of approximately $198.67 million.

Operations: ChoiceOne Financial Services, Inc. generates its revenue primarily through banking activities, totaling $80.51 million.

Dividend Yield: 4.1%

ChoiceOne Financial Services offers a steady dividend yield of 4.12%, slightly below the top quartile in the U.S. market, yet its payments are well-supported by a low payout ratio of 37.6%. Over the past decade, dividends have shown stability and growth, reflecting reliable shareholder returns despite earnings forecasts projecting modest annual growth of 4.7%. Recent affirmations include maintaining quarterly dividends at $0.27 per share, consistent with prior periods and slightly increased from the previous year, underscoring ongoing commitment to shareholder returns amidst stable earnings as reported for Q1 2024 with net income holding steady at US$5.63 million.

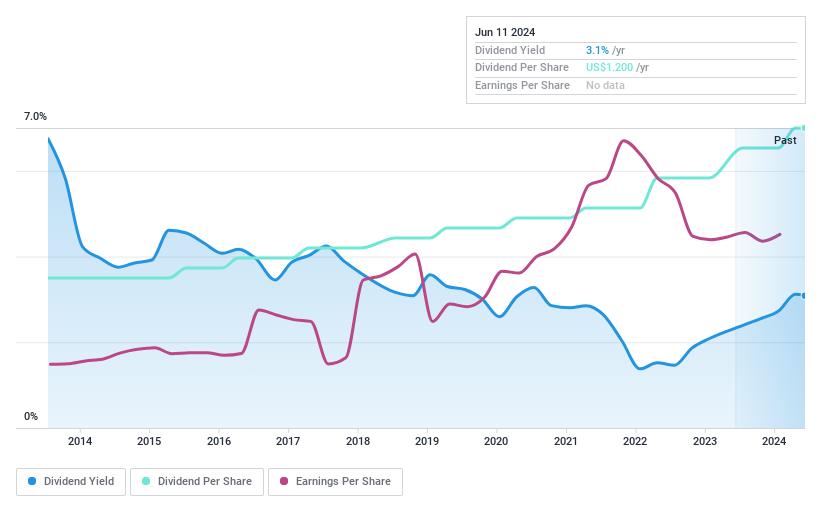

Value Line

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Value Line, Inc., a company that produces and sells investment periodicals and related publications, has a market capitalization of approximately $366.44 million.

Operations: Value Line, Inc. generates revenue primarily through its publishing segment, which amounted to $38.20 million.

Dividend Yield: 3.1%

Value Line, Inc. has demonstrated a consistent commitment to dividends, with a decade of stable and growing payments, recently increasing to US$1.20 per share annually. Despite a dividend yield of 3.09%, which is below the top quartile for U.S. stocks, its payouts are well-supported by both earnings and cash flow with payout ratios of 57.8% and 62.1% respectively. This financial prudence is underscored by a recent uptick in quarterly net income to US$5.89 million as of January 2024, maintaining robust shareholder returns amidst steady revenue streams.

Get an in-depth perspective on Value Line's performance by reading our dividend report here.

Our valuation report unveils the possibility Value Line's shares may be trading at a discount.

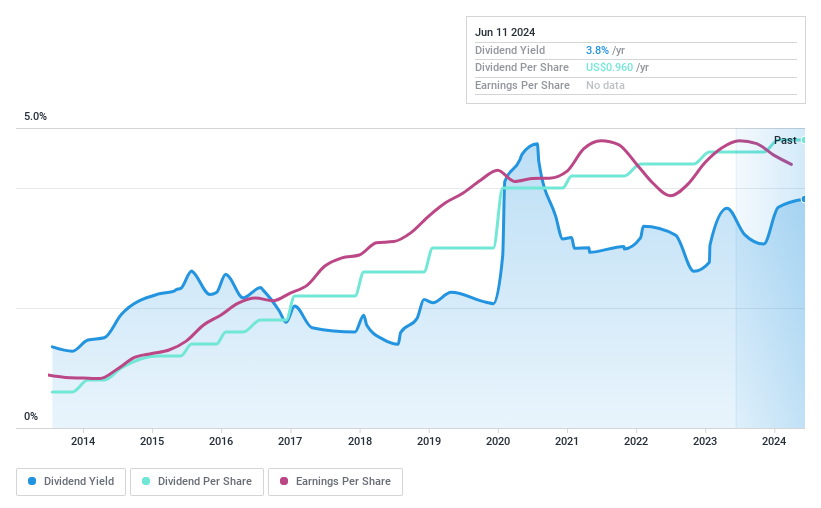

Timberland Bancorp

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Timberland Bancorp, Inc., serving as the holding company for Timberland Bank, offers a range of community banking services in Washington, with a market capitalization of approximately $201.77 million.

Operations: Timberland Bancorp, Inc. generates its revenue primarily through community banking services, totaling $74.79 million.

Dividend Yield: 3.8%

Timberland Bancorp is trading at a significant discount to its estimated fair value and offers a modest dividend yield of 3.82%. While this yield is below the top quartile for U.S. stocks, the company has a history of reliable and growing dividends over the past decade, supported by a reasonable payout ratio of 30.2%. Recent financials show a dip in net income and net interest income compared to last year, but the firm continues its shareholder commitments with regular dividends and share buybacks.

Make It Happen

Reveal the 209 hidden gems among our Top Dividend Stocks screener with a single click here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:COFS NasdaqCM:VALU and NasdaqGM:TSBK.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance