Exploring Three Growth Companies With High Insider Commitment

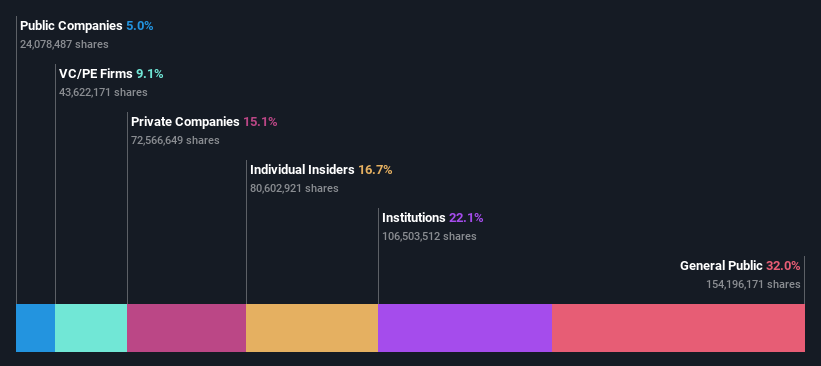

As global markets exhibit mixed signals with the Dow Jones experiencing its worst week since early April while the Nasdaq hits new records, investors are navigating a complex landscape. In such an environment, growth companies with high insider ownership can offer a unique appeal, suggesting a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 50.3% |

Plenti Group (ASX:PLT) | 12.6% | 106.4% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 86.5% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

Vow (OB:VOW) | 31.8% | 97.5% |

Adocia (ENXTPA:ADOC) | 12.4% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Grupo Aeroportuario del Sureste S. A. B. de C. V

Simply Wall St Growth Rating: ★★★★☆☆

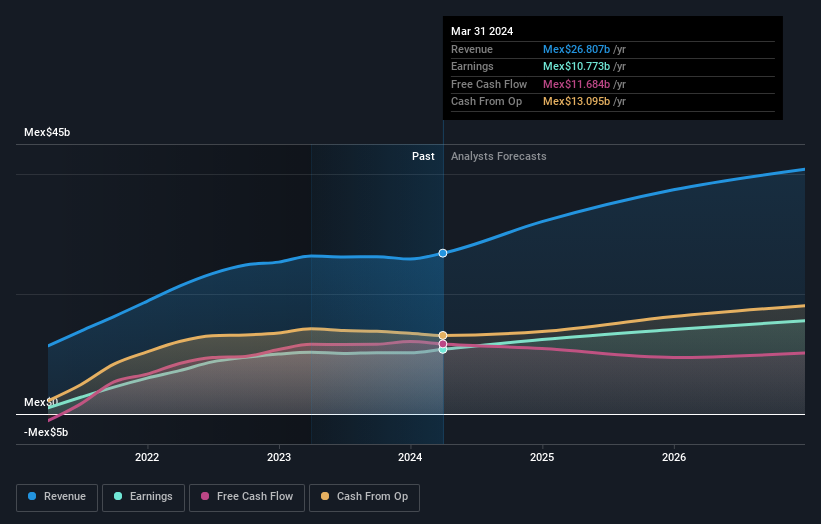

Overview: Grupo Aeroportuario del Sureste, S. A. B. de C. V operates as an airport group in Mexico and has a market capitalization of approximately MX$171.51 billion.

Operations: Grupo Aeroportuario del Sureste's revenue is primarily derived from operations at Cancun, generating MX$15.74 billion, followed by SAN Juan, Puerto Rico with MX$4.20 billion, Colombia at MX$2.71 billion, Merida contributing MX$1.34 billion, and Villahermosa with MX$0.57 billion.

Insider Ownership: 28.3%

Revenue Growth Forecast: 13% p.a.

Grupo Aeroportuario del Sureste, S.A.B. de C.V. has demonstrated consistent growth with a 23% annual increase in earnings over the past five years. Recent reports show an uptick in passenger traffic and a solid revenue rise to MXN 7.43 billion for Q1 2024, up from MXN 6.45 billion the previous year, reflecting ongoing operational strength. Despite this performance, the company's dividend track record remains unstable, and there is no substantial insider buying reported in the last three months. While forecasted revenue and earnings growth are robust compared to the Mexican market average, they do not exceed significantly high thresholds.

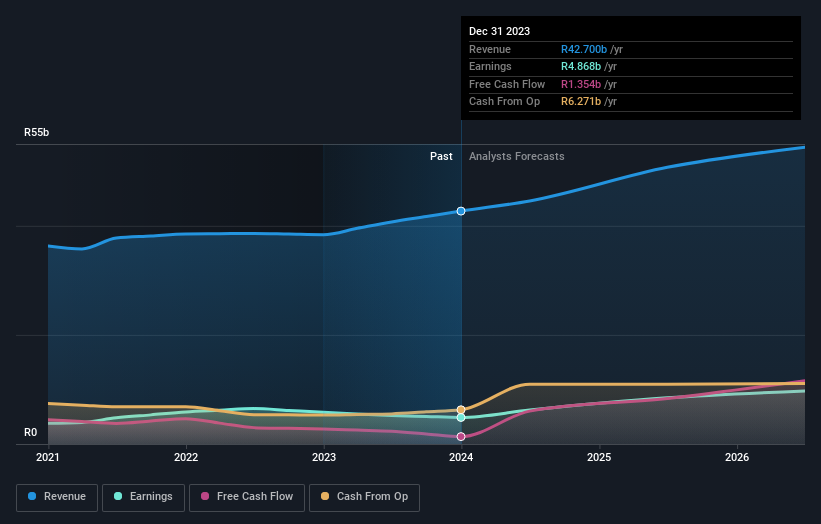

Aspen Pharmacare Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aspen Pharmacare Holdings Limited operates globally, manufacturing and supplying specialty and branded pharmaceutical products, with a market capitalization of approximately ZAR 103.34 billion.

Operations: The company's revenue from manufacturing amounts to ZAR 12.81 billion.

Insider Ownership: 17.2%

Revenue Growth Forecast: 10.2% p.a.

Aspen Pharmacare Holdings is poised for robust growth, with earnings expected to increase by 27.24% annually. Despite a lower forecasted Return on Equity of 9.4%, the company trades at a significant discount of 41.3% below its estimated fair value, highlighting potential undervalued status. Recent strategic board appointments and active pursuit of acquisitions signal a strengthening leadership and expansion strategy, particularly in emerging markets, which could enhance its market position and drive future revenue growth.

Ingenic SemiconductorLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ingenic Semiconductor Co., Ltd. specializes in the research, development, design, and sale of integrated circuit chip products both domestically in China and internationally, with a market capitalization of approximately CN¥28.11 billion.

Operations: The company generates its revenue primarily from the design and sale of integrated circuit chips across domestic and international markets.

Insider Ownership: 16.7%

Revenue Growth Forecast: 19.1% p.a.

Ingenic Semiconductor Co., Ltd. has demonstrated a solid growth trajectory, with earnings expected to grow by 29.83% annually, outpacing the CN market's average. Despite this, revenue growth is anticipated to be slightly below the 20% annual benchmark. Recent corporate activities include consistent dividend payments and amendments to company bylaws, reflecting stable governance and shareholder returns focus. However, its Return on Equity is projected to remain low at 7.7% in three years, suggesting potential challenges in generating shareholder value efficiently from its equity base.

Key Takeaways

Embark on your investment journey to our 1481 Fast Growing Companies With High Insider Ownership selection here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include BMV:ASUR B JSE:APN and SZSE:300223.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance