Exploring Three Growth Companies Where Insiders Hold The Reins

As global markets navigate through a landscape marked by fluctuating inflation rates and shifting monetary policies, investors are keenly observing the impact on various stock sectors. In this environment, growth companies with high insider ownership can offer unique advantages, as insiders' substantial equity stakes often align their interests closely with those of shareholders, potentially fostering robust governance and strategic consistency amidst market volatility.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Gaming Innovation Group (OB:GIG) | 21.6% | 36.2% |

Elliptic Laboratories (OB:ELABS) | 31.6% | 124.6% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 84.1% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 53% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 12.4% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

Here we highlight a subset of our preferred stocks from the screener.

Pharma Mar

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pharma Mar, S.A. is a Spanish biopharmaceutical company focused on researching, developing, producing, and commercializing bio-active principles primarily for oncology treatments across various global markets, with a market capitalization of approximately €679.83 million.

Operations: The company generates €160.64 million from its oncology segment.

Insider Ownership: 11.8%

Earnings Growth Forecast: 47.7% p.a.

Pharma Mar, a company with high insider ownership, is not top of class but shows promise as a growth entity. Recent Phase II trial results for lurbinectedin in treating Small Cell Lung Cancer indicate positive response rates and manageable safety profiles, reinforcing its potential in ongoing pivotal trials. Financially, Pharma Mar reported increased revenue and net income for Q1 2024. However, while earnings are expected to grow significantly over the next three years, its profit margins have declined compared to the previous year.

Dive into the specifics of Pharma Mar here with our thorough growth forecast report.

Upon reviewing our latest valuation report, Pharma Mar's share price might be too pessimistic.

Kossan Rubber Industries Bhd

Simply Wall St Growth Rating: ★★★★☆☆

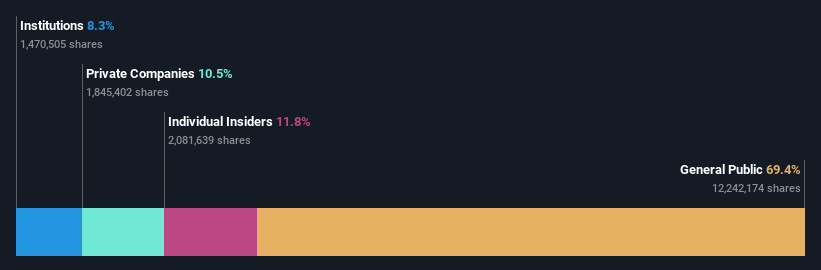

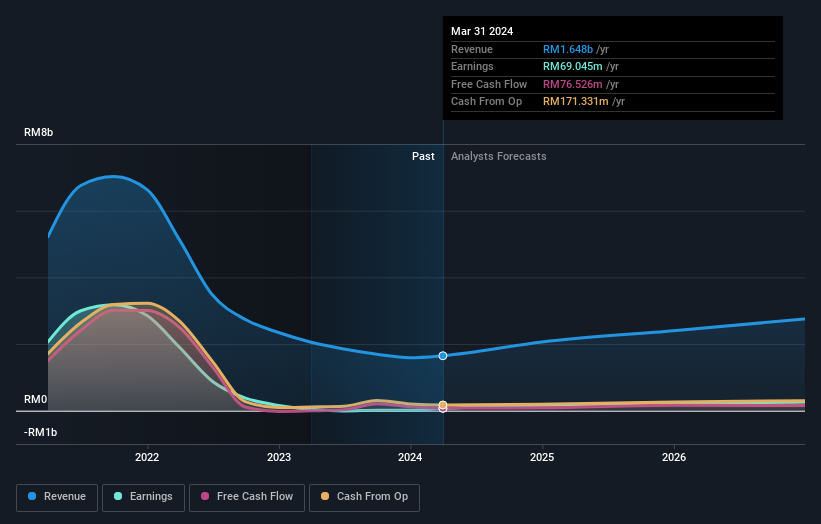

Overview: Kossan Rubber Industries Bhd is a Malaysia-based investment holding company that specializes in manufacturing and selling latex disposable gloves globally, with a market capitalization of approximately MYR 5.79 billion.

Operations: The company generates revenue primarily through three segments: Gloves contributing MYR 1.35 billion, Technical Rubber at MYR 197.38 million, and Clean-Room operations yielding MYR 102.09 million.

Insider Ownership: 14.2%

Earnings Growth Forecast: 38.7% p.a.

Kossan Rubber Industries Bhd, a Malaysian company, exhibits strong revenue growth at 17.7% annually, outpacing the local market's 6%. Earnings are also set to rise significantly by 38.68% yearly. However, its Return on Equity is expected to remain low at 5.4%. Recent financials show a rebound with MYR 451.63 million in sales and MYR 31.45 million net income for Q1 2024 after a previous loss, alongside approval of a modest dividend of 2 sen per share at its latest AGM.

Atea

Simply Wall St Growth Rating: ★★★★☆☆

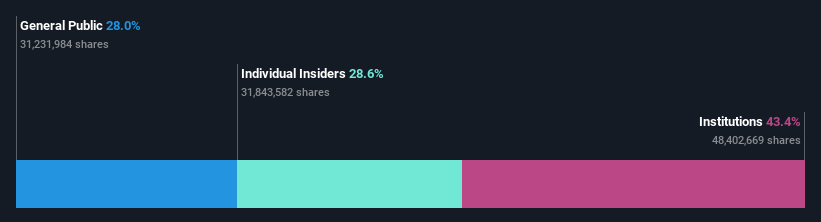

Overview: Atea ASA specializes in providing IT infrastructure and related solutions to businesses and public-sector organizations in the Nordic countries and Baltic regions, with a market capitalization of approximately NOK 16.57 billion.

Operations: Atea's revenue is primarily generated from Sweden (NOK 12.58 billion), followed by Norway (NOK 8.31 billion), Denmark (NOK 7.41 billion), Finland (NOK 3.67 billion), and the Baltics (NOK 1.70 billion).

Insider Ownership: 28.6%

Earnings Growth Forecast: 18.1% p.a.

Atea ASA, a Norwegian company, reported a slight decrease in Q1 2024 sales to NOK 7.61 billion but an increase in net income to NOK 192 million. Despite trading at 60% below estimated fair value and having high insider ownership, its dividend coverage is weak. Revenue is expected to grow by 6.5% annually, surpassing the local market's 1.5%, with earnings projected to increase by 18.08% per year, also above the market forecast of 11.8%.

Taking Advantage

Click this link to deep-dive into the 1475 companies within our Fast Growing Companies With High Insider Ownership screener.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include BME:PHM KLSE:KOSSAN and OB:ATEA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance