Exploring Three Euronext Paris Stocks With Estimated Intrinsic Discounts Ranging From 10.1% to 37.7%

Amid heightened political uncertainty and rising bond yields, France's market landscape presents a challenging yet potentially rewarding environment for discerning investors. Identifying undervalued stocks in such conditions requires a keen understanding of intrinsic value and market dynamics, which can offer significant opportunities for those looking to invest wisely in the Euronext Paris.

Top 10 Undervalued Stocks Based On Cash Flows In France

Name | Current Price | Fair Value (Est) | Discount (Est) |

Airbus (ENXTPA:AIR) | €128.26 | €247.37 | 48.2% |

Wavestone (ENXTPA:WAVE) | €51.20 | €93.14 | 45% |

Lectra (ENXTPA:LSS) | €27.55 | €44.20 | 37.7% |

Arcure (ENXTPA:ALCUR) | €4.85 | €7.54 | 35.7% |

MEMSCAP (ENXTPA:MEMS) | €5.43 | €8.91 | 39% |

Vivendi (ENXTPA:VIV) | €9.756 | €15.94 | 38.8% |

Tikehau Capital (ENXTPA:TKO) | €20.95 | €32.21 | 35% |

Thales (ENXTPA:HO) | €149.50 | €262.60 | 43.1% |

Figeac Aero Société Anonyme (ENXTPA:FGA) | €5.48 | €8.15 | 32.8% |

Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €3.84 | €6.28 | 38.8% |

Let's explore several standout options from the results in the screener

Esker

Overview: Esker SA is a company that operates a cloud platform for finance and customer service professionals both in France and internationally, with a market capitalization of approximately €1.04 billion.

Operations: The company generates its revenue primarily from the Software & Programming segment, which amounted to €190.92 million.

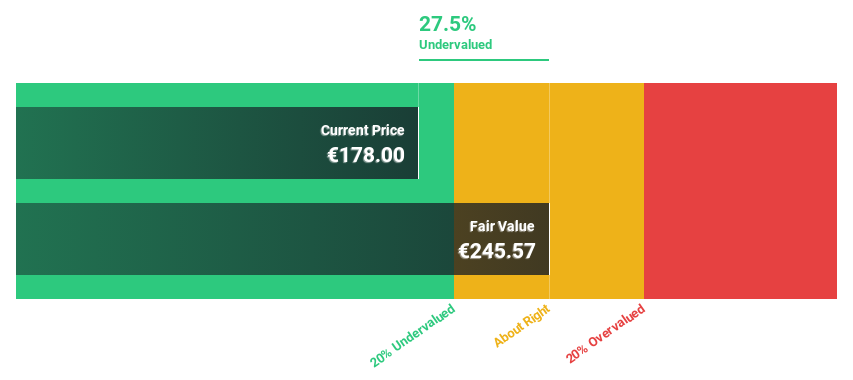

Estimated Discount To Fair Value: 32.7%

Esker, a French software company, appears undervalued based on discounted cash flow analysis, trading at €175.7 against a fair value of €261.06. Despite recent dividend cuts reflecting a 15% decrease to €0.65 per share, Esker's financial health remains robust with significant earnings growth expected—forecasted at 25.8% annually over the next three years, outpacing the French market average of 10.9%. Additionally, revenue growth is projected to exceed the national rate (11.8% vs 5.7%), supporting a strong investment case despite slower-than-ideal revenue acceleration compared to global peers.

Our growth report here indicates Esker may be poised for an improving outlook.

Click to explore a detailed breakdown of our findings in Esker's balance sheet health report.

Exclusive Networks

Overview: Exclusive Networks SA is a global cybersecurity specialist focusing on digital infrastructure, with a market capitalization of approximately €1.70 billion.

Operations: Exclusive Networks' revenue is primarily generated from three geographical segments: APAC (€420 million), EMEA (€4.04 billion), and the Americas (€689 million).

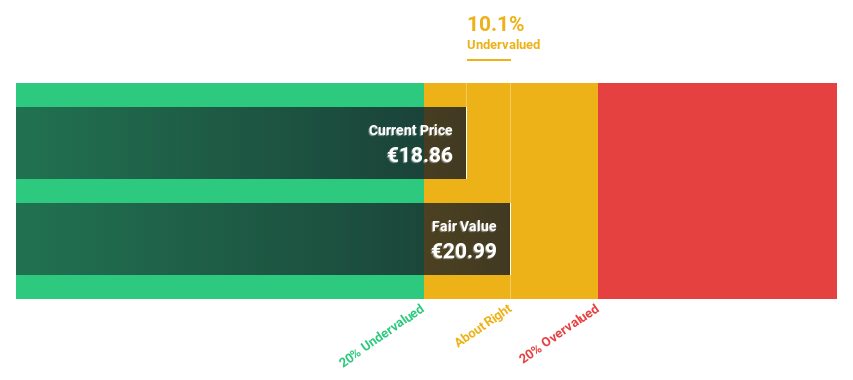

Estimated Discount To Fair Value: 10.1%

Exclusive Networks, priced at €18.86, is currently undervalued by 10.1% against a fair value of €20.99 and analysts expect a 29.3% price increase. Recent financials show a slight revenue dip to €393 million from €399 million year-on-year in Q1 2024, amidst forecasts for robust sales growth between 10% and 12%. The company's earnings are projected to grow by an impressive 28.44% annually over the next three years, surpassing the French market's expected growth significantly. Despite this promising outlook, its Return on Equity is anticipated to remain low at just above average in three years' time.

Lectra

Overview: Lectra SA offers industrial intelligence solutions tailored for the fashion, automotive, and furniture industries across Northern Europe, Southern Europe, the Americas, and Asia Pacific, with a market capitalization of approximately €1.04 billion.

Operations: The company generates revenue primarily from the Americas and Asia-Pacific regions, amounting to €170.33 million and €110.28 million respectively.

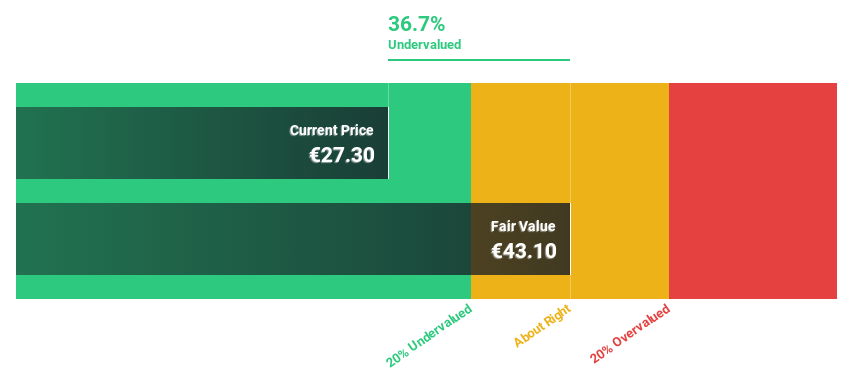

Estimated Discount To Fair Value: 37.7%

Lectra, with a current price of €27.55, is significantly undervalued by 37.7%, trading well below the estimated fair value of €44.2. Analysts forecast a substantial 29.6% potential increase in stock price, supported by expectations of earnings growth at an annual rate of 28.6% over the next three years—outpacing the French market's average significantly. Despite robust revenue growth projections (11.3% annually), its Return on Equity is expected to remain modest at 13.3%. Recent earnings show slight declines, with Q1 net income dropping to €7.17 million from €7.63 million year-over-year.

The analysis detailed in our Lectra growth report hints at robust future financial performance.

Delve into the full analysis health report here for a deeper understanding of Lectra.

Seize The Opportunity

Navigate through the entire inventory of 14 Undervalued Euronext Paris Stocks Based On Cash Flows here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ALESKENXTPA:EXN ENXTPA:LSS and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance